Filling out forms can be a daunting task, especially when it comes to complex government documents like Form FW-003. However, with the right guidance, you can navigate this process with ease. In this article, we will walk you through five ways to fill out Form FW-003 accurately and efficiently.

Understanding Form FW-003

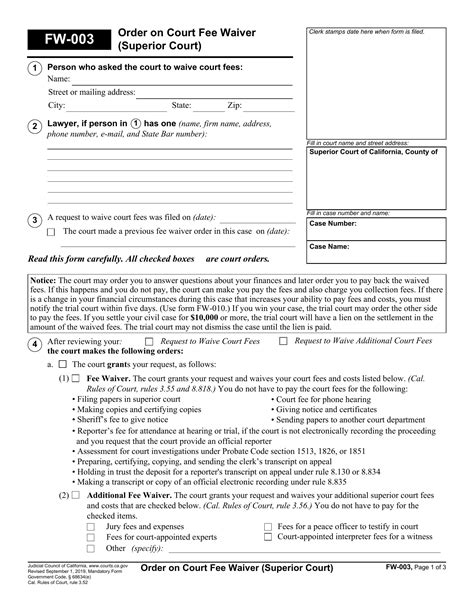

Before we dive into the nitty-gritty of filling out Form FW-003, it's essential to understand what this form is used for. Form FW-003 is a critical document used by the courts to determine child support payments. It's a worksheet that helps calculate the amount of child support one parent must pay to the other. The form takes into account various factors, including income, expenses, and the number of children involved.

1. Gather Required Documents and Information

To fill out Form FW-003 accurately, you'll need to gather specific documents and information. This includes:

- Pay stubs or proof of income

- Tax returns (previous year)

- Expense records (housing, utilities, food, etc.)

- Health insurance information

- Childcare costs

- Number of children and their ages

Having these documents readily available will make the process much smoother.

Organizing Your Documents

Take the time to organize your documents in a logical order. This will help you quickly reference the information you need when filling out the form.

2. Understand the Form's Layout and Sections

Form FW-003 is divided into several sections, each with its own set of questions and calculations. Understanding the layout of the form will help you navigate it more efficiently. The main sections include:

- Section 1: Income and Expenses

- Section 2: Child Support Calculation

- Section 3: Additional Expenses

Take a few minutes to review the form and familiarize yourself with each section.

Section 1: Income and Expenses

This section requires you to provide detailed information about your income and expenses. Make sure to accurately report your income, including any bonuses or overtime pay. When calculating expenses, be sure to include all necessary costs, such as housing, utilities, and food.

3. Calculate Your Income and Expenses

Accurate calculations are crucial when filling out Form FW-003. Take your time to carefully calculate your income and expenses, using the information you've gathered.

- Use a calculator to ensure accuracy

- Double-check your calculations

- Make sure to include all necessary expenses

Using Online Resources

If you're struggling with calculations, consider using online resources, such as child support calculators. These tools can help you estimate your child support payments and provide a more accurate calculation.

4. Fill Out the Form Accurately and Completely

With your calculations complete, it's time to fill out the form. Make sure to:

- Answer all questions truthfully and accurately

- Provide all required information

- Sign and date the form

Avoiding Common Mistakes

When filling out Form FW-003, it's essential to avoid common mistakes, such as:

- Inaccurate calculations

- Omitting necessary information

- Failing to sign and date the form

5. Review and Submit the Form

Before submitting the form, take a few minutes to review it carefully. Ensure that:

- All questions are answered accurately

- Calculations are correct

- The form is signed and dated

Once you've reviewed the form, submit it to the court as instructed.

Seeking Professional Help

If you're struggling to fill out Form FW-003 or have complex child support issues, consider seeking professional help. A qualified attorney or child support specialist can guide you through the process and ensure that your rights are protected.

Now that you've learned the five ways to fill out Form FW-003, you're ready to tackle this complex document with confidence. Remember to take your time, gather all necessary documents, and seek help if needed.

What is Form FW-003 used for?

+Form FW-003 is a worksheet used by the courts to determine child support payments. It takes into account various factors, including income, expenses, and the number of children involved.

What documents do I need to fill out Form FW-003?

+You'll need to gather specific documents and information, including pay stubs, tax returns, expense records, health insurance information, childcare costs, and the number of children and their ages.

How do I calculate my income and expenses on Form FW-003?

+Use a calculator to ensure accuracy, double-check your calculations, and make sure to include all necessary expenses.