Filing taxes can be a daunting task, but with the right guidance, it can become a manageable process. The Form CT 1040V is a crucial document for Connecticut residents who need to make a payment with their state income tax return. In this article, we will explore five ways to fill out Form CT 1040V, making it easier for you to complete the process accurately and efficiently.

Understanding the Purpose of Form CT 1040V

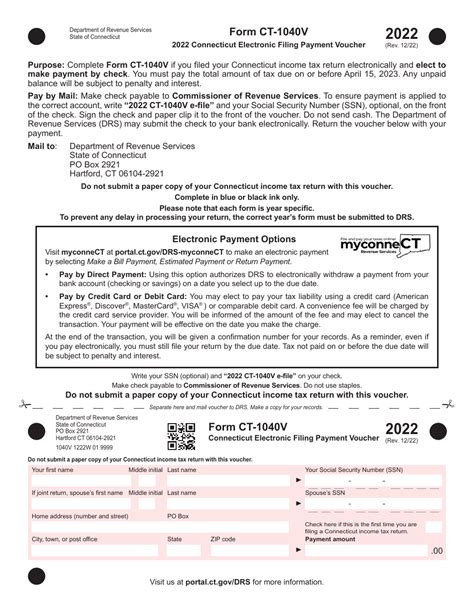

Before we dive into the five ways to fill out Form CT 1040V, it's essential to understand its purpose. Form CT 1040V is a payment voucher that allows taxpayers to make a payment with their state income tax return. It is typically used by individuals who owe taxes and need to submit a payment along with their tax return.

Method 1: E-Filing with Tax Software

One of the most convenient ways to fill out Form CT 1040V is by using tax software that supports e-filing. Tax software like TurboTax, H&R Block, or TaxAct can guide you through the process of filling out Form CT 1040V and submitting it electronically. These software programs will prompt you to enter your payment information, and you can pay your taxes directly through the software.

To e-file with tax software, follow these steps:

- Choose a tax software that supports e-filing for Connecticut state taxes

- Create an account or log in to your existing account

- Follow the software's instructions to fill out Form CT 1040V

- Enter your payment information and submit your return electronically

Benefits of E-Filing with Tax Software

- Convenient and time-saving

- Reduces errors and ensures accuracy

- Fast processing and quick refunds

- Supports multiple payment options

Method 2: Filing by Mail with a Check or Money Order

Another way to fill out Form CT 1040V is by mailing it with a check or money order. This method is ideal for those who prefer to pay by mail or do not have access to e-filing software.

To file by mail with a check or money order, follow these steps:

- Download and print Form CT 1040V from the Connecticut Department of Revenue Services website

- Fill out the form accurately and completely

- Attach a check or money order payable to the "Commissioner of Revenue Services"

- Mail the form and payment to the address listed on the form

Benefits of Filing by Mail with a Check or Money Order

- No need for e-filing software or online payment

- Allows for payment by mail

- Can be used for those who prefer a paper-based process

Method 3: Using the Connecticut DRS Website

The Connecticut Department of Revenue Services (DRS) website offers an online payment option for Form CT 1040V. This method is convenient and allows you to make a payment directly through the website.

To use the Connecticut DRS website, follow these steps:

- Visit the Connecticut DRS website and navigate to the "Make a Payment" section

- Select the "Form CT 1040V" option and enter your payment information

- Choose your payment method (e.g., credit card, debit card, or electronic funds transfer)

- Submit your payment and print a confirmation receipt

Benefits of Using the Connecticut DRS Website

- Convenient and easy to use

- Allows for online payment and immediate confirmation

- Supports multiple payment options

Method 4: Using a Tax Professional

If you prefer to have a tax professional handle your taxes, you can hire a certified public accountant (CPA) or enrolled agent (EA) to fill out Form CT 1040V on your behalf. This method is ideal for those who have complex tax situations or prefer to have a professional handle their taxes.

To use a tax professional, follow these steps:

- Find a reputable tax professional in your area

- Provide your tax professional with your tax documents and payment information

- Let your tax professional fill out Form CT 1040V and submit it on your behalf

Benefits of Using a Tax Professional

- Expert guidance and advice

- Reduces errors and ensures accuracy

- Convenient and time-saving

Method 5: Using a Payroll Service

If you have a payroll service that handles your taxes, you can ask them to fill out Form CT 1040V on your behalf. This method is ideal for businesses or individuals who have a payroll service that handles their tax obligations.

To use a payroll service, follow these steps:

- Contact your payroll service and ask them to fill out Form CT 1040V

- Provide your payroll service with your tax documents and payment information

- Let your payroll service submit Form CT 1040V on your behalf

Benefits of Using a Payroll Service

- Convenient and time-saving

- Reduces errors and ensures accuracy

- Expert guidance and advice

What is Form CT 1040V?

+Form CT 1040V is a payment voucher that allows taxpayers to make a payment with their state income tax return.

How do I fill out Form CT 1040V?

+You can fill out Form CT 1040V using tax software, mailing it with a check or money order, using the Connecticut DRS website, hiring a tax professional, or using a payroll service.

What is the deadline for submitting Form CT 1040V?

+The deadline for submitting Form CT 1040V is typically April 15th of each year, but it may vary depending on your specific tax situation.

By following these five methods, you can easily fill out Form CT 1040V and submit it to the Connecticut Department of Revenue Services. Remember to choose the method that best suits your needs and tax situation. If you have any questions or concerns, feel free to ask in the comments below. Share this article with your friends and family who may need help with filling out Form CT 1040V.