As a resident of Georgia, understanding the state's tax laws and filing requirements is essential to ensure compliance and avoid any potential penalties. The Georgia Tax Form 500EZ is a simplified tax form designed for individuals with straightforward tax situations. In this article, we will provide a comprehensive guide to help you navigate the Georgia Tax Form 500EZ and ensure a smooth filing process.

The Importance of Accurate Tax Filing

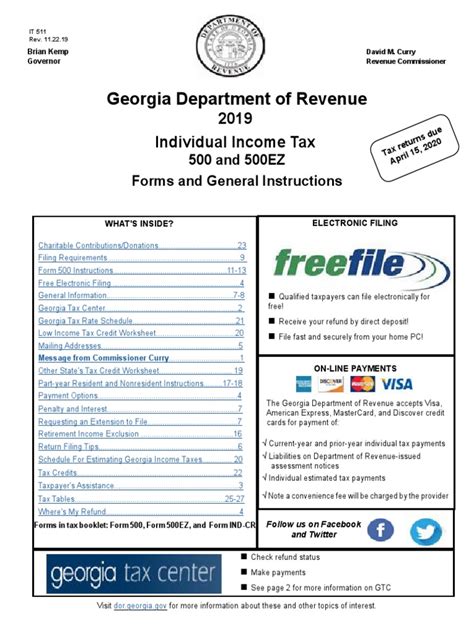

Filing taxes accurately and on time is crucial to avoid any potential penalties and interest. The Georgia Department of Revenue offers various tax forms, including the 500EZ, to cater to different taxpayer needs. The 500EZ form is specifically designed for individuals who have a simple tax situation, with few or no dependents, and no itemized deductions. By using the correct tax form, you can ensure that you are taking advantage of the tax credits and deductions you are eligible for.

Who Can Use the Georgia Tax Form 500EZ?

The Georgia Tax Form 500EZ is designed for individuals who meet specific eligibility criteria. To qualify for the 500EZ form, you must:

- Be a resident of Georgia

- Have only one income source (W-2)

- Have no dependents

- Not itemize deductions

- Not claim any tax credits other than the Earned Income Tax Credit (EITC)

If you meet these criteria, you can use the 500EZ form to file your state taxes.

Benefits of Using the Georgia Tax Form 500EZ

Using the Georgia Tax Form 500EZ offers several benefits, including:

- Simplified filing process: The 500EZ form is designed to be easy to understand and complete, reducing the complexity of the tax filing process.

- Reduced paperwork: With the 500EZ form, you only need to report your income, claim the standard deduction, and sign the form.

- Faster refunds: The Georgia Department of Revenue processes 500EZ forms more quickly than other tax forms, resulting in faster refunds.

How to Complete the Georgia Tax Form 500EZ

Completing the Georgia Tax Form 500EZ is a straightforward process. Here are the steps to follow:

- Gather required information: You will need your W-2 form, Social Security number, and any other relevant tax documents.

- Download and print the form: You can download the 500EZ form from the Georgia Department of Revenue website or pick one up from a local library or tax office.

- Complete the form: Fill in the required information, including your name, address, Social Security number, and income.

- Sign and date the form: Once you have completed the form, sign and date it.

- File the form: You can file the form electronically or by mail.

Tips for Filing the Georgia Tax Form 500EZ

Here are some tips to keep in mind when filing the Georgia Tax Form 500EZ:

- Make sure to report all income: Include all income from your W-2 form, as well as any other income you may have received.

- Claim the standard deduction: The standard deduction is a fixed amount that you can claim without itemizing deductions.

- Review and edit carefully: Double-check your form for errors and edit as needed before submitting.

- File electronically: Filing electronically can reduce errors and speed up the refund process.

Common Mistakes to Avoid

When filing the Georgia Tax Form 500EZ, there are several common mistakes to avoid:

- Inaccurate income reporting: Make sure to report all income accurately to avoid any penalties or interest.

- Incorrect Social Security number: Double-check your Social Security number to ensure it is accurate.

- Unsigned or undated form: Make sure to sign and date the form before submitting.

Amending the Georgia Tax Form 500EZ

If you need to make changes to your original tax return, you can file an amended return using Form 500X. Here are the steps to follow:

- Complete Form 500X: Fill in the required information, including the changes you want to make.

- Attach supporting documentation: Include any supporting documentation, such as W-2 forms or receipts.

- File the form: File the amended return electronically or by mail.

Conclusion

Filing taxes can be a complex and overwhelming process, but using the Georgia Tax Form 500EZ can simplify the process. By following the steps outlined in this guide, you can ensure a smooth filing process and take advantage of the tax credits and deductions you are eligible for. Remember to review and edit carefully, avoid common mistakes, and amend your return if necessary.

What's Next?

Now that you have a better understanding of the Georgia Tax Form 500EZ, it's time to take action. Download the form, gather required information, and complete the form. If you have any questions or concerns, don't hesitate to contact the Georgia Department of Revenue or a tax professional.

FAQ Section

What is the Georgia Tax Form 500EZ?

+The Georgia Tax Form 500EZ is a simplified tax form designed for individuals with straightforward tax situations.

Who can use the Georgia Tax Form 500EZ?

+The 500EZ form is designed for individuals who meet specific eligibility criteria, including being a resident of Georgia, having only one income source, and not itemizing deductions.

How do I file the Georgia Tax Form 500EZ?

+You can file the 500EZ form electronically or by mail. Make sure to sign and date the form and include all required information.