When disaster strikes, it's not uncommon for individuals to experience food loss due to power outages, flooding, or other damages to their homes. The IRS understands that replacing lost food can be a significant expense, and they provide guidance on how to handle these costs. In this article, we will delve into the world of Form 841 and explore how the IRS guides taxpayers in replacing lost food.

Understanding Form 841

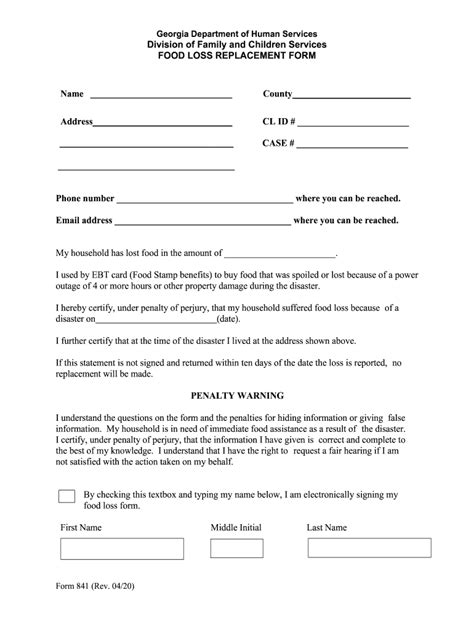

Form 841, also known as the Taxpayer Compliance Contact Report, is a document used by the IRS to record information about taxpayer contacts. However, in the context of food loss, Form 841 is used to report the loss and calculate the fair market value of the lost food. This form is essential in determining the amount of the loss that can be claimed as a deduction on the taxpayer's return.

Why is Form 841 Important for Replacing Lost Food?

Form 841 serves as a crucial document in the process of replacing lost food. By completing this form, taxpayers can provide the necessary information to support their claim for a deduction. The form requires taxpayers to provide details about the lost food, including the type, quantity, and fair market value. This information is essential in determining the amount of the loss that can be claimed.

IRS Guidance on Replacing Lost Food

The IRS provides guidance on replacing lost food through Publication 547, Casualties, Disasters, and Thefts. According to this publication, taxpayers can claim a deduction for the fair market value of the lost food. The fair market value is the price that a willing buyer would pay for the food in its original condition.

To determine the fair market value, taxpayers can use the following methods:

- Check receipts or invoices for the original purchase price of the food

- Look up the prices of similar food items in the local market

- Use the prices listed in a reliable pricing guide

Steps to Follow When Replacing Lost Food

When replacing lost food, taxpayers should follow these steps:

- Document the loss: Take photos or videos of the damaged food and keep records of the dates and times of the loss.

- Complete Form 841: Fill out Form 841 to report the loss and calculate the fair market value of the lost food.

- Gather receipts and invoices: Collect receipts or invoices for the original purchase price of the food.

- Research fair market value: Look up prices of similar food items in the local market or use a reliable pricing guide.

- Claim the deduction: Claim the deduction for the fair market value of the lost food on your tax return.

Additional Tips and Considerations

When replacing lost food, taxpayers should keep the following tips and considerations in mind:

- Keep accurate records: Keep accurate records of the loss, including photos, videos, and receipts.

- Only claim the fair market value: Only claim the fair market value of the lost food, not the original purchase price.

- Consult a tax professional: If you are unsure about the process or need help with completing Form 841, consult a tax professional.

- Be aware of deadlines: Be aware of the deadlines for filing your tax return and claiming the deduction.

Common Mistakes to Avoid

When replacing lost food, taxpayers should avoid the following common mistakes:

- Failing to document the loss: Failing to document the loss can make it difficult to claim the deduction.

- Overstating the value: Overstating the value of the lost food can lead to penalties and fines.

- Not following the correct procedures: Not following the correct procedures can lead to delays or rejection of the claim.

Conclusion

Replacing lost food can be a significant expense, but with the guidance of the IRS and the use of Form 841, taxpayers can claim a deduction for the fair market value of the lost food. By following the steps outlined in this article and avoiding common mistakes, taxpayers can ensure a smooth and successful process.

We encourage readers to share their experiences and tips on replacing lost food in the comments section below. Don't forget to share this article with your friends and family who may have experienced food loss due to a disaster or other unforeseen circumstances.

What is Form 841?

+Form 841 is a document used by the IRS to record information about taxpayer contacts. In the context of food loss, Form 841 is used to report the loss and calculate the fair market value of the lost food.

How do I determine the fair market value of lost food?

+To determine the fair market value, taxpayers can use the following methods: check receipts or invoices for the original purchase price of the food, look up prices of similar food items in the local market, or use prices listed in a reliable pricing guide.

What are some common mistakes to avoid when replacing lost food?

+Common mistakes to avoid include failing to document the loss, overstating the value, and not following the correct procedures.