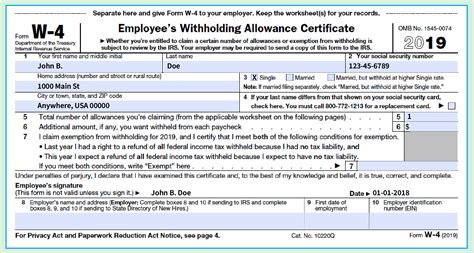

Completing a W-4 form is a crucial step in the hiring process for employers and employees alike. The W-4 form, also known as the Employee's Withholding Certificate, is used by employers to determine the amount of federal income tax to withhold from an employee's wages. The form requires employees to provide information about their income, filing status, and number of dependents, among other things.

In this article, we will explore the five ways to complete a W-4 form, including the new changes that went into effect in 2020. We will also provide tips and examples to help employees and employers navigate the process.

Why is it Important to Complete a W-4 Form Correctly?

Completing a W-4 form correctly is essential to ensure that the correct amount of federal income tax is withheld from an employee's wages. If too little tax is withheld, the employee may end up owing a large amount of taxes when they file their tax return. On the other hand, if too much tax is withheld, the employee may be eligible for a large refund.

In addition, completing a W-4 form correctly can help employees avoid penalties and fines from the IRS. The IRS requires employers to withhold federal income tax from their employees' wages, and employers who fail to do so may be subject to penalties and fines.

5 Ways to Complete a W-4 Form

There are five ways to complete a W-4 form, and we will explore each method in detail below.

Method 1: Claiming Single Filing Status

If an employee is single and has no dependents, they can claim single filing status on their W-4 form. To do this, the employee will need to complete the following steps:

- Check the box marked "Single" under the "Filing Status" section of the form.

- Enter their name and address in the "Employee's Information" section of the form.

- Enter their Social Security number or Individual Taxpayer Identification Number (ITIN) in the "Employee's Information" section of the form.

- Sign and date the form.

Example:

Let's say an employee named John is single and has no dependents. John would check the box marked "Single" under the "Filing Status" section of the form, enter his name and address in the "Employee's Information" section of the form, enter his Social Security number in the "Employee's Information" section of the form, and sign and date the form.

Method 2: Claiming Married Filing Status

If an employee is married, they can claim married filing status on their W-4 form. To do this, the employee will need to complete the following steps:

- Check the box marked "Married" under the "Filing Status" section of the form.

- Enter their name and address in the "Employee's Information" section of the form.

- Enter their Social Security number or ITIN in the "Employee's Information" section of the form.

- Enter their spouse's name and Social Security number or ITIN in the "Spouse's Information" section of the form, if applicable.

- Sign and date the form.

Example:

Let's say an employee named Jane is married and has a spouse who also works. Jane would check the box marked "Married" under the "Filing Status" section of the form, enter her name and address in the "Employee's Information" section of the form, enter her Social Security number in the "Employee's Information" section of the form, enter her spouse's name and Social Security number in the "Spouse's Information" section of the form, and sign and date the form.

Method 3: Claiming Head of Household Filing Status

If an employee is single and has dependents, they can claim head of household filing status on their W-4 form. To do this, the employee will need to complete the following steps:

- Check the box marked "Head of Household" under the "Filing Status" section of the form.

- Enter their name and address in the "Employee's Information" section of the form.

- Enter their Social Security number or ITIN in the "Employee's Information" section of the form.

- Enter the number of dependents they have in the "Dependents" section of the form.

- Sign and date the form.

Example:

Let's say an employee named Michael is single and has two dependents. Michael would check the box marked "Head of Household" under the "Filing Status" section of the form, enter his name and address in the "Employee's Information" section of the form, enter his Social Security number in the "Employee's Information" section of the form, enter the number of dependents he has in the "Dependents" section of the form, and sign and date the form.

Method 4: Claiming Exempt from Federal Income Tax Withholding

If an employee is exempt from federal income tax withholding, they can claim exempt on their W-4 form. To do this, the employee will need to complete the following steps:

- Check the box marked "Exempt" under the "Federal Income Tax Withholding" section of the form.

- Enter their name and address in the "Employee's Information" section of the form.

- Enter their Social Security number or ITIN in the "Employee's Information" section of the form.

- Sign and date the form.

Example:

Let's say an employee named Sarah is exempt from federal income tax withholding. Sarah would check the box marked "Exempt" under the "Federal Income Tax Withholding" section of the form, enter her name and address in the "Employee's Information" section of the form, enter her Social Security number in the "Employee's Information" section of the form, and sign and date the form.

Method 5: Using the Tax Withholding Estimator

The IRS provides a tax withholding estimator that employees can use to determine how much federal income tax to withhold from their wages. To use the tax withholding estimator, employees will need to complete the following steps:

- Visit the IRS website and click on the "Tax Withholding Estimator" link.

- Enter their income, filing status, and number of dependents into the estimator.

- Follow the prompts to determine how much federal income tax to withhold from their wages.

- Use the results from the estimator to complete their W-4 form.

Example:

Let's say an employee named David wants to use the tax withholding estimator to determine how much federal income tax to withhold from his wages. David would visit the IRS website, click on the "Tax Withholding Estimator" link, enter his income, filing status, and number of dependents into the estimator, and follow the prompts to determine how much federal income tax to withhold from his wages. David would then use the results from the estimator to complete his W-4 form.

In conclusion, completing a W-4 form correctly is essential to ensure that the correct amount of federal income tax is withheld from an employee's wages. By following the five methods outlined above, employees can ensure that they are withholding the correct amount of taxes and avoiding penalties and fines from the IRS. Employers should also ensure that they are providing their employees with accurate information and guidance on how to complete a W-4 form correctly.

What is a W-4 form?

+A W-4 form is a document that employees complete to determine the amount of federal income tax to withhold from their wages.

Why do I need to complete a W-4 form?

+You need to complete a W-4 form to ensure that the correct amount of federal income tax is withheld from your wages. If too little tax is withheld, you may end up owing a large amount of taxes when you file your tax return.

What happens if I don't complete a W-4 form?

+If you don't complete a W-4 form, your employer will withhold taxes at the highest rate, which may result in you owing a large amount of taxes when you file your tax return.