Understanding the Importance of Citibank IRA Withdrawal

As we navigate the complexities of retirement planning, it's essential to understand the process of withdrawing funds from an Individual Retirement Account (IRA). For Citibank customers, the Citibank IRA withdrawal form is a crucial document that facilitates the withdrawal process. In this article, we will delve into the world of Citibank IRA withdrawals, exploring the benefits, requirements, and steps involved in completing the withdrawal form.

The Benefits of Citibank IRA Withdrawals

Citibank IRA withdrawals offer several benefits, including:

- Flexibility: Withdrawing funds from a Citibank IRA provides customers with the flexibility to access their retirement savings when needed.

- Tax benefits: Withdrawals from a traditional IRA are taxed as ordinary income, while Roth IRA withdrawals are tax-free if certain conditions are met.

- Investment options: Citibank offers a range of investment options for IRA accounts, allowing customers to grow their retirement savings over time.

5 Easy Steps to Complete the Citibank IRA Withdrawal Form

Completing the Citibank IRA withdrawal form is a straightforward process that can be accomplished in five easy steps:

Step 1: Gather Required Documents

Before initiating the withdrawal process, customers must gather the required documents, including:

- A valid government-issued ID (driver's license, passport, or state ID)

- The Citibank IRA account number

- The withdrawal amount and frequency (one-time or recurring)

Step 2: Choose the Withdrawal Method

Customers can choose from two withdrawal methods:

- Online withdrawal: Customers can initiate withdrawals online through the Citibank website or mobile app.

- Phone or mail withdrawal: Customers can also initiate withdrawals by calling Citibank's customer service or by mailing a completed withdrawal form.

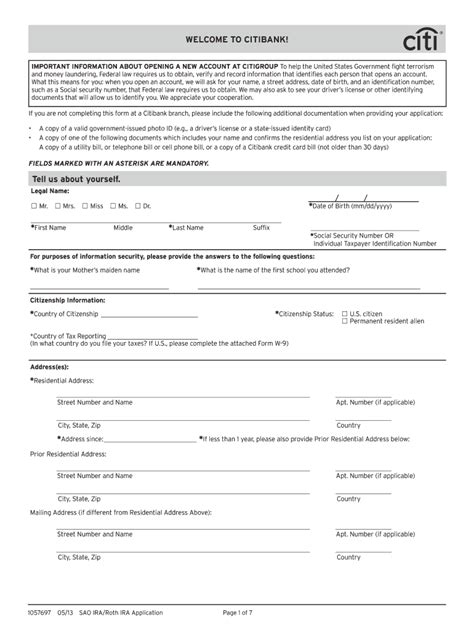

Step 3: Complete the Withdrawal Form

The Citibank IRA withdrawal form requires customers to provide the following information:

- Account information (account number, account holder's name, and address)

- Withdrawal details (withdrawal amount, frequency, and method)

- Tax withholding information (if applicable)

Step 4: Review and Sign the Form

Once the form is completed, customers must review the information carefully and sign the form. This step is crucial, as it confirms the withdrawal request and authorizes Citibank to process the transaction.

Step 5: Submit the Form and Verify the Withdrawal

After signing the form, customers can submit it to Citibank through the chosen method (online, phone, or mail). Citibank will verify the withdrawal request and process the transaction accordingly.

Additional Tips and Considerations

- Customers should carefully review the withdrawal form to ensure accuracy and completeness.

- Withdrawals from a traditional IRA may be subject to taxes and penalties if not done correctly.

- Customers should consider consulting with a financial advisor before initiating a withdrawal.

Common Questions and Concerns

Q: What are the fees associated with Citibank IRA withdrawals?

A: Fees may apply for certain types of withdrawals, such as wire transfers or overdrafts. Customers should review their account agreement or consult with Citibank's customer service for more information.

Q: Can I withdraw funds from my Citibank IRA at any time?

A: Yes, customers can withdraw funds from their Citibank IRA at any time, but certain restrictions and penalties may apply. Customers should review their account agreement or consult with Citibank's customer service for more information.

Q: How long does it take to process a Citibank IRA withdrawal?

A: The processing time for a Citibank IRA withdrawal varies depending on the method chosen. Online withdrawals are typically processed within 1-2 business days, while phone or mail withdrawals may take 3-5 business days.

Conclusion and Next Steps

Completing the Citibank IRA withdrawal form is a straightforward process that requires careful attention to detail and a clear understanding of the benefits and requirements involved. By following the five easy steps outlined in this article, customers can initiate a withdrawal from their Citibank IRA with confidence. If you have any questions or concerns about the Citibank IRA withdrawal process, please don't hesitate to comment below or share this article with a friend who may find it helpful.

FAQ Section:

What is the minimum withdrawal amount for a Citibank IRA?

+The minimum withdrawal amount for a Citibank IRA varies depending on the account type and customer agreement. Customers should review their account agreement or consult with Citibank's customer service for more information.

Can I withdraw funds from my Citibank IRA to purchase a primary residence?

+Yes, customers can withdraw funds from their Citibank IRA to purchase a primary residence, but certain restrictions and penalties may apply. Customers should review their account agreement or consult with Citibank's customer service for more information.

How do I report Citibank IRA withdrawals on my tax return?

+Customers should consult with a tax professional or the IRS to determine how to report Citibank IRA withdrawals on their tax return. Citibank will provide a 1099-R form to report the withdrawal income.