Riverside County, located in Southern California, is a popular destination for individuals and families looking to purchase or sell a property. When it comes to transferring ownership of a property in Riverside County, a Grant Deed is a commonly used document. In this article, we will delve into the requirements for a Grant Deed form in Riverside County, California.

Understanding Grant Deeds in California

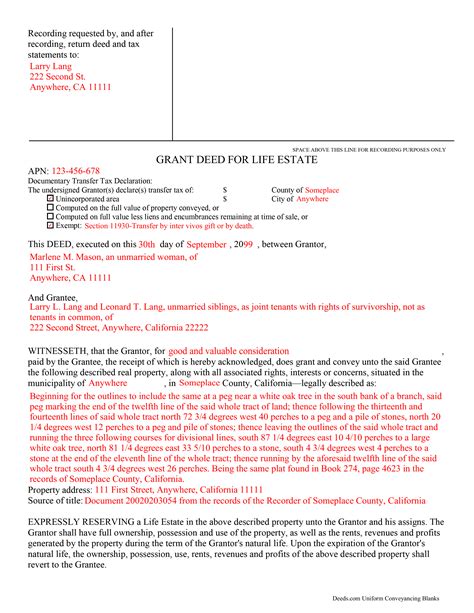

A Grant Deed is a type of deed that transfers ownership of a property from one party to another. It is a crucial document in the real estate process, as it ensures that the buyer receives the property with clear title. In California, Grant Deeds are governed by the California Civil Code and must meet specific requirements to be valid.

Grant Deed Form Requirements in Riverside County

To be recorded in Riverside County, a Grant Deed must meet the following requirements:

- The deed must be in writing and signed by the grantor (the party transferring the property).

- The grantor's signature must be notarized.

- The deed must contain the grantor's name and address.

- The deed must contain the grantee's name and address (the party receiving the property).

- The deed must contain a description of the property being transferred, including the assessor's parcel number.

- The deed must contain the consideration (the price or value of the property being transferred).

- The deed must be acknowledged by a notary public.

Additional Requirements for Recording a Grant Deed in Riverside County

In addition to the requirements mentioned above, the Riverside County Recorder's office has specific requirements for recording a Grant Deed. These requirements include:

- The deed must be recorded in the Riverside County Recorder's office within a certain timeframe (usually 30 days) after it is signed and notarized.

- The deed must be accompanied by a Preliminary Change of Ownership Report (PCOR) form.

- The deed must be accompanied by a Documentary Transfer Tax payment (if applicable).

- The deed must meet the Riverside County Recorder's formatting requirements.

Preliminary Change of Ownership Report (PCOR) Form

The PCOR form is a required document that must be submitted with the Grant Deed when recording it in Riverside County. The form provides information about the property being transferred, including the property's value, location, and ownership information.

Documentary Transfer Tax in Riverside County

Documentary Transfer Tax is a tax imposed on the transfer of real property in California. In Riverside County, the Documentary Transfer Tax rate is $1.10 per $1,000 of the property's value. The tax is usually paid by the seller, but it can be negotiated between the parties.

How to Obtain a Grant Deed Form in Riverside County

Grant Deed forms can be obtained from various sources, including:

- The Riverside County Recorder's office

- Real estate attorneys

- Online form providers

- Office supply stores

It is essential to use a Grant Deed form that meets the specific requirements of Riverside County and the State of California.

Consequences of Non-Compliance with Grant Deed Requirements

Failure to comply with the Grant Deed requirements in Riverside County can result in significant consequences, including:

- Delayed or rejected recording of the deed

- Additional fees and penalties

- Potential loss of property ownership

Best Practices for Completing a Grant Deed Form in Riverside County

To avoid errors and ensure a smooth transfer of ownership, it is recommended to:

- Use a Grant Deed form that meets the specific requirements of Riverside County and the State of California.

- Carefully review the form for accuracy and completeness.

- Have the form reviewed by a real estate attorney or other qualified professional.

- Ensure that all parties sign and notarize the form as required.

By following these best practices and understanding the Grant Deed form requirements in Riverside County, individuals and families can ensure a successful transfer of ownership and avoid potential pitfalls.

We hope this article has provided valuable information about Grant Deed form requirements in Riverside County, California. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with others who may find it helpful, and don't forget to follow us for more informative articles on real estate and property law.

FAQ Section:

What is a Grant Deed in California?

+A Grant Deed is a type of deed that transfers ownership of a property from one party to another. It is a crucial document in the real estate process, as it ensures that the buyer receives the property with clear title.

What are the requirements for recording a Grant Deed in Riverside County?

+To be recorded in Riverside County, a Grant Deed must meet specific requirements, including being in writing, signed by the grantor, notarized, and containing the grantor's name and address, the grantee's name and address, and a description of the property being transferred.

What is the Documentary Transfer Tax in Riverside County?

+The Documentary Transfer Tax in Riverside County is a tax imposed on the transfer of real property, with a rate of $1.10 per $1,000 of the property's value.