The world of tax returns and financial documentation can be complex and overwhelming, especially when it comes to specific forms like the Form 4506-C. This form, also known as the IVES Request for Transcript of Tax Return, plays a crucial role in various financial transactions and verifications. In this article, we will delve into the purpose and uses of Form 4506-C, explaining its significance and providing insights into its application.

As we navigate the intricacies of Form 4506-C, it's essential to understand the context in which it is used. This form is primarily employed by the Internal Revenue Service (IRS) to facilitate the exchange of tax return information between the IRS, taxpayers, and authorized third-party recipients. By examining the form's purpose and uses, we can better comprehend its importance in the financial ecosystem.

Understanding Form 4506-C

Form 4506-C is a standardized form used to request transcripts of tax returns from the IRS. The form is designed to facilitate the secure and authorized exchange of tax return information, ensuring that sensitive financial data is protected. By using Form 4506-C, taxpayers and authorized third-party recipients can obtain the necessary tax return transcripts for various purposes, such as mortgage applications, student loan processing, and tax planning.

Purpose of Form 4506-C

The primary purpose of Form 4506-C is to enable the IRS to provide tax return transcripts to authorized recipients. This form serves as a request mechanism, allowing taxpayers to consent to the release of their tax return information to specific parties. By completing Form 4506-C, taxpayers can ensure that their tax return information is shared securely and efficiently, minimizing the risk of identity theft and unauthorized access.

Uses of Form 4506-C

Form 4506-C has various uses, including:

- Mortgage Applications: Lenders often require tax return transcripts as part of the mortgage application process. Form 4506-C enables borrowers to request and authorize the release of their tax return information to lenders.

- Student Loan Processing: Educational institutions and lenders may require tax return transcripts to verify income and determine student loan eligibility.

- Tax Planning: Tax professionals use Form 4506-C to obtain tax return transcripts for clients, facilitating tax planning and preparation.

- Identity Verification: Form 4506-C can be used to verify an individual's identity, as it requires the taxpayer's signature and authorization.

Benefits of Using Form 4506-C

Using Form 4506-C offers several benefits, including:

- Secure Data Transfer: The form ensures that tax return information is shared securely, reducing the risk of identity theft and unauthorized access.

- Efficient Processing: Form 4506-C streamlines the process of requesting and obtaining tax return transcripts, saving time and reducing administrative burdens.

- Compliance: By using Form 4506-C, taxpayers and authorized recipients can ensure compliance with IRS regulations and guidelines.

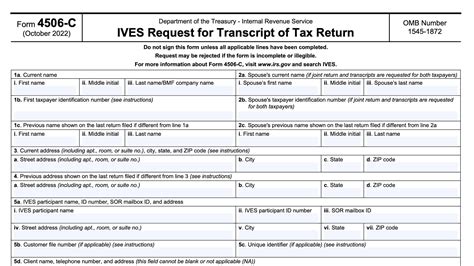

How to Complete Form 4506-C

Completing Form 4506-C requires careful attention to detail. Here's a step-by-step guide:

- Download the Form: Obtain the latest version of Form 4506-C from the IRS website or through a tax professional.

- Enter Taxpayer Information: Provide the taxpayer's name, address, and Social Security number or Employer Identification Number (EIN).

- Specify the Tax Year: Identify the tax year for which the transcript is being requested.

- Authorize Release: Sign and date the form to authorize the release of tax return information to the specified recipient.

- Submit the Form: Mail or fax the completed form to the IRS or submit it through a tax professional.

Tips for Completing Form 4506-C

- Use the Latest Version: Ensure you're using the most recent version of Form 4506-C to avoid delays or rejection.

- Double-Check Information: Verify the accuracy of taxpayer information and recipient details to prevent errors.

- Retain a Copy: Keep a copy of the completed form for your records.

Common Challenges and Solutions

When working with Form 4506-C, you may encounter challenges such as:

- Incomplete or Inaccurate Information: Double-check taxpayer information and recipient details to prevent errors.

- Delayed Processing: Ensure you're using the latest version of the form and submitting it through the correct channels.

- Unauthorized Access: Verify the identity of the recipient and ensure they are authorized to receive the tax return transcript.

By understanding the purpose and uses of Form 4506-C, taxpayers and authorized recipients can navigate the complexities of tax return transcripts with confidence. By following the guidelines outlined in this article, you can ensure secure and efficient exchange of tax return information.

We hope this article has provided you with a comprehensive understanding of Form 4506-C. If you have any further questions or would like to share your experiences with this form, please leave a comment below.

What is the purpose of Form 4506-C?

+The primary purpose of Form 4506-C is to enable the IRS to provide tax return transcripts to authorized recipients.

What are the common uses of Form 4506-C?

+Form 4506-C is commonly used for mortgage applications, student loan processing, tax planning, and identity verification.

How do I complete Form 4506-C?

+To complete Form 4506-C, download the latest version, enter taxpayer information, specify the tax year, authorize release, and submit the form to the IRS or through a tax professional.