As the tax filing season approaches, many Americans living abroad or with foreign income may find themselves navigating the complexities of international taxation. One crucial step in reporting foreign-earned income is filing Form 2555, Foreign Earned Income. If you're unsure about the process or have questions about how to file, don't worry – Turbotax has got you covered. In this article, we'll guide you through the process of filing Form 2555 with Turbotax, making it easier for you to claim your foreign earned income exclusion and stay on top of your tax obligations.

Why File Form 2555?

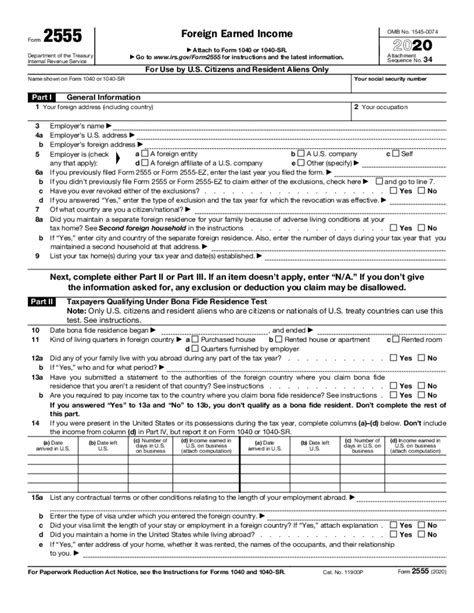

Before we dive into the Turbotax process, let's quickly review why filing Form 2555 is essential for individuals with foreign-earned income. Form 2555 allows you to claim the foreign earned income exclusion, which can significantly reduce your taxable income. In 2022, the exclusion amount is $105,900. By filing Form 2555, you can also claim a housing exclusion or deduction, which can further reduce your taxable income.

Turbotax: A Reliable Solution for Filing Form 2555

Turbotax is a well-established tax preparation software that has been helping individuals and businesses file their taxes for over three decades. Its user-friendly interface, comprehensive guidance, and accuracy guarantee make it an excellent choice for filing Form 2555. With Turbotax, you can rest assured that your tax return is accurate, complete, and compliant with the IRS regulations.

Step-by-Step Guide to Filing Form 2555 with Turbotax

To file Form 2555 with Turbotax, follow these steps:

- Gather Your Documents: Before starting the filing process, ensure you have all necessary documents, including:

- Your W-2 or 1099 forms

- Foreign earned income statements (e.g., pay stubs, invoices)

- Records of foreign taxes paid

- Information about your foreign housing expenses

- Create a Turbotax Account: If you haven't already, create a Turbotax account and select the appropriate tax filing product (e.g., Deluxe, Premier, or Self-Employed).

- Answer Tax Questions: Turbotax will guide you through a series of tax-related questions to determine your eligibility for Form 2555. Answer these questions honestly and accurately.

- Report Foreign Earned Income: Enter your foreign earned income, including any wages, salaries, tips, and commissions. You'll need to report this income in the foreign currency and then convert it to US dollars.

- Claim Foreign Earned Income Exclusion: Turbotax will help you calculate the foreign earned income exclusion based on your income and expenses. You can claim the exclusion for the tax year or elect to use the prior year's exclusion amount.

- Claim Housing Exclusion or Deduction: If you qualify, claim the housing exclusion or deduction by reporting your foreign housing expenses, such as rent, utilities, and furniture.

- Review and Submit: Review your Form 2555 and tax return for accuracy and completeness. Once satisfied, submit your return to the IRS.

Tips and Reminders

When filing Form 2555 with Turbotax, keep the following tips and reminders in mind:

- Foreign Currency Conversion: Ensure you convert your foreign earned income to US dollars using the exchange rate in effect on the date you received the income.

- Housing Expenses: Keep accurate records of your foreign housing expenses, as these can impact your exclusion or deduction.

- Tax Credits: Claim any foreign tax credits you're eligible for to reduce your US tax liability.

- File Electronically: File your tax return electronically to expedite the processing time and receive your refund faster.

Frequently Asked Questions

For your convenience, we've included a list of frequently asked questions related to filing Form 2555 with Turbotax:

What is the deadline for filing Form 2555?

+The deadline for filing Form 2555 is typically April 15th, but you may qualify for an automatic two-month extension to June 15th if you're living outside the United States.

Can I file Form 2555 if I'm self-employed?

+Yes, self-employed individuals can file Form 2555 to claim the foreign earned income exclusion. However, you'll need to report your business income and expenses on Schedule C (Form 1040).

How do I report foreign taxes paid on Form 2555?

+Report foreign taxes paid on Form 2555, Part II, Line 12. You'll need to convert the foreign taxes to US dollars using the exchange rate in effect on the date you paid the taxes.

Next Steps

By following this guide and utilizing Turbotax's expertise, you'll be able to accurately file Form 2555 and claim the foreign earned income exclusion. Remember to:

- Stay Organized: Keep accurate records of your foreign earned income, housing expenses, and tax-related documents.

- Seek Professional Help: If you're unsure about any aspect of the filing process, consider consulting a tax professional or seeking guidance from the IRS.

- Plan Ahead: Start preparing for next year's tax season by tracking your foreign earned income and expenses throughout the year.

Don't hesitate to share your experiences or ask questions in the comments section below. Help others by sharing this article on social media platforms.