Obtaining a Navy Federal Tax ID Certification Form is a crucial step for individuals and businesses that want to establish a financial relationship with Navy Federal Credit Union. This form, also known as the W-9 form, is used to certify the taxpayer identification number (TIN) of a borrower, ensuring that the credit union complies with the Internal Revenue Service (IRS) requirements. In this article, we will discuss the importance of the Navy Federal Tax ID Certification Form and provide five ways to obtain it.

The Navy Federal Tax ID Certification Form is essential for several reasons. Firstly, it helps the credit union to verify the identity of its members and ensure that they are complying with tax laws. Secondly, it enables the credit union to report interest income and other tax-related information to the IRS accurately. Lastly, the form helps to prevent identity theft and ensures that the credit union is not liable for any tax-related errors.

Now, let's explore the five ways to obtain a Navy Federal Tax ID Certification Form:

Option 1: Download the Form from the Navy Federal Website

The easiest way to obtain the Navy Federal Tax ID Certification Form is to download it from the Navy Federal Credit Union website. Simply visit the website, navigate to the "Forms" section, and click on the "Tax ID Certification Form" link. The form will be available in PDF format, which you can download and print.

Option 2: Visit a Navy Federal Branch

Get the Form in Person

If you prefer to obtain the form in person, you can visit a Navy Federal Credit Union branch near you. The staff will be happy to provide you with the form, and they can also answer any questions you may have. To find a branch near you, simply visit the Navy Federal website and use the branch locator tool.

Option 3: Request the Form by Mail

Get the Form by Mail

If you are unable to visit a branch or download the form from the website, you can request the Navy Federal Tax ID Certification Form by mail. Simply contact the credit union's customer service department and ask them to mail the form to you. Be sure to provide your name and address so that they can send the form to the correct location.

Option 4: Obtain the Form through Fax

Get the Form by Fax

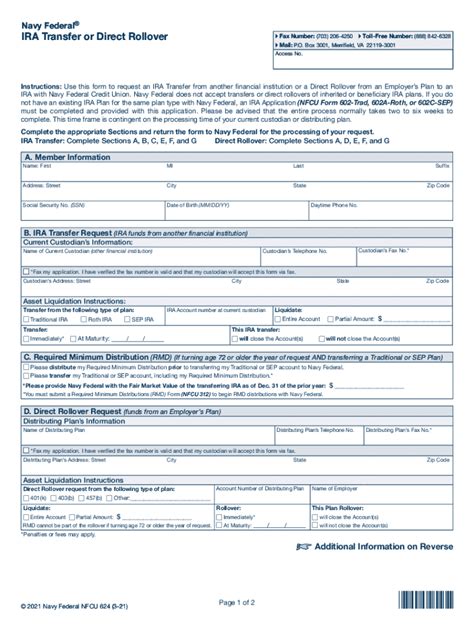

Another option is to obtain the Navy Federal Tax ID Certification Form through fax. Simply contact the credit union's customer service department and ask them to fax the form to you. Be sure to provide your fax number so that they can send the form to the correct location.

Option 5: Use Online Tax Preparation Software

Use Online Tax Preparation Software

Finally, you can also obtain the Navy Federal Tax ID Certification Form through online tax preparation software. Many tax preparation software programs, such as TurboTax or H&R Block, offer the form as part of their services. Simply sign up for the software, and you will be able to access the form and complete it electronically.

Once you have obtained the Navy Federal Tax ID Certification Form, you will need to complete it accurately and return it to the credit union. The form requires you to provide your name, address, and taxpayer identification number (TIN), as well as certify that the information is accurate.

What to Do with the Completed Form

Return the Form to Navy Federal

Once you have completed the Navy Federal Tax ID Certification Form, you will need to return it to the credit union. You can do this by mail, fax, or in person. Be sure to keep a copy of the completed form for your records.

Benefits of Obtaining a Navy Federal Tax ID Certification Form

Establish a Financial Relationship with Navy Federal

Obtaining a Navy Federal Tax ID Certification Form is an essential step in establishing a financial relationship with Navy Federal Credit Union. The form helps to ensure that the credit union is complying with IRS requirements and prevents identity theft. Additionally, the form enables the credit union to report interest income and other tax-related information to the IRS accurately.

In conclusion, obtaining a Navy Federal Tax ID Certification Form is a crucial step for individuals and businesses that want to establish a financial relationship with Navy Federal Credit Union. By following the five options outlined above, you can easily obtain the form and complete it accurately. Remember to return the completed form to the credit union and keep a copy for your records.

We hope this article has been informative and helpful. If you have any questions or need further assistance, please don't hesitate to contact us. We are always here to help.

Call to Action

Get Started Today!

Don't wait any longer to establish a financial relationship with Navy Federal Credit Union. Obtain your Navy Federal Tax ID Certification Form today and take the first step towards a secure financial future. Contact Navy Federal Credit Union or visit their website to get started.

What is a Navy Federal Tax ID Certification Form?

+A Navy Federal Tax ID Certification Form is a document that certifies the taxpayer identification number (TIN) of a borrower, ensuring that the credit union complies with IRS requirements.

Why do I need to obtain a Navy Federal Tax ID Certification Form?

+You need to obtain a Navy Federal Tax ID Certification Form to establish a financial relationship with Navy Federal Credit Union and ensure that the credit union is complying with IRS requirements.

How can I obtain a Navy Federal Tax ID Certification Form?

+You can obtain a Navy Federal Tax ID Certification Form by downloading it from the Navy Federal website, visiting a Navy Federal branch, requesting it by mail, obtaining it through fax, or using online tax preparation software.