Filling out tax forms can be a daunting task, especially for those who are new to the process. Idaho Form 967, also known as the Idaho Corporation Income Tax Return, is a crucial document for businesses operating in the state. In this article, we will guide you through five ways to fill out Idaho Form 967 accurately and efficiently.

Idaho Form 967 is a complex document that requires careful attention to detail. Failure to complete it correctly can result in delays, penalties, or even audits. As a business owner, it's essential to understand the importance of accurate tax filing and how to navigate the process with ease.

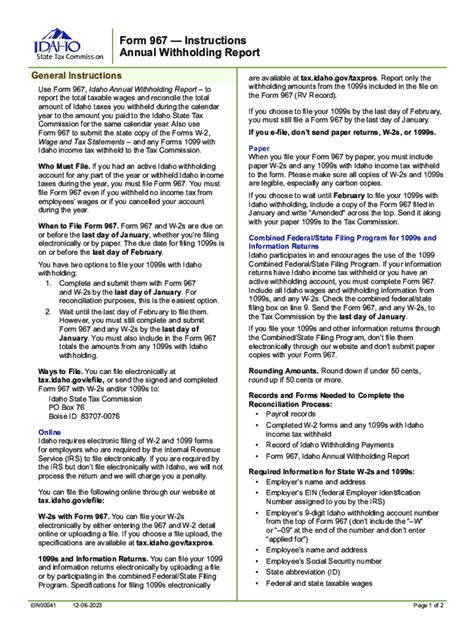

The Idaho State Tax Commission requires corporations to file Form 967 annually, reporting their income, deductions, and tax liabilities. The form consists of multiple sections, each with its own set of instructions and requirements. To ensure accuracy and compliance, it's crucial to follow the correct procedures when filling out Idaho Form 967.

1. Gather Required Documents and Information

Before starting the filing process, gather all necessary documents and information. This includes:

- Federal income tax return (Form 1120)

- Idaho business registration documents

- Financial statements (balance sheet and income statement)

- Depreciation schedules

- Tax credits and deductions documentation

Having all the required information readily available will save time and reduce the risk of errors.

2. Determine the Correct Filing Status

Idaho Form 967 has different filing statuses, including:

- Corporation

- S-Corporation

- Limited Liability Company (LLC)

- Partnership

Ensure you select the correct filing status for your business. This will determine the sections of the form you need to complete and the tax rates applicable to your business.

3. Complete the Form Sections

Idaho Form 967 is divided into several sections, including:

- Section 1: Income

- Section 2: Deductions

- Section 3: Tax Credits

- Section 4: Tax Liability

Complete each section carefully, following the instructions provided. Ensure you report all income, deductions, and tax credits accurately.

4. Calculate Tax Liability

Calculate your tax liability using the information reported in the previous sections. Idaho has a corporate tax rate of 7.4%, but this rate may vary depending on your business's specific circumstances.

5. Review and Submit the Form

Once you've completed the form, review it carefully for accuracy and completeness. Ensure you've signed and dated the form, and attach all required supporting documentation.

Submit the form to the Idaho State Tax Commission by the designated deadline. You can file electronically or by mail, depending on your preference.

Benefits of Accurate Filing

Accurate filing of Idaho Form 967 offers several benefits, including:

- Avoidance of penalties and fines

- Reduced risk of audits

- Improved compliance with state tax laws

- Enhanced credibility and reputation for your business

Common Mistakes to Avoid

When filling out Idaho Form 967, avoid common mistakes such as:

- Inaccurate or incomplete information

- Failure to report all income and deductions

- Incorrect tax credits and deductions

- Late or incomplete filing

Importance of Timely Filing

Timely filing of Idaho Form 967 is crucial to avoid penalties and fines. The Idaho State Tax Commission imposes penalties for late filing, which can range from 5% to 25% of the tax liability.

Conclusion

Filling out Idaho Form 967 requires attention to detail and careful planning. By following the five ways outlined in this article, you can ensure accurate and efficient filing of your Idaho corporation income tax return. Remember to gather required documents, determine the correct filing status, complete the form sections, calculate tax liability, and review and submit the form carefully.

If you're unsure about any aspect of the filing process, consider consulting a tax professional or seeking guidance from the Idaho State Tax Commission.

Additional Tips

- Keep accurate and detailed records of your business's financial transactions.

- Stay up-to-date with changes in Idaho tax laws and regulations.

- Consider using tax preparation software to streamline the filing process.

Call to Action

Share your experiences and tips for filling out Idaho Form 967 in the comments section below. If you have any questions or concerns, feel free to ask, and we'll do our best to assist you.

What is the deadline for filing Idaho Form 967?

+The deadline for filing Idaho Form 967 is typically March 15th for corporations and April 15th for S-Corporations and LLCs.

Can I file Idaho Form 967 electronically?

+Yes, you can file Idaho Form 967 electronically through the Idaho State Tax Commission's website.

What are the consequences of late filing?

+Late filing can result in penalties and fines, ranging from 5% to 25% of the tax liability.