As a homebuyer, navigating the complex world of mortgage financing can be daunting. One crucial document that can provide clarity and protection is the FHA Amendatory Clause form. In this article, we will delve into the importance of this form and explore five ways it helps homebuyers.

The Federal Housing Administration (FHA) is a government agency that provides mortgage insurance to borrowers, enabling them to secure loans with lower down payments and more lenient credit score requirements. The FHA Amendatory Clause form is a critical component of the FHA mortgage process, and its significance cannot be overstated. By understanding the benefits and functions of this form, homebuyers can make informed decisions and avoid potential pitfalls.

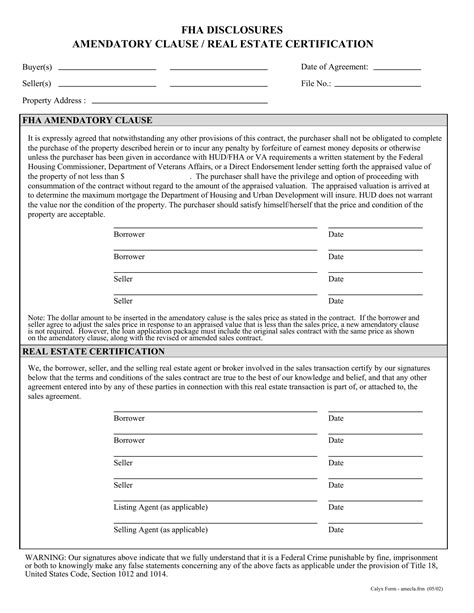

What is an FHA Amendatory Clause Form?

An FHA Amendatory Clause form is a document that amends the sales contract between the buyer and seller. It acknowledges that the buyer's mortgage financing is contingent upon the property meeting the FHA's minimum property standards (MPS). The form ensures that the buyer's lender will only provide financing if the property meets these standards.

1. Protection from Defective Properties

The FHA Amendatory Clause form protects homebuyers from purchasing defective properties. By requiring the property to meet the FHA's MPS, the form ensures that the buyer is not stuck with a property that needs costly repairs or poses health and safety risks. This clause gives buyers leverage to negotiate with sellers or walk away from the deal if the property does not meet the FHA's standards.

Key Components of the MPS

The FHA's MPS includes requirements for:

- A safe and secure foundation

- Adequate roofing and ventilation

- Functional plumbing, heating, and electrical systems

- Proper insulation and weatherstripping

- Clean and safe living conditions

2. Clarity on Repair Responsibilities

The FHA Amendatory Clause form provides clarity on who is responsible for making repairs to the property. In most cases, the seller is responsible for addressing any defects or issues that arise during the inspection process. However, the form may also specify that the buyer is willing to accept the property "as-is" or negotiate a credit for repairs.

Common Repair Responsibilities

The form typically addresses the following repair responsibilities:

- Seller's responsibility for major repairs

- Buyer's acceptance of minor defects

- Negotiation of credits for repairs

3. Enhanced Negotiating Power

The FHA Amendatory Clause form gives homebuyers enhanced negotiating power. By having a clear understanding of the property's condition and the seller's responsibilities, buyers can negotiate a better price or request repairs. This clause can also provide a way out of the deal if the seller is unwilling to make necessary repairs.

Effective Negotiation Strategies

To get the most out of the FHA Amendatory Clause form, buyers should:

- Review the form carefully before signing

- Use the form as a bargaining chip to negotiate repairs or credits

- Consider hiring a real estate attorney to review the contract

4. Compliance with FHA Regulations

The FHA Amendatory Clause form ensures compliance with FHA regulations. By signing the form, the buyer acknowledges that they understand the FHA's MPS and that the lender will only provide financing if the property meets these standards. This clause helps prevent potential issues with the loan and ensures that the buyer is not stuck with a property that does not meet FHA requirements.

FHA Regulations and Requirements

The FHA Amendatory Clause form addresses the following regulations and requirements:

- FHA mortgage insurance requirements

- Property condition standards

- Appraisal and inspection requirements

5. Reduced Risk of Delays or Defaults

The FHA Amendatory Clause form reduces the risk of delays or defaults. By having a clear understanding of the property's condition and the seller's responsibilities, buyers can avoid potential issues that may arise during the closing process. This clause also provides a clear outline of the steps to be taken if the property does not meet the FHA's MPS.

Common Causes of Delays or Defaults

The form typically addresses the following common causes of delays or defaults:

- Property defects or needed repairs

- Seller's failure to disclose known issues

- Buyer's failure to secure financing

In conclusion, the FHA Amendatory Clause form is a vital component of the homebuying process. By understanding its benefits and functions, homebuyers can navigate the complex world of mortgage financing with confidence. Whether it's protecting against defective properties, clarifying repair responsibilities, or ensuring compliance with FHA regulations, this form provides a safeguard for buyers and helps prevent potential pitfalls.

What is the purpose of the FHA Amendatory Clause form?

+The FHA Amendatory Clause form amends the sales contract between the buyer and seller, acknowledging that the buyer's mortgage financing is contingent upon the property meeting the FHA's minimum property standards (MPS).

What are the key components of the FHA's minimum property standards (MPS)?

+The FHA's MPS includes requirements for a safe and secure foundation, adequate roofing and ventilation, functional plumbing, heating, and electrical systems, proper insulation and weatherstripping, and clean and safe living conditions.

Who is responsible for making repairs to the property?

+The FHA Amendatory Clause form typically specifies that the seller is responsible for addressing any defects or issues that arise during the inspection process. However, the form may also specify that the buyer is willing to accept the property "as-is" or negotiate a credit for repairs.