The world of taxes can be overwhelming, especially when it comes to understanding the various tax forms and schedules. One such form that often raises questions is Schedule W, also known as the Withholding Certificate for Certain Future Payments. If you're a taxpayer receiving certain types of income, you may need to file Schedule W to report the taxes withheld from these payments. In this article, we'll delve into the essential facts about Schedule W, helping you understand its purpose, who needs to file it, and what information it requires.

What is Schedule W?

Schedule W is a tax form used to report the taxes withheld from certain types of income, such as pensions, annuities, and other deferred compensation. The form is used to certify the amount of taxes withheld from these payments, ensuring that the taxpayer is in compliance with tax laws.

Purpose of Schedule W

The primary purpose of Schedule W is to provide the taxpayer with a record of the taxes withheld from their income. This information is essential for accurately completing their tax return, as it ensures that the correct amount of taxes is reported and paid. By filing Schedule W, taxpayers can avoid potential penalties and interest associated with underreporting their income.

Who Needs to File Schedule W?

Not all taxpayers are required to file Schedule W. Generally, you'll need to file this form if you receive certain types of income, such as:

- Pensions and annuities

- Deferred compensation

- Retirement accounts, like 401(k) or IRA distributions

- Social Security benefits

If you're unsure whether you need to file Schedule W, consult with a tax professional or refer to the IRS guidelines.

Types of Income Reported on Schedule W

Schedule W reports various types of income, including:

- Taxable pensions and annuities

- Deferred compensation, such as 401(k) or IRA distributions

- Retirement account distributions

- Social Security benefits

- Other types of income, like disability payments or survivor benefits

It's essential to accurately report all types of income on Schedule W to ensure compliance with tax laws.

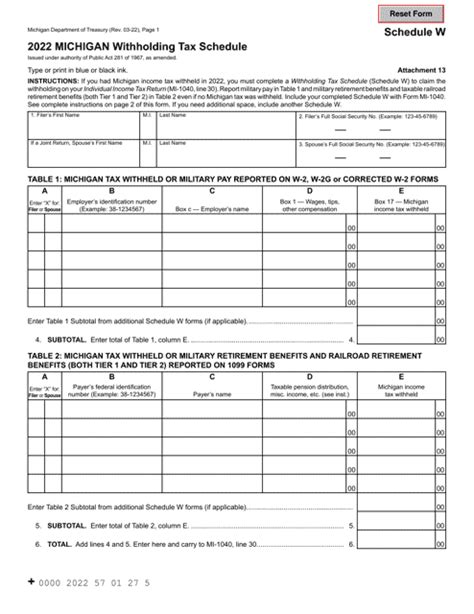

How to Complete Schedule W

Completing Schedule W requires accurate information about the taxes withheld from your income. Here's a step-by-step guide to help you fill out the form:

- Gather all necessary documents, including your W-2, 1099, and other income statements.

- Identify the types of income you need to report on Schedule W.

- Complete the required fields, including your name, address, and taxpayer identification number.

- Report the taxes withheld from each type of income.

- Calculate the total taxes withheld and enter the amount on the form.

Common Mistakes to Avoid

When completing Schedule W, it's essential to avoid common mistakes that can lead to penalties and interest. Some common errors include:

- Failing to report all types of income

- Incorrectly calculating the taxes withheld

- Failing to sign and date the form

Double-check your calculations and ensure you've reported all required information to avoid any issues.

Consequences of Not Filing Schedule W

Failing to file Schedule W or accurately report the taxes withheld from your income can result in severe consequences, including:

- Penalties and interest on underreported taxes

- Delayed refunds or audits

- Potential loss of credits and deductions

Don't risk facing these consequences – ensure you file Schedule W accurately and on time.

Seeking Professional Help

If you're unsure about completing Schedule W or have complex tax situations, consider seeking the help of a tax professional. They can guide you through the process, ensuring you accurately report your income and avoid any potential issues.

In conclusion, Schedule W is an essential tax form for taxpayers receiving certain types of income. By understanding the purpose, requirements, and completion process, you can accurately report your income and avoid potential penalties. If you're unsure about any aspect of Schedule W, don't hesitate to seek professional help.

What is the purpose of Schedule W?

+Schedule W is used to report the taxes withheld from certain types of income, such as pensions, annuities, and other deferred compensation.

Who needs to file Schedule W?

+Taxpayers receiving certain types of income, such as pensions, annuities, and deferred compensation, need to file Schedule W.

What are the consequences of not filing Schedule W?

+Failing to file Schedule W can result in penalties and interest on underreported taxes, delayed refunds or audits, and potential loss of credits and deductions.