Filling out Form G-45, also known as the Hawaii Tax Withholding Form, is a crucial step for both employers and employees in Hawaii. This form determines the amount of state income tax to be withheld from an employee's wages. In this article, we will explore five ways to fill out Form G-45, ensuring that you comply with Hawaii tax laws and regulations.

Understanding Form G-45

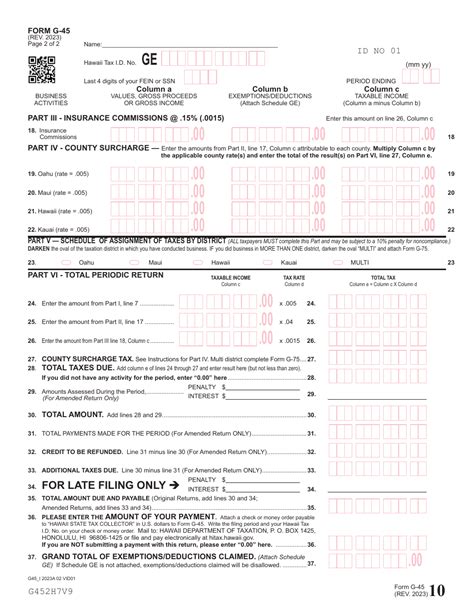

Before we dive into the ways to fill out Form G-45, it's essential to understand its purpose and the information required. Form G-45 is a state tax withholding form used by employers to determine the amount of Hawaii state income tax to withhold from an employee's wages. The form requires employees to provide their personal and tax-related information, which will help employers determine the correct tax withholding.

1. Obtain and Review Form G-45

The first step in filling out Form G-45 is to obtain the form from the Hawaii Department of Taxation website or from your employer. Review the form carefully, ensuring you understand the information required. The form consists of two parts: Part I, which requires employee information, and Part II, which requires tax withholding information.

2. Fill Out Part I: Employee Information

In Part I of Form G-45, you will need to provide your personal and employment information. This includes:

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your date of birth

- Your occupation and employer information

Ensure that you provide accurate and complete information to avoid any errors or delays in processing your tax withholding.

3. Fill Out Part II: Tax Withholding Information

In Part II of Form G-45, you will need to provide information related to your tax withholding. This includes:

- Your filing status (single, married, head of household, etc.)

- The number of exemptions you are claiming

- Your tax withholding preferences (e.g., standard withholding, additional withholding, etc.)

You may also need to provide information about your dependents, if applicable.

4. Claim Exemptions and Adjust Withholding

As an employee, you may be eligible to claim exemptions, which can reduce your tax withholding. You can claim exemptions for yourself, your spouse, and your dependents. Additionally, you may need to adjust your withholding if you have multiple jobs or if your income changes.

To claim exemptions, complete the exemption section of Form G-45. You will need to provide the number of exemptions you are claiming and the type of exemption (e.g., single, married, head of household, etc.).

5. Submit Form G-45 to Your Employer

Once you have completed Form G-45, submit it to your employer. Your employer will use the information provided on the form to determine the correct tax withholding for your wages. Ensure that you submit the form on time to avoid any errors or delays in processing your tax withholding.

Tips and Reminders

- Complete Form G-45 accurately and thoroughly to avoid any errors or delays in processing your tax withholding.

- Review and update your tax withholding information periodically to ensure that it remains accurate.

- If you have any questions or concerns about completing Form G-45, consult with your employer or a tax professional.

By following these five ways to fill out Form G-45, you can ensure that your Hawaii state income tax withholding is accurate and compliant with state tax laws and regulations.

Final Thoughts

Filling out Form G-45 is a crucial step in ensuring that your Hawaii state income tax withholding is accurate and compliant with state tax laws and regulations. By understanding the form, providing accurate and complete information, and submitting the form on time, you can avoid any errors or delays in processing your tax withholding. If you have any questions or concerns about completing Form G-45, don't hesitate to reach out to your employer or a tax professional.

Share Your Thoughts

Have you completed Form G-45 before? Share your experiences and tips in the comments below. If you have any questions or concerns about filling out Form G-45, ask us, and we'll do our best to help.

FAQ Section

What is Form G-45?

+Form G-45, also known as the Hawaii Tax Withholding Form, is a state tax withholding form used by employers to determine the amount of Hawaii state income tax to withhold from an employee's wages.

Who needs to complete Form G-45?

+All employees in Hawaii need to complete Form G-45 to determine their state income tax withholding.

How often do I need to update my tax withholding information?

+You should review and update your tax withholding information periodically to ensure that it remains accurate. You may need to update your information if your income changes, you get married or divorced, or you have children.