Colorado, known for its breathtaking natural beauty and outdoor recreational opportunities, is also home to a thriving business community. For partnerships operating within the state, accurate and timely tax reporting is crucial to avoid penalties and ensure compliance with state regulations. One essential document for partnerships in Colorado is Form 106, specifically the Schedule K-1, which details partnership income and allocations to partners. In this article, we will delve into the world of Colorado Form 106 Schedule K-1, exploring its significance, components, and how to accurately complete it.

Understanding the Importance of Form 106 Schedule K-1

Form 106, the Colorado Partnership Return, is a critical tax document that partnerships must file annually with the Colorado Department of Revenue. It reports the partnership's income, deductions, and credits, as well as allocations of these items to its partners. The Schedule K-1 is a supporting schedule to Form 106, providing detailed information about each partner's share of the partnership's income, deductions, and credits.

Why Accurate Reporting Matters

Accurate and timely reporting of partnership income and allocations is essential for several reasons:

- Compliance: Failure to file or incorrect filing can lead to penalties and fines.

- Tax Liability: Accurate reporting ensures that each partner is correctly assessed for their tax liability.

- Partner Relations: Transparency in financial reporting is crucial for maintaining trust and clarity among partners.

Components of the Schedule K-1

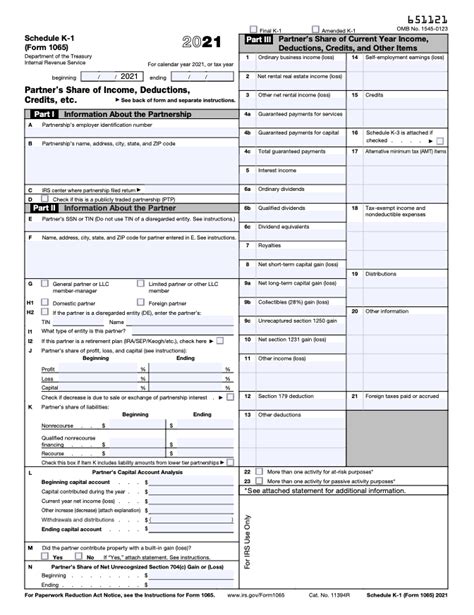

The Schedule K-1 is divided into several parts, each serving a specific purpose in detailing partnership income and allocations.

Part I: Information About the Partnership

- Partnership Name and EIN: Identifying information for the partnership.

- Address: The partnership's address, used for correspondence.

Part II: Partner's Distributive Share Items

- Ordinary Business Income (Loss): The partner's share of the partnership's ordinary business income or loss.

- Capital Gains (Loss): The partner's share of the partnership's capital gains or losses.

- Tax Preference Items: Items that may be subject to the Alternative Minimum Tax (AMT).

Part III: Partner's Share of Liabilities

- Nonrecourse Liabilities: Liabilities for which no partner has personal liability.

- Recourse Liabilities: Liabilities for which one or more partners have personal liability.

Steps to Complete the Schedule K-1

Completing the Schedule K-1 requires careful attention to detail and an understanding of the partnership's financial situation.

- Gather Necessary Documents: Ensure you have the partnership's financial statements, tax returns, and any other relevant documents.

- Identify Partners and Their Interests: List all partners and their percentage interests in the partnership.

- Calculate Distributive Shares: Determine each partner's share of income, deductions, and credits based on their interest in the partnership.

- Complete the Schedule K-1: Fill out the schedule accurately, ensuring all required information is provided.

Tips for Accurate Completion

- Use Accurate Financial Data: Ensure all financial data used is accurate and up-to-date.

- Seek Professional Advice: If uncertain about any aspect of the Schedule K-1, consult with a tax professional.

- File Timely: Submit the Schedule K-1 with the partnership return by the deadline to avoid penalties.

Common Challenges and Solutions

Partnerships may encounter several challenges when completing the Schedule K-1. Here are some common issues and their solutions:

Challenge 1: Complexity of Partnership Income Allocations

- Solution: Use a spreadsheet to track income allocations throughout the year, ensuring accuracy and ease of reporting.

Challenge 2: Changes in Partnership Ownership

- Solution: Update the partnership agreement and notify the Colorado Department of Revenue of any changes in ownership.

Challenge 3: Understanding Tax Implications

- Solution: Consult with a tax professional to ensure understanding of the tax implications of partnership income and allocations.

Encouragement to Engage

As a partnership operating in Colorado, understanding and accurately completing the Schedule K-1 is crucial for compliance and transparency. If you have any questions or need further clarification on any aspect of the Schedule K-1, please don't hesitate to reach out. Share this article with your network to ensure that all partnerships in Colorado are equipped with the knowledge to accurately report their income and allocations.

What is the purpose of the Schedule K-1 in Colorado?

+The Schedule K-1 is used to report each partner's share of the partnership's income, deductions, and credits.

Who needs to complete the Schedule K-1?

+All partnerships operating in Colorado must complete the Schedule K-1 as part of their annual tax return.

What are the consequences of not filing or incorrectly filing the Schedule K-1?

+Failure to file or incorrect filing can lead to penalties and fines. It may also affect the tax liability of individual partners.