As a resident of Missouri, filing your taxes can seem like a daunting task, especially with the numerous forms and instructions to follow. However, with a clear understanding of the process, you can navigate the filing of your MO 1040 tax form with ease. In this article, we will provide you with a comprehensive guide on how to file your MO 1040 tax form, including the necessary steps, required documents, and tips to ensure a smooth and efficient process.

Understanding the MO 1040 Tax Form

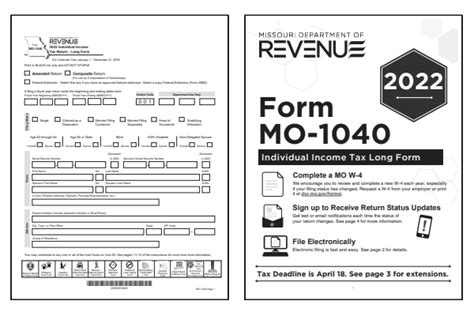

The MO 1040 tax form is the standard form used by the Missouri Department of Revenue to report an individual's income tax. The form is used to calculate the amount of tax owed or refund due to the taxpayer. The MO 1040 form is typically filed on an annual basis, with the deadline usually falling on April 15th.

Gathering Required Documents

Before you begin filing your MO 1040 tax form, it's essential to gather all the necessary documents to ensure a smooth and efficient process. Some of the required documents include:

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's social security number or ITIN (if applicable)

- Your dependents' social security numbers or ITINs (if applicable)

- Your W-2 forms from all employers

- Your 1099 forms for freelance work, interest, dividends, and capital gains

- Your Schedule A for itemized deductions (if applicable)

- Your Schedule B for interest and dividend income (if applicable)

- Your Schedule C for business income and expenses (if applicable)

- Your Schedule D for capital gains and losses (if applicable)

Step-by-Step Guide to Filing Your MO 1040 Tax Form

Filing your MO 1040 tax form involves several steps, which are outlined below:

Step 1: Determine Your Filing Status

Your filing status determines the tax rates and deductions you're eligible for. The most common filing statuses in Missouri include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 2: Calculate Your Income

Report all your income from various sources, including:

- Wages, salaries, and tips

- Freelance work and self-employment income

- Interest and dividend income

- Capital gains and losses

- Business income and expenses

Step 3: Claim Your Deductions

Missouri allows several deductions, including:

- Standard deduction

- Itemized deductions

- Personal exemption

- Dependent exemption

Step 4: Calculate Your Tax Liability

Use the tax tables or tax calculator to determine your tax liability based on your filing status and income.

Step 5: Claim Your Credits

Missouri offers several tax credits, including:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education Credits

Step 6: File Your Return

You can file your MO 1040 tax form electronically or by mail. Electronic filing is faster and more secure, while mailing your return may take longer.

Tips and Reminders

- File your return on time to avoid penalties and interest.

- Use the correct form and instructions to avoid errors and delays.

- Keep accurate records of your income and deductions.

- Take advantage of tax credits and deductions to minimize your tax liability.

- Consider consulting a tax professional or using tax software to ensure accuracy and efficiency.

Common Mistakes to Avoid

- Failing to report all income

- Claiming incorrect deductions and credits

- Failing to sign and date the return

- Using incorrect forms and instructions

- Missing the filing deadline

FAQs

What is the deadline for filing my MO 1040 tax form?

+The deadline for filing your MO 1040 tax form is usually April 15th.

Can I file my MO 1040 tax form electronically?

+Yes, you can file your MO 1040 tax form electronically through the Missouri Department of Revenue website.

What if I need help filing my MO 1040 tax form?

+You can consult a tax professional or use tax software to ensure accuracy and efficiency.

By following this comprehensive guide, you'll be able to navigate the process of filing your MO 1040 tax form with ease. Remember to gather all necessary documents, follow the step-by-step guide, and avoid common mistakes to ensure a smooth and efficient process. If you have any questions or need help, don't hesitate to consult a tax professional or use tax software.

Now that you've completed the guide, we invite you to share your thoughts and experiences in the comments below. Have you filed your MO 1040 tax form before? What challenges did you face, and how did you overcome them? Share your story and help others in the community!