If you're an individual who contributes to a nondeductible individual retirement account (IRA) or a Coverdell education savings account (ESA), you'll need to file Form 8606 with the IRS. This form is used to report the annual contributions and distributions from these types of accounts. In this article, we'll walk you through the Form 8606 instructions, providing a step-by-step guide to help you complete the form accurately and efficiently.

Why is Form 8606 Important?

Before we dive into the instructions, let's quickly discuss why Form 8606 is important. This form helps the IRS track the contributions and distributions from your nondeductible IRAs and Coverdell ESAs. By reporting this information, you'll ensure that you're meeting the necessary requirements for these accounts, which can help you avoid penalties and fines.

Gathering the Necessary Information

Before you start filling out Form 8606, make sure you have the following information:

- Your name, address, and Social Security number

- The name and address of the IRA or ESA custodian

- The account number and type of account (IRA or ESA)

- The date of birth of the account owner (for ESAs)

- The amount of contributions made to the account during the tax year

- The amount of distributions taken from the account during the tax year

Step-by-Step Instructions for Form 8606

Now that you have the necessary information, let's go through the Form 8606 instructions step by step:

Part I: Nondeductible IRAs

In Part I, you'll report the contributions and distributions from your nondeductible IRAs.

- Enter the total amount of contributions made to your nondeductible IRAs during the tax year in box 1.

- If you received a distribution from your nondeductible IRA, enter the amount in box 2.

- Calculate the net investment income from your nondeductible IRA by multiplying the amount in box 1 by the applicable interest rate (you can find this rate on the IRS website). Enter the result in box 3.

- If you have multiple nondeductible IRAs, complete a separate Part I for each account.

Calculating the Basis of Your Nondeductible IRA

To calculate the basis of your nondeductible IRA, you'll need to keep track of the total contributions made to the account, minus any distributions taken. You can use the following formula:

Basis = Total Contributions - Total Distributions

Part II: Coverdell ESAs

In Part II, you'll report the contributions and distributions from your Coverdell ESAs.

- Enter the total amount of contributions made to your Coverdell ESA during the tax year in box 4.

- If you received a distribution from your Coverdell ESA, enter the amount in box 5.

- Calculate the net investment income from your Coverdell ESA by multiplying the amount in box 4 by the applicable interest rate (you can find this rate on the IRS website). Enter the result in box 6.

- If you have multiple Coverdell ESAs, complete a separate Part II for each account.

Calculating the Basis of Your Coverdell ESA

To calculate the basis of your Coverdell ESA, you'll need to keep track of the total contributions made to the account, minus any distributions taken. You can use the following formula:

Basis = Total Contributions - Total Distributions

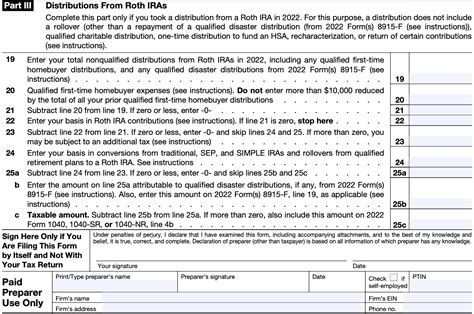

Part III: Distributions

In Part III, you'll report any distributions taken from your nondeductible IRAs or Coverdell ESAs.

- Enter the total amount of distributions taken from your nondeductible IRAs and Coverdell ESAs during the tax year in box 7.

- If you received a distribution from a nondeductible IRA or Coverdell ESA, complete Form 8606, Part III, for each account.

Tips and Reminders

Here are a few tips and reminders to keep in mind when completing Form 8606:

- Make sure to complete a separate Form 8606 for each nondeductible IRA and Coverdell ESA you have.

- Keep accurate records of your contributions and distributions, as you'll need this information to complete the form.

- If you have any questions or concerns, consult the IRS website or contact a tax professional for assistance.

Conclusion

Completing Form 8606 can seem daunting, but by following these step-by-step instructions, you'll be able to report your nondeductible IRA and Coverdell ESA contributions and distributions accurately and efficiently. Remember to keep accurate records and seek assistance if needed. By doing so, you'll ensure that you're meeting the necessary requirements for these accounts and avoiding any potential penalties or fines.

What is the purpose of Form 8606?

+Form 8606 is used to report the annual contributions and distributions from nondeductible individual retirement accounts (IRAs) and Coverdell education savings accounts (ESAs).

Who needs to file Form 8606?

+Individuals who contribute to nondeductible IRAs or Coverdell ESAs need to file Form 8606 with the IRS.

What information do I need to complete Form 8606?

+You'll need to gather information about your nondeductible IRA or Coverdell ESA, including the account number, type of account, contributions made, and distributions taken.