The Form PAFS-76, a crucial document in the world of finance and taxation, can be a daunting task for many. However, with the right guidance, mastering this form can become a breeze. In this article, we will delve into the world of Form PAFS-76, exploring its importance, benefits, and most importantly, providing you with six essential tips to help you navigate this complex document with ease.

The Form PAFS-76 is a vital tool for financial institutions, tax authorities, and individuals alike. It provides a standardized format for reporting financial transactions, making it easier to track and analyze financial data. The form's importance cannot be overstated, as it plays a critical role in ensuring compliance with tax laws and regulations. By mastering the Form PAFS-76, individuals and organizations can avoid costly errors, reduce the risk of audits, and ensure seamless financial transactions.

Understanding the Form PAFS-76

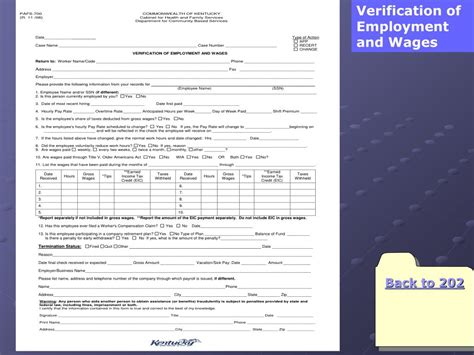

Before we dive into the tips, it's essential to understand the basics of the Form PAFS-76. The form is divided into several sections, each designed to capture specific financial information. The sections include:

- Section 1: General Information

- Section 2: Financial Transaction Details

- Section 3: Tax Information

- Section 4: Additional Information

Each section requires careful attention to detail, as errors or omissions can lead to delays or even audits.

Tip 1: Familiarize Yourself with the Form's Layout

To master the Form PAFS-76, it's crucial to understand the form's layout and structure. Take time to review the form, familiarizing yourself with each section and the required information. This will help you navigate the form with ease, reducing the risk of errors.

Tip 2: Gather Required Information in Advance

To ensure accurate completion of the Form PAFS-76, gather all required information in advance. This includes financial statements, tax documents, and any other relevant data. Having all the necessary information at your fingertips will save you time and reduce stress.

Tip 3: Use the Correct Codes and Classifications

The Form PAFS-76 requires the use of specific codes and classifications to accurately report financial transactions. Familiarize yourself with these codes and classifications to ensure accuracy and avoid errors.

Tip 4: Double-Check Your Math

Math errors are a common mistake when completing the Form PAFS-76. To avoid this, double-check your math calculations, ensuring accuracy and attention to detail.

Tip 5: Seek Professional Help When Needed

If you're unsure about any aspect of the Form PAFS-76, don't hesitate to seek professional help. Consult with a tax professional or financial advisor to ensure accurate completion of the form.

Tip 6: Review and Edit Carefully

Once you've completed the Form PAFS-76, review and edit carefully. Check for errors, omissions, and inconsistencies, making sure the form is accurate and complete.

By following these six essential tips, you'll be well on your way to mastering the Form PAFS-76. Remember to take your time, gather required information, use the correct codes and classifications, double-check your math, seek professional help when needed, and review and edit carefully.

As you become more comfortable with the Form PAFS-76, you'll find that completing it becomes a breeze. Whether you're an individual or an organization, mastering this form will save you time, reduce stress, and ensure compliance with tax laws and regulations.

We hope you found this article informative and helpful. Share your thoughts and experiences with the Form PAFS-76 in the comments below. Don't forget to share this article with your colleagues and friends who may benefit from mastering this essential financial document.

What is the Form PAFS-76 used for?

+The Form PAFS-76 is a standardized document used for reporting financial transactions and providing tax information.

What are the consequences of errors on the Form PAFS-76?

+Errors on the Form PAFS-76 can lead to delays, audits, and penalties. It's essential to ensure accurate completion of the form to avoid these consequences.

Can I seek professional help when completing the Form PAFS-76?

+Yes, if you're unsure about any aspect of the Form PAFS-76, it's recommended to seek professional help from a tax professional or financial advisor.