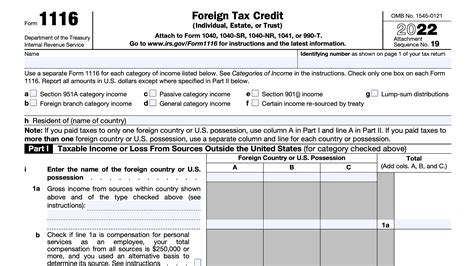

As a taxpayer, it's essential to understand the intricacies of Form 1116, Foreign Tax Credit (Individual, Estate, or Trust). This form is used to claim a foreign tax credit against U.S. taxes, and its accuracy can significantly impact your tax liability. In this article, we'll delve into five crucial Form 1116 filing tips to help you navigate the complexities of foreign tax credits.

Understanding the Purpose of Form 1116

Form 1116 is used by individual taxpayers, estates, and trusts to claim a foreign tax credit against U.S. taxes. The form is designed to prevent double taxation on foreign-earned income. By claiming a foreign tax credit, taxpayers can reduce their U.S. tax liability, thereby avoiding taxation on the same income by both the foreign country and the United States.

Who Needs to File Form 1116?

To determine if you need to file Form 1116, consider the following scenarios:

- You received foreign-earned income, such as wages, dividends, or interest.

- You paid foreign taxes on that income.

- You want to claim a foreign tax credit against your U.S. tax liability.

If any of these situations apply to you, it's likely that you'll need to file Form 1116.

Tips for Filing Form 1116

1. Gather Required Documents

Before starting the filing process, ensure you have the necessary documents, including:

- Foreign tax returns or statements showing taxes paid

- W-2 or 1099 forms for foreign-earned income

- Records of foreign tax credits claimed in previous years

- Any other relevant documentation supporting your foreign tax credit claim

Having these documents readily available will help you accurately complete Form 1116.

Choosing the Correct Filing Status

When filing Form 1116, it's essential to select the correct filing status. This will determine which section of the form you'll complete and how you'll calculate your foreign tax credit. The available filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the filing status that matches your tax return.

Calculating the Foreign Tax Credit

Calculating the foreign tax credit involves several steps:

- Determine your foreign-earned income and foreign taxes paid.

- Calculate your U.S. tax liability on that income.

- Apply the foreign tax credit limitation, which is the lesser of the foreign taxes paid or the U.S. tax liability on the foreign-earned income.

The resulting amount is your foreign tax credit, which can be claimed against your U.S. tax liability.

Carryover and Carryback Rules

If your foreign tax credit exceeds your U.S. tax liability, you may be able to carry over or carry back the excess credit. The carryover rule allows you to claim the excess credit in future tax years, while the carryback rule permits you to claim the excess credit in previous tax years.

Understand the carryover and carryback rules to maximize your foreign tax credit benefits.

Common Errors to Avoid

When filing Form 1116, be aware of common errors that can lead to delays or even audits:

- Inaccurate or incomplete documentation

- Incorrect filing status or calculation of the foreign tax credit

- Failure to claim the correct carryover or carryback amount

- Not reporting foreign-earned income or foreign taxes paid

Avoid these mistakes by carefully reviewing your form and seeking professional assistance if needed.

Seeking Professional Help

If you're unsure about any aspect of Form 1116, consider consulting a tax professional. They can help you:

- Accurately complete the form

- Ensure compliance with IRS regulations

- Maximize your foreign tax credit benefits

Don't hesitate to seek professional help if you're unsure about any part of the filing process.

Conclusion

Filing Form 1116 can be a complex process, but by understanding the essential tips outlined in this article, you'll be better equipped to navigate the intricacies of foreign tax credits. Remember to gather required documents, choose the correct filing status, accurately calculate the foreign tax credit, and avoid common errors. If needed, don't hesitate to seek professional help to ensure you're taking advantage of the foreign tax credit benefits available to you.

We encourage you to share your experiences or ask questions about Form 1116 in the comments below. Your input can help others who may be facing similar challenges. Additionally, feel free to share this article with others who may benefit from this information.

What is Form 1116 used for?

+Form 1116 is used to claim a foreign tax credit against U.S. taxes. It's designed to prevent double taxation on foreign-earned income.

Who needs to file Form 1116?

+You'll need to file Form 1116 if you received foreign-earned income, paid foreign taxes on that income, and want to claim a foreign tax credit against your U.S. tax liability.

What documents do I need to file Form 1116?

+You'll need foreign tax returns or statements showing taxes paid, W-2 or 1099 forms for foreign-earned income, records of foreign tax credits claimed in previous years, and any other relevant documentation supporting your foreign tax credit claim.