Tax season can be a daunting time for many individuals, especially when it comes to reporting capital gains and losses on investments. One crucial step in this process is filing Form 8949, also known as the Sales and Other Dispositions of Capital Assets form. This form is used to report the sale or exchange of capital assets, such as stocks, bonds, and real estate, and is typically attached to the taxpayer's Form 1040. In this article, we will provide five tips for filing Form 8949 attachment to help make the process smoother and less overwhelming.

Understanding Form 8949: A Brief Overview

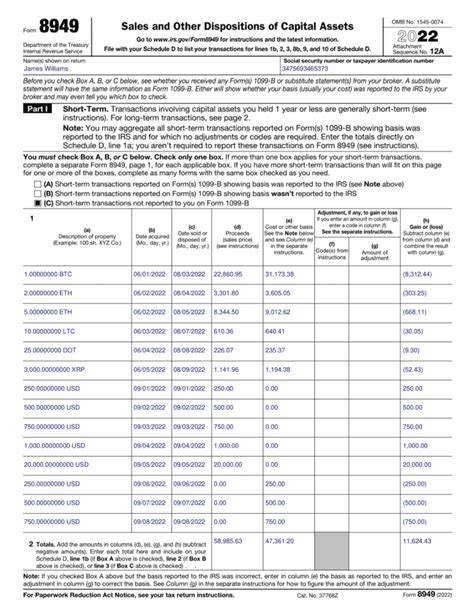

Before we dive into the tips, it's essential to understand what Form 8949 is and what it's used for. Form 8949 is a schedule that reports the sale or exchange of capital assets, which are assets held for investment or used in a trade or business. The form is used to calculate the gain or loss from these transactions, which is then reported on Schedule D (Form 1040).

Tip 1: Gather All Necessary Documents and Information

To file Form 8949 accurately, you'll need to gather all relevant documents and information related to the sale or exchange of your capital assets. This includes:

- Brokerage statements and confirmation slips

- Real estate settlement statements

- Cancellation of debt notices

- Other documents that show the sale or exchange of capital assets

Make sure to have these documents organized and readily available to ensure you don't miss any essential information.

What to Include in Your Records

When gathering documents, make sure to include the following information:

- Date of sale or exchange

- Description of the asset sold or exchanged

- Proceeds from the sale or exchange

- Cost or other basis of the asset

- Gain or loss from the sale or exchange

Tip 2: Determine the Correct Reporting Category

Form 8949 has two main reporting categories: short-term and long-term. Short-term capital gains and losses are reported in Part I of the form, while long-term capital gains and losses are reported in Part II.

Short-Term vs. Long-Term: What's the Difference?

- Short-term capital gains and losses are those from assets held for one year or less.

- Long-term capital gains and losses are those from assets held for more than one year.

Tip 3: Report Wash Sales Correctly

A wash sale occurs when you sell a security at a loss and buy a substantially identical security within 30 days before or after the sale. To report a wash sale correctly, you'll need to:

- Identify the wash sale on Form 8949

- Report the loss as a nondeductible loss on Schedule D (Form 1040)

- Add the disallowed loss to the basis of the replacement security

Tip 4: Attach Form 8949 to Your Tax Return

Once you've completed Form 8949, make sure to attach it to your tax return (Form 1040). You can attach multiple copies of Form 8949 if you have multiple transactions to report.

Electronic Filing: What You Need to Know

If you're filing your tax return electronically, you'll need to attach Form 8949 to your return using your tax software or the IRS's Free File Fillable Forms. Make sure to follow the software's instructions for attaching the form.

Tip 5: Double-Check Your Math and Accuracy

Before submitting your tax return, double-check your math and accuracy on Form 8949. A single mistake can lead to delays or even an audit.

By following these five tips, you'll be well on your way to filing Form 8949 accurately and efficiently. Remember to stay organized, report correctly, and double-check your math to avoid any potential issues.

We hope this article has provided you with valuable insights and tips for filing Form 8949 attachment. If you have any questions or concerns, please don't hesitate to comment below. Don't forget to share this article with your friends and family who may be struggling with the tax filing process.

FAQ Section:

What is Form 8949 used for?

+Form 8949 is used to report the sale or exchange of capital assets, such as stocks, bonds, and real estate.

What is the difference between short-term and long-term capital gains and losses?

+Short-term capital gains and losses are those from assets held for one year or less, while long-term capital gains and losses are those from assets held for more than one year.

How do I report a wash sale on Form 8949?

+To report a wash sale, identify the wash sale on Form 8949, report the loss as a nondeductible loss on Schedule D (Form 1040), and add the disallowed loss to the basis of the replacement security.