New Jersey businesses are required to file the NJ 1065 form, also known as the New Jersey Partnership Return, with the New Jersey Division of Taxation. This form is used to report the income, gains, losses, deductions, and credits of partnerships, limited liability companies (LLCs), and other entities that are taxed as partnerships. Filling out the NJ 1065 form can be a complex task, but by following these 5 steps, you can ensure that you complete it accurately and efficiently.

Step 1: Gather Required Information and Documents

Before you start filling out the NJ 1065 form, you need to gather all the required information and documents. This includes:

- The partnership's name, address, and federal Employer Identification Number (EIN)

- The names and addresses of all partners, including their percentage of ownership

- The partnership's accounting method and fiscal year

- The partnership's income, gains, losses, deductions, and credits

- Schedule K-1 forms for each partner

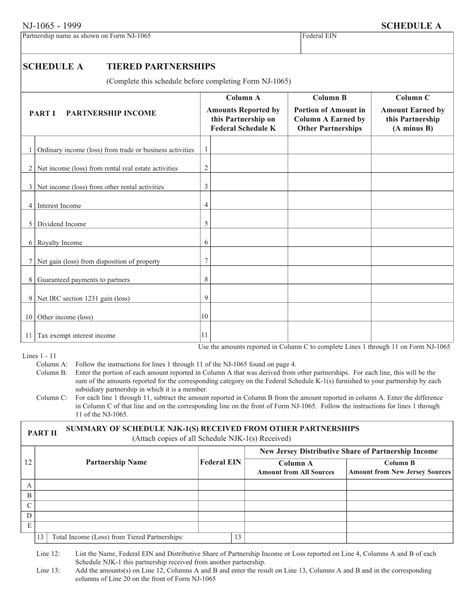

- Supporting schedules and statements, such as Schedule A (Income) and Schedule B (Losses)

Make sure you have all the necessary documents and information before starting the form.

**Step 2: Complete the Form Header and Partnership Information**

The first section of the NJ 1065 form requires you to provide information about the partnership. This includes:

- The partnership's name and address

- The partnership's federal EIN

- The partnership's accounting method and fiscal year

- The partnership's business activity code

Complete this section accurately and make sure to double-check the information.

Step 3: Report Income, Gains, Losses, Deductions, and Credits

The next section of the NJ 1065 form requires you to report the partnership's income, gains, losses, deductions, and credits. This includes:

- Schedule A (Income): report the partnership's income from various sources, such as sales, rents, and royalties

- Schedule B (Losses): report the partnership's losses from various sources, such as sales, rents, and royalties

- Schedule C (Deductions): report the partnership's deductions, such as depreciation, amortization, and interest

- Schedule D (Credits): report the partnership's credits, such as the research and development credit

Complete these schedules accurately and make sure to attach supporting statements and schedules.

**Step 3.1: Complete Schedule K-1 Forms**

Schedule K-1 forms are required for each partner and report their share of the partnership's income, gains, losses, deductions, and credits. Complete these forms accurately and make sure to attach them to the NJ 1065 form.

Step 4: Complete the Partnership's Tax Liability and Payment

The next section of the NJ 1065 form requires you to calculate the partnership's tax liability and payment. This includes:

- Calculating the partnership's tax liability based on the reported income and credits

- Determining the payment due, including any penalties and interest

Complete this section accurately and make sure to pay the required tax liability.

**Step 4.1: Complete the Payment Voucher**

If you are making a payment with the NJ 1065 form, you need to complete the payment voucher. This includes:

- The payment amount

- The payment method (check or electronic payment)

- The payment date

Complete the payment voucher accurately and make sure to attach it to the NJ 1065 form.

Step 5: Review and Sign the NJ 1065 Form

The final step is to review and sign the NJ 1065 form. This includes:

- Reviewing the form for accuracy and completeness

- Signing the form as the partnership's authorized representative

- Dating the form

Make sure to review the form carefully and sign it accurately.

**Additional Tips and Reminders**

- Make sure to file the NJ 1065 form on time to avoid penalties and interest.

- Keep a copy of the NJ 1065 form and supporting documents for your records.

- If you are unsure about any part of the form, consult with a tax professional or the New Jersey Division of Taxation.

By following these 5 steps, you can ensure that you complete the NJ 1065 form accurately and efficiently.

What is the NJ 1065 form?

+The NJ 1065 form is the New Jersey Partnership Return, which is used to report the income, gains, losses, deductions, and credits of partnerships, limited liability companies (LLCs), and other entities that are taxed as partnerships.

Who needs to file the NJ 1065 form?

+All partnerships, LLCs, and other entities that are taxed as partnerships and have a New Jersey nexus are required to file the NJ 1065 form.

What is the deadline for filing the NJ 1065 form?

+The deadline for filing the NJ 1065 form is typically April 15th of each year, but it may vary depending on the partnership's fiscal year.

We hope this article has been helpful in guiding you through the process of filling out the NJ 1065 form. If you have any further questions or concerns, please don't hesitate to reach out.