As a nonresident of California, understanding the state's tax laws and filing requirements can be a daunting task. However, it's essential to comply with the California Franchise Tax Board's (FTB) regulations to avoid penalties and fines. In this comprehensive guide, we'll walk you through the process of filing California Tax Form 540NR, a crucial document for nonresidents with California income.

Who Needs to File California Tax Form 540NR?

California Tax Form 540NR is designed for nonresidents who have income sourced from California. This includes individuals who:

- Live outside of California but have a job or business in the state

- Own rental properties or investments in California

- Receive income from California sources, such as royalties or dividends

- Have a California-based trust or estate

Even if you're not a resident of California, you may still be required to file a state tax return if you have income sourced from the state.

What is California Tax Form 540NR?

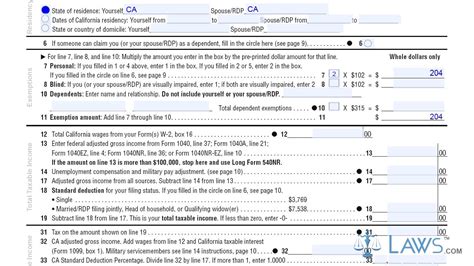

California Tax Form 540NR is the Nonresident or Part-Year Resident Income Tax Return. This form is used to report your California income and claim any credits or deductions you're eligible for. The form is similar to the federal Form 1040, but it's specific to California's tax laws.

Key Sections of California Tax Form 540NR

- Income: Report all your California-sourced income, including wages, salaries, tips, and self-employment income.

- Deductions: Claim deductions for expenses related to your California income, such as mortgage interest, property taxes, and charitable donations.

- Credits: Claim credits for taxes paid to other states, California earned income tax credit, and other eligible credits.

How to File California Tax Form 540NR

To file California Tax Form 540NR, follow these steps:

- Gather necessary documents: Collect your W-2 forms, 1099 forms, and any other relevant tax documents.

- Determine your filing status: Choose your filing status, such as single, married filing jointly, or head of household.

- Complete the form: Fill out California Tax Form 540NR, making sure to report all your California income and claim eligible deductions and credits.

- Submit the form: Mail the completed form to the California Franchise Tax Board or e-file using the FTB's online portal.

Electronic Filing Options

The California Franchise Tax Board offers several e-filing options, including:

- CalFile: A free online filing system for eligible taxpayers.

- e-file: A paid e-filing service offered through the FTB's website.

Deadlines and Penalties

The deadline for filing California Tax Form 540NR is typically April 15th, but it may vary depending on your specific situation. If you're unable to meet the deadline, you can request an automatic six-month extension.

Failure to file or pay taxes on time can result in penalties and fines. The FTB may impose:

- Late filing penalty: 1% of the unpaid tax per month, up to 47.6%

- Late payment penalty: 0.5% of the unpaid tax per month, up to 22.5%

- Interest: Accruing daily, starting from the original due date

Tips and Reminders

- Keep accurate records: Maintain detailed records of your California income and expenses to ensure accurate reporting.

- Consult a tax professional: If you're unsure about any aspect of the filing process, consider consulting a tax professional.

- Stay up-to-date: Familiarize yourself with California's tax laws and regulations to avoid any unexpected surprises.

By following this guide, you'll be well on your way to successfully filing California Tax Form 540NR. Remember to stay organized, take advantage of eligible credits and deductions, and seek professional help if needed.

We hope this article has been informative and helpful. If you have any questions or comments, please don't hesitate to share them below.

What is the deadline for filing California Tax Form 540NR?

+The deadline for filing California Tax Form 540NR is typically April 15th, but it may vary depending on your specific situation.

Can I e-file California Tax Form 540NR?

+Yes, you can e-file California Tax Form 540NR using the California Franchise Tax Board's online portal or through a paid e-filing service.

What are the penalties for late filing or payment?

+The California Franchise Tax Board may impose penalties and fines for late filing or payment, including a late filing penalty of 1% of the unpaid tax per month and a late payment penalty of 0.5% of the unpaid tax per month.