The Work Opportunity Tax Credit (WOTC) is a valuable incentive for employers who hire individuals from specific target groups, providing a tax credit of up to $9,600 per eligible employee. To claim this credit, employers must file Form 5884, which can be a complex process. In this article, we will guide you through the Form 5884 instructions, helping you understand the requirements and procedures for claiming the WOTC.

What is the Work Opportunity Tax Credit?

The WOTC is a federal tax credit program designed to encourage employers to hire individuals from specific target groups, including veterans, individuals with disabilities, and those receiving government assistance. The credit is calculated based on the wages paid to eligible employees during their first year of employment.

Who is Eligible for the WOTC?

To be eligible for the WOTC, an employee must belong to one of the following target groups:

- Veterans

- Individuals with disabilities

- Summer youth employees

- Food stamp recipients

- Supplemental Security Income (SSI) recipients

- Long-term family assistance recipients

- Ex-felons

- Designated community residents

- Vocational rehabilitation referrals

- Supplemental Nutrition Assistance Program (SNAP) recipients

How to Claim the WOTC: Form 5884 Instructions

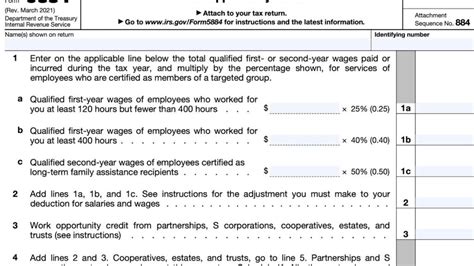

To claim the WOTC, employers must complete Form 5884, which consists of three parts:

- Part I: Certification and Identification of Eligible Employees

- Identify the eligible employees and their corresponding target groups

- Provide the employee's name, Social Security number, and dates of employment

- Certify that the employee meets the eligibility requirements

- Part II: Computation of Credit

- Calculate the credit based on the wages paid to eligible employees during their first year of employment

- Multiply the wages by the applicable percentage (e.g., 25% or 40%)

- Apply the credit limit (e.g., $9,600 per eligible employee)

- Part III: Additional Information and Certification

Additional Requirements and Tips

- Pre-Screening and Certification: Employers must pre-screen applicants and obtain certification from the state workforce agency (SWA) or the Department of Labor (DOL) to verify the employee's eligibility.

- Wages and Hours: Only wages paid during the first year of employment are eligible for the credit. Employers must track hours worked and wages paid to eligible employees.

- Record Keeping: Maintain accurate records of employee eligibility, wages, and hours worked.

- Amended Returns: If an employer needs to file an amended return, they must complete a new Form 5884 and attach it to the amended return.

Common Errors to Avoid

- Incorrect Employee Identification: Ensure accurate employee identification, including Social Security numbers and dates of employment.

- Ineligible Employees: Verify employee eligibility and avoid claiming credits for ineligible employees.

- Miscalculated Credits: Double-check calculations to avoid errors in credit computation.

Frequently Asked Questions

Q: What is the deadline for filing Form 5884? A: The deadline for filing Form 5884 is typically the same as the employer's tax return deadline.

Q: Can I claim the WOTC for employees hired before 2022? A: Yes, the WOTC is available for eligible employees hired before 2022, but the credit calculation and limits may differ.

Q: How long do I need to keep records for the WOTC? A: Employers must keep records for at least three years from the date of the employee's hire.

Q: Can I claim the WOTC for employees who work part-time? A: Yes, employers can claim the WOTC for part-time employees, but the credit calculation will be based on the number of hours worked.

Conclusion: Maximize Your Tax Savings with the WOTC

The Work Opportunity Tax Credit offers a valuable incentive for employers who hire individuals from specific target groups. By following the Form 5884 instructions and understanding the requirements and procedures, employers can maximize their tax savings and support their business growth. Don't miss out on this opportunity – claim your WOTC today!

What is the maximum credit amount per eligible employee?

+The maximum credit amount per eligible employee is $9,600.

Can I claim the WOTC for employees who work in a different state?

+Yes, employers can claim the WOTC for employees who work in a different state, but they must follow the specific state's certification and filing requirements.

How do I report the WOTC on my tax return?

+Employers must complete Form 5884 and attach it to their tax return (Form 1040 or Form 1120). The credit is reported on Line 12 of Form 1040 or Line 5 of Form 1120.