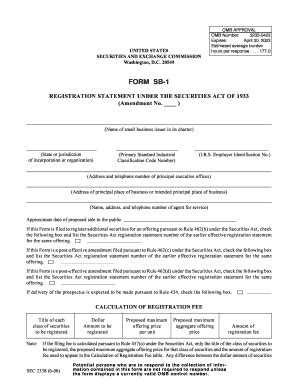

Filing a Form Sb-1, also known as the Statement of Beneficial Ownership of Securities, is a crucial step for companies to disclose the ownership structure of their securities. This form is typically required by the Securities and Exchange Commission (SEC) for companies that issue securities to the public. In this article, we will delve into the world of Form Sb-1, exploring its importance, benefits, and providing a step-by-step guide on how to file with ease.

The Importance of Form Sb-1

Form Sb-1 is a vital document that helps the SEC monitor and regulate the ownership structure of publicly traded companies. By filing this form, companies provide transparency into their ownership structure, which is essential for maintaining investor confidence and preventing fraudulent activities. The form requires companies to disclose the names and addresses of their beneficial owners, as well as the number of securities they own.

Benefits of Filing Form Sb-1

Filing Form Sb-1 has numerous benefits for companies, including:

- Increased transparency: By disclosing the ownership structure of their securities, companies demonstrate their commitment to transparency and accountability.

- Improved investor confidence: Investors are more likely to invest in companies that provide clear and accurate information about their ownership structure.

- Enhanced regulatory compliance: Filing Form Sb-1 helps companies comply with SEC regulations, reducing the risk of penalties and fines.

Who Needs to File Form Sb-1?

Form Sb-1 is required for companies that issue securities to the public, including:

- Publicly traded companies: Companies listed on a national securities exchange, such as the New York Stock Exchange (NYSE) or NASDAQ.

- Companies with a large number of shareholders: Companies with 500 or more shareholders of record, or with a total asset value of $10 million or more.

- Companies that issue securities in private offerings: Companies that issue securities in private offerings, such as venture capital or private equity investments.

Step-by-Step Guide to Filing Form Sb-1

Filing Form Sb-1 can be a complex process, but by following these steps, you can ensure a smooth and efficient filing experience:

Step 1: Gather Required Information

- Company information: Obtain the company's name, address, and taxpayer identification number.

- Beneficial owner information: Gather the names, addresses, and taxpayer identification numbers of the company's beneficial owners.

- Security information: Collect information about the securities issued by the company, including the type, number, and class of securities.

Step 2: Determine the Filing Deadline

- Filing deadline: Form Sb-1 must be filed within 120 days after the end of the company's fiscal year.

- Extension of time: If necessary, companies can request an extension of time to file Form Sb-1.

Step 3: Prepare the Form

- Download the form: Obtain the Form Sb-1 template from the SEC's website.

- Complete the form: Fill out the form with the required information, using the instructions provided by the SEC.

Step 4: File the Form

- Electronic filing: File the form electronically through the SEC's EDGAR system.

- Paper filing: Alternatively, file the form in paper format, using the SEC's paper filing procedures.

Step 5: Pay the Filing Fee

- Filing fee: Pay the required filing fee, which varies depending on the type and number of securities issued.

Tips for Filing Form Sb-1 with Ease

To ensure a smooth and efficient filing experience, follow these tips:

- Plan ahead: Start gathering required information and preparing the form well in advance of the filing deadline.

- Seek professional help: Consider hiring a professional, such as a lawyer or accountant, to assist with the filing process.

- Use SEC resources: Utilize the SEC's resources, including the EDGAR system and the SEC's website, to guide the filing process.

Common Mistakes to Avoid When Filing Form Sb-1

To avoid delays and penalties, be aware of the following common mistakes:

- Incomplete or inaccurate information: Ensure that all required information is complete and accurate.

- Missed filing deadline: File the form on time to avoid late filing fees and penalties.

- Insufficient filing fee: Pay the required filing fee to avoid delays in processing.

Conclusion

Filing Form Sb-1 is a critical step for companies to disclose their ownership structure and maintain regulatory compliance. By following the steps outlined in this guide, companies can ensure a smooth and efficient filing experience. Remember to plan ahead, seek professional help, and use SEC resources to guide the filing process. Avoid common mistakes, such as incomplete or inaccurate information, missed filing deadlines, and insufficient filing fees.

What's Next?

Now that you have a comprehensive understanding of Form Sb-1, it's time to take action. Start gathering required information, preparing the form, and filing it with the SEC. If you have any questions or need further guidance, don't hesitate to reach out to a professional or the SEC.

Get Ready to File Form Sb-1 with Confidence!

By following the tips and guidelines outlined in this article, you'll be well on your way to filing Form Sb-1 with ease. Remember to stay organized, plan ahead, and seek help when needed. Good luck!

What is Form Sb-1?

+Form Sb-1 is a document required by the Securities and Exchange Commission (SEC) for companies to disclose the ownership structure of their securities.

Who needs to file Form Sb-1?

+Form Sb-1 is required for companies that issue securities to the public, including publicly traded companies, companies with a large number of shareholders, and companies that issue securities in private offerings.

What is the filing deadline for Form Sb-1?

+Form Sb-1 must be filed within 120 days after the end of the company's fiscal year.