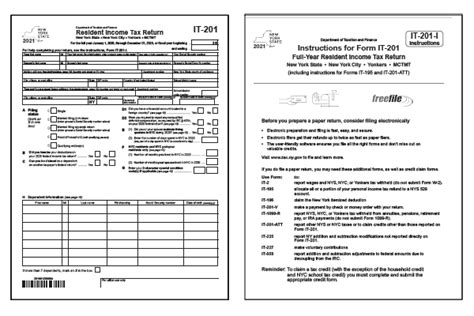

Filing taxes can be a daunting task, especially for those who are new to the process. In New York, the IT-201 form is a crucial part of the tax filing process. In this article, we will guide you through the IT-201 form, explaining its purpose, the benefits of filing, and provide step-by-step instructions on how to complete it.

What is the IT-201 Form?

The IT-201 form is the standard form used for personal income tax returns in New York. It is used to report an individual's income, deductions, and credits for the tax year. The form is typically filed by April 15th of each year, and it is essential to submit it accurately and on time to avoid penalties and interest.

Why File the IT-201 Form?

Filing the IT-201 form is mandatory for all New York residents who earned income during the tax year. Even if you don't owe taxes, filing the form can help you claim a refund or take advantage of tax credits. Some benefits of filing the IT-201 form include:

- Reporting income and claiming deductions to reduce your tax liability

- Claiming tax credits, such as the Earned Income Tax Credit (EITC)

- Reporting self-employment income and expenses

- Claiming a refund if you overpaid taxes throughout the year

Who Needs to File the IT-201 Form?

Not everyone needs to file the IT-201 form. However, if you meet any of the following conditions, you are required to file:

- You are a New York resident and earned income during the tax year

- You are a non-resident who earned income from a New York source

- You have self-employment income and expenses

- You are claiming a refund or tax credits

What You Need to File the IT-201 Form

Before you start filing the IT-201 form, make sure you have the following documents and information:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Your dependents' Social Security numbers or ITINs

- W-2 forms from all employers

- 1099 forms for self-employment income and expenses

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

Step-by-Step Guide to Filing the IT-201 Form

Filing the IT-201 form can be a complex process, but breaking it down into smaller steps can make it more manageable. Here's a step-by-step guide to help you get started:

- Gather all necessary documents and information

- Determine your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er))

- Calculate your income from all sources (W-2, 1099, self-employment, etc.)

- Calculate your deductions (standard or itemized)

- Calculate your credits (EITC, child tax credit, etc.)

- Complete the IT-201 form, using the instructions provided

- Sign and date the form

- Submit the form electronically or by mail

Common Errors to Avoid When Filing the IT-201 Form

When filing the IT-201 form, it's essential to avoid common errors that can delay your refund or result in penalties. Some common errors to avoid include:

- Incorrect Social Security numbers or ITINs

- Incorrect filing status

- Missing or incorrect W-2 or 1099 forms

- Math errors or incorrect calculations

- Failure to sign and date the form

What to Expect After Filing the IT-201 Form

After filing the IT-201 form, you can expect the following:

- A confirmation of receipt from the New York State Tax Department

- A refund or bill, depending on your tax liability

- A notice of any errors or discrepancies on your return

- A request for additional information or documentation

Amending Your IT-201 Return

If you need to make changes to your IT-201 return, you can file an amended return using Form IT-203. You can amend your return for a variety of reasons, including:

- Correcting math errors or incorrect calculations

- Claiming additional credits or deductions

- Reporting additional income or expenses

Conclusion

Filing the IT-201 form can be a daunting task, but with this guide, you're well on your way to completing your New York tax return. Remember to gather all necessary documents, avoid common errors, and seek help if you need it. By following these steps, you'll be able to file your IT-201 form with confidence and accuracy.

We hope this article has been helpful in guiding you through the IT-201 form. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with friends and family who may need help with their New York tax return.

What is the deadline for filing the IT-201 form?

+The deadline for filing the IT-201 form is typically April 15th of each year.

Can I file the IT-201 form electronically?

+Yes, you can file the IT-201 form electronically through the New York State Tax Department's website.

What is the penalty for late filing of the IT-201 form?

+The penalty for late filing of the IT-201 form is 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.