As a business owner, you've worked hard to build your corporation from the ground up. However, sometimes circumstances change, and you may need to dissolve your corporation. In Ontario, Canada, the process of dissolving a corporation involves filing a Form TR-960, Consent to Dissolve a Corporation. In this article, we'll break down the Form TR-960, its requirements, and the steps involved in dissolving a corporation in Ontario.

What is Form TR-960, Consent to Dissolve a Corporation?

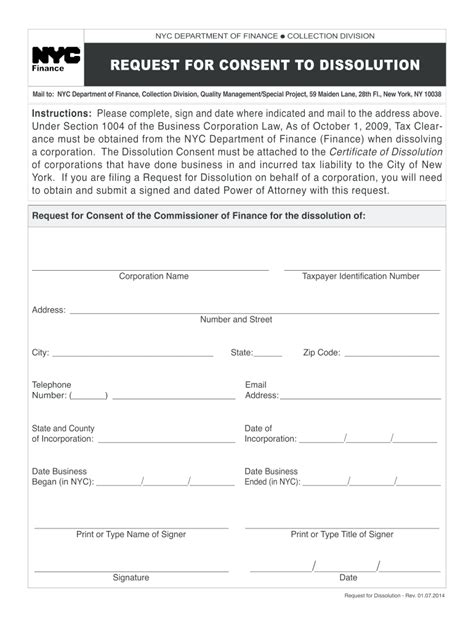

Form TR-960, Consent to Dissolve a Corporation, is a document used to obtain the consent of the Ministry of Finance to dissolve a corporation in Ontario, Canada. The form is required under the Ontario Business Corporations Act (OBCA) and must be filed with the Ministry of Finance before a corporation can be dissolved.

Why Do You Need to File Form TR-960?

Filing Form TR-960 is a crucial step in dissolving a corporation in Ontario. The form serves as a formal request to the Ministry of Finance to cancel the corporation's charter and remove it from the corporate register. Without this consent, a corporation cannot be dissolved, and it will continue to exist as a legal entity.

Who Needs to Sign Form TR-960?

The Form TR-960 must be signed by:

- The corporation's authorized representative (e.g., a director or officer)

- The corporation's accountant or lawyer (if applicable)

What Information is Required on Form TR-960?

The Form TR-960 requires the following information:

- Corporation name and number

- Reason for dissolution (e.g., bankruptcy, amalgamation, or voluntary dissolution)

- Statement that the corporation has no outstanding liabilities or assets

- Statement that the corporation has paid all taxes and fees owed to the Ministry of Finance

- Signature of the authorized representative and accountant or lawyer (if applicable)

How to File Form TR-960

To file Form TR-960, follow these steps:

- Obtain the form from the Ontario government's website or contact the Ministry of Finance directly.

- Complete the form accurately and sign it as required.

- Attach supporting documentation, such as a statement of account or a tax clearance certificate.

- File the form with the Ministry of Finance by mail or in person.

Timeline for Filing Form TR-960

The timeline for filing Form TR-960 varies depending on the reason for dissolution. Generally, the form must be filed within a specific timeframe after the corporation's last annual meeting.

- Voluntary dissolution: Within 30 days after the corporation's last annual meeting

- Bankruptcy: Within 30 days after the bankruptcy order is made

- Amalgamation: Within 30 days after the amalgamation agreement is signed

Consequences of Not Filing Form TR-960

Failure to file Form TR-960 can result in serious consequences, including:

- The corporation remaining active and subject to ongoing compliance requirements

- Liability for taxes and fees owed to the Ministry of Finance

- Potential penalties and fines for non-compliance

Conclusion: Dissolving a Corporation in Ontario

Dissolving a corporation in Ontario requires careful planning and attention to detail. Filing Form TR-960, Consent to Dissolve a Corporation, is a critical step in the process. By understanding the requirements and timeline for filing this form, you can ensure a smooth and efficient dissolution process.

Steps to Take After Filing Form TR-960

After filing Form TR-960, you should:

- Notify the Canada Revenue Agency (CRA) and other relevant authorities of the corporation's dissolution

- Update the corporation's records and accounts to reflect its dissolved status

- Distribute any remaining assets or property to shareholders or creditors

Frequently Asked Questions

What is the difference between voluntary and involuntary dissolution?

+Voluntary dissolution occurs when the corporation's shareholders or directors decide to dissolve the corporation. Involuntary dissolution occurs when the corporation is forced to dissolve due to bankruptcy or other external factors.

Can I file Form TR-960 online?

+No, Form TR-960 must be filed in paper format with the Ministry of Finance.

How long does it take to process Form TR-960?

+The processing time for Form TR-960 varies depending on the complexity of the application and the workload of the Ministry of Finance. Generally, it takes several weeks to several months to process the form.

Share Your Thoughts

Have you ever had to dissolve a corporation in Ontario? Share your experiences and insights in the comments below.