As a business owner or accountant in New York State, you're likely familiar with the various tax compliance requirements that come with operating a business in the Empire State. One crucial document that plays a significant role in ensuring tax compliance is the Certificate of Tax Compliance, also known as Form CT-6. In this article, we'll delve into the world of Form CT-6, exploring its purpose, benefits, and steps for obtaining and maintaining tax compliance.

What is Form CT-6?

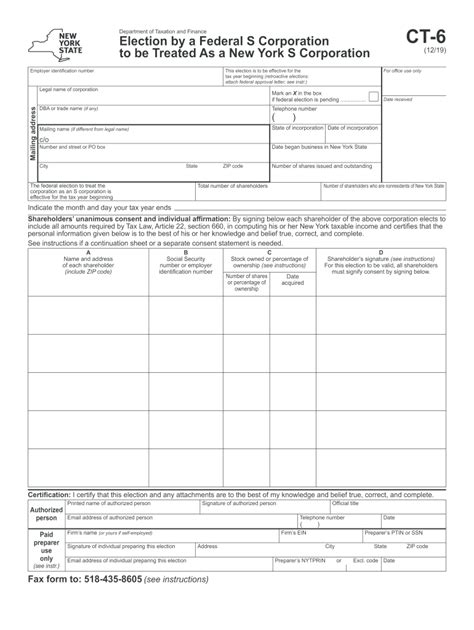

Form CT-6, also known as the Certificate of Tax Compliance, is a document issued by the New York State Department of Taxation and Finance (DTF) to verify that a business has met its tax obligations. This certificate is typically required when a business is involved in a significant transaction, such as a sale, merger, or acquisition. The certificate confirms that the business has filed all required tax returns, paid all taxes due, and is in compliance with New York State tax laws.

Why is Form CT-6 important?

The Certificate of Tax Compliance is essential for several reasons:

- Verification of tax compliance: Form CT-6 provides assurance that a business has met its tax obligations, reducing the risk of tax liabilities and penalties.

- Protection for buyers and investors: When a business is involved in a significant transaction, the buyer or investor requires Form CT-6 to ensure that they are not assuming any tax liabilities.

- Compliance with New York State tax laws: The certificate demonstrates that a business is in compliance with New York State tax laws, reducing the risk of penalties and fines.

Benefits of Form CT-6

The Certificate of Tax Compliance offers several benefits to businesses and individuals involved in significant transactions:

- Reduced risk of tax liabilities: Form CT-6 verifies that a business has met its tax obligations, reducing the risk of tax liabilities and penalties.

- Increased confidence in transactions: The certificate provides assurance that a business is in compliance with New York State tax laws, increasing confidence in transactions.

- Simplified due diligence: Form CT-6 simplifies the due diligence process for buyers and investors, providing a clear understanding of a business's tax compliance status.

How to obtain Form CT-6

To obtain a Certificate of Tax Compliance, businesses must follow these steps:

- File all required tax returns: Ensure that all tax returns, including sales tax, income tax, and withholding tax, are filed and up-to-date.

- Pay all taxes due: Pay any outstanding taxes, including penalties and interest.

- Submit Form CT-6 application: Submit the Form CT-6 application to the New York State Department of Taxation and Finance.

- Provide required documentation: Provide required documentation, including tax returns and payment receipts.

Maintaining Tax Compliance

To maintain tax compliance, businesses must:

- File tax returns on time: File all tax returns, including sales tax, income tax, and withholding tax, on time.

- Pay taxes due: Pay all taxes due, including penalties and interest.

- Monitor tax account activity: Regularly monitor tax account activity to ensure that all taxes are paid and up-to-date.

Common mistakes to avoid

When obtaining and maintaining tax compliance, businesses should avoid the following common mistakes:

- Failing to file tax returns: Failing to file tax returns can result in penalties and fines.

- Underpaying taxes: Underpaying taxes can result in penalties and interest.

- Failing to maintain records: Failing to maintain accurate records can result in difficulties when obtaining Form CT-6.

FAQs

What is the purpose of Form CT-6?

+Form CT-6, also known as the Certificate of Tax Compliance, is a document issued by the New York State Department of Taxation and Finance to verify that a business has met its tax obligations.

Who is required to obtain Form CT-6?

+Businesses involved in significant transactions, such as sales, mergers, or acquisitions, are typically required to obtain Form CT-6.

How do I obtain Form CT-6?

+To obtain Form CT-6, businesses must file all required tax returns, pay all taxes due, and submit the Form CT-6 application to the New York State Department of Taxation and Finance.

In conclusion, the Certificate of Tax Compliance is a critical document that verifies a business's tax compliance status. By understanding the purpose, benefits, and steps for obtaining Form CT-6, businesses can reduce the risk of tax liabilities and penalties, increase confidence in transactions, and simplify the due diligence process. We encourage you to share your thoughts and experiences with Form CT-6 in the comments section below.