Filing taxes can be a daunting task, especially for those who are new to the process. With so many forms, deductions, and regulations to navigate, it's easy to feel overwhelmed. However, with the right guidance, you can ensure that your tax filing experience is smooth and stress-free. In this article, we'll take a closer look at Form 84-0001a, a crucial document for many taxpayers, and provide you with a comprehensive guide to filing success.

Whether you're a seasoned tax pro or a novice, understanding the ins and outs of Form 84-0001a is essential for accurate and efficient tax filing. We'll break down the form's components, explain its purpose, and provide expert tips to help you avoid common pitfalls.

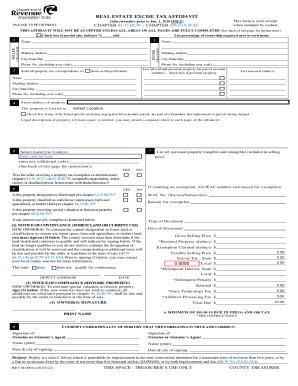

What is Form 84-0001a?

Form 84-0001a is a tax document used to report certain types of income and claim specific deductions. It's a critical component of the tax filing process, and its accuracy is essential for ensuring you receive the correct refund or pay the right amount of taxes.

Who Needs to File Form 84-0001a?

Form 84-0001a is required for individuals who have received certain types of income, such as self-employment income, rental income, or income from a side hustle. If you've received any of these types of income, you'll need to file Form 84-0001a to report it accurately.

Additionally, if you're claiming specific deductions, such as business expenses or charitable donations, you may need to file Form 84-0001a to support your claims.

Components of Form 84-0001a

Form 84-0001a consists of several sections, each designed to capture specific information about your income and deductions. The form is divided into the following parts:

- Part I: Income

- Section 1: Self-Employment Income

- Section 2: Rental Income

- Section 3: Other Income

- Part II: Deductions

- Section 1: Business Expenses

- Section 2: Charitable Donations

- Section 3: Other Deductions

- Part III: Credits

- Section 1: Earned Income Tax Credit (EITC)

- Section 2: Child Tax Credit

- Section 3: Other Credits

How to Fill Out Form 84-0001a

Filling out Form 84-0001a requires attention to detail and accuracy. Here are some tips to help you complete the form successfully:

- Gather all necessary documents: Before starting the form, make sure you have all the necessary documents, including receipts, invoices, and bank statements.

- Read the instructions carefully: Take the time to read the instructions for each section, and make sure you understand what's required.

- Use the correct codes: Use the correct codes and labels for each section to ensure accuracy.

- Double-check your math: Double-check your math calculations to avoid errors.

Common Mistakes to Avoid

When filling out Form 84-0001a, it's easy to make mistakes. Here are some common errors to avoid:

- Incorrect income reporting: Make sure you report all income accurately, including self-employment income and rental income.

- Inadequate documentation: Ensure you have adequate documentation to support your deductions and credits.

- Math errors: Double-check your math calculations to avoid errors.

Tips for a Smooth Filing Experience

To ensure a smooth filing experience, follow these tips:

- Start early: Give yourself plenty of time to complete the form, and don't wait until the last minute.

- Seek help if needed: If you're unsure about any part of the form, don't hesitate to seek help from a tax professional.

- Use tax software: Consider using tax software to help guide you through the process and catch any errors.

Conclusion

Filing taxes can be a complex and daunting task, but with the right guidance, you can ensure a smooth and stress-free experience. By understanding the ins and outs of Form 84-0001a, you'll be better equipped to navigate the tax filing process and avoid common pitfalls. Remember to take your time, seek help if needed, and use tax software to ensure accuracy and efficiency.

What's Next?

Now that you've read our comprehensive guide to Form 84-0001a, it's time to take action. If you have any questions or concerns, don't hesitate to reach out to a tax professional or seek additional resources. Remember to stay organized, take your time, and seek help if needed.

What is Form 84-0001a used for?

+Form 84-0001a is used to report certain types of income and claim specific deductions.

Who needs to file Form 84-0001a?

+Individuals who have received certain types of income, such as self-employment income, rental income, or income from a side hustle, need to file Form 84-0001a.

How do I fill out Form 84-0001a?

+Gather all necessary documents, read the instructions carefully, use the correct codes, and double-check your math calculations.