The importance of FTCA (Federal Tort Claims Act) coverage and CAQH (Council for Affordable Quality Healthcare) forms cannot be overstated for healthcare providers. While both concepts are crucial in their own right, they intersect in significant ways, particularly when it comes to risk management and compliance. In this article, we will delve into the ways in which FTCA coverage impacts CAQH forms, exploring the critical aspects of both and how they affect healthcare providers.

Healthcare providers must navigate a complex landscape of regulations, standards, and requirements to ensure they deliver high-quality care while minimizing risks. Two key components of this landscape are FTCA coverage, which provides liability protection for certain healthcare providers, and CAQH forms, which standardize the credentialing and enrollment process. Understanding how these two elements interact is essential for healthcare providers seeking to optimize their operations and reduce their exposure to potential claims.

Understanding FTCA Coverage

FTCA coverage is a form of liability protection provided to healthcare providers who participate in certain federal programs, such as community health centers. This coverage shields these providers from medical malpractice claims, offering a degree of financial security in the event of a lawsuit. For healthcare providers, FTCA coverage is not just beneficial but often a necessity, given the high stakes and risks involved in healthcare delivery.

Key Benefits of FTCA Coverage

- Financial Protection: FTCA coverage protects healthcare providers from financial losses due to medical malpractice claims, which can be devastating.

- Reduced Administrative Burden: By having a standardized process for handling claims, FTCA coverage reduces the administrative burden on healthcare providers.

- Improved Focus on Care: With the financial risks managed, healthcare providers can focus more on delivering quality care rather than worrying about potential lawsuits.

Understanding CAQH Forms

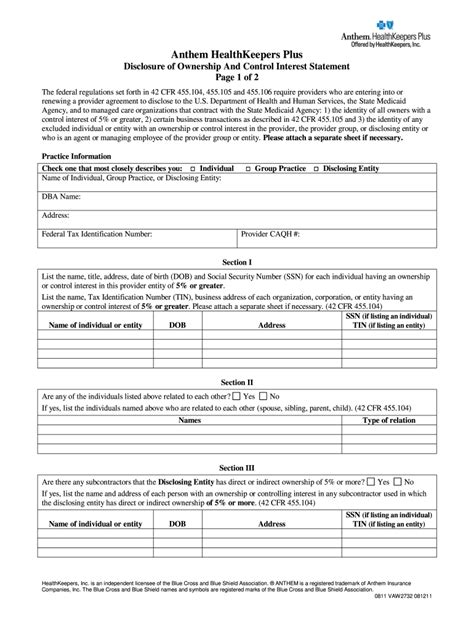

CAQH forms are standardized documents used in the credentialing and enrollment process for healthcare providers. These forms simplify the process of verifying a provider's credentials and facilitate the enrollment in insurance panels. CAQH forms are essential for streamlining the administrative tasks associated with provider enrollment, making it easier for providers to participate in various healthcare programs.

Key Benefits of CAQH Forms

- Streamlined Process: CAQH forms standardize the credentialing process, reducing the time and effort required for provider enrollment.

- Improved Accuracy: By using standardized forms, the likelihood of errors in the credentialing process is significantly reduced.

- Enhanced Compliance: CAQH forms help healthcare providers comply with regulatory requirements, reducing the risk of non-compliance.

5 Ways FTCA Coverage Impacts CAQH Forms

1. Risk Management and Compliance

FTCA coverage and CAQH forms both play crucial roles in risk management and compliance for healthcare providers. FTCA coverage protects providers from medical malpractice claims, while CAQH forms ensure compliance with credentialing and enrollment standards. Together, they help providers navigate the complex regulatory landscape.

2. Simplified Credentialing Process

The use of CAQH forms simplifies the credentialing process, which is a prerequisite for obtaining FTCA coverage for some healthcare providers. By streamlining this process, CAQH forms make it easier for providers to apply for and maintain FTCA coverage.

3. Reduced Administrative Burden

Both FTCA coverage and CAQH forms contribute to reducing the administrative burden on healthcare providers. FTCA coverage does so by managing the financial risks associated with medical malpractice claims, while CAQH forms simplify the credentialing and enrollment process.

4. Improved Focus on Patient Care

By managing risks and reducing administrative burdens, FTCA coverage and CAQH forms enable healthcare providers to focus more on delivering quality patient care. This alignment is crucial for improving healthcare outcomes and patient satisfaction.

5. Enhanced Collaboration and Efficiency

The integration of FTCA coverage and CAQH forms promotes a more efficient and collaborative healthcare environment. By standardizing processes and reducing risks, these two elements facilitate better communication and coordination among healthcare providers, insurers, and patients.

Conclusion: Navigating the Complexities of FTCA Coverage and CAQH Forms

Navigating the complexities of FTCA coverage and CAQH forms is essential for healthcare providers seeking to optimize their operations, minimize risks, and deliver high-quality care. By understanding how these two critical components interact, providers can better manage their risks, streamline their administrative processes, and focus on what matters most: delivering excellent patient care.

We encourage you to share your thoughts on the impact of FTCA coverage on CAQH forms in the comments section below. How do you think these two elements could be further integrated to benefit healthcare providers and patients alike? Share this article with your peers to spark a discussion on this important topic.

What is FTCA coverage, and why is it important for healthcare providers?

+FTCA coverage is a form of liability protection provided to healthcare providers who participate in certain federal programs. It shields these providers from medical malpractice claims, offering financial security in the event of a lawsuit. This coverage is crucial for managing risks and ensuring providers can focus on delivering quality care.

How do CAQH forms simplify the credentialing process for healthcare providers?

+CAQH forms standardize the credentialing process, reducing the time and effort required for provider enrollment. They also improve accuracy and compliance with regulatory requirements, making it easier for providers to participate in various healthcare programs.

Can FTCA coverage and CAQH forms be used in conjunction to enhance risk management and compliance for healthcare providers?

+Yes, FTCA coverage and CAQH forms can be used together to manage risks and ensure compliance. FTCA coverage protects providers from medical malpractice claims, while CAQH forms simplify the credentialing process and ensure compliance with regulatory standards.