As a taxpayer in Georgia, it's essential to understand the various tax forms that are required to be filed with the state's Department of Revenue. One of the most critical forms is the GA-500, also known as the Individual Income Tax Return. This form is used to report an individual's income, deductions, and credits for the tax year. In this article, we'll provide a comprehensive guide to help you understand the GA-500 tax form, its components, and how to fill it out accurately.

The Importance of Accurate Tax Filing

Filing taxes accurately is crucial to avoid any penalties, fines, or delays in receiving your refund. The GA-500 form requires careful attention to detail, and any mistakes can lead to processing delays or even an audit. As a taxpayer, it's your responsibility to ensure that you're reporting your income correctly and claiming the right deductions and credits. In this article, we'll break down the GA-500 form into its key components and provide step-by-step guidance on how to fill it out.

GA-500 Form Components

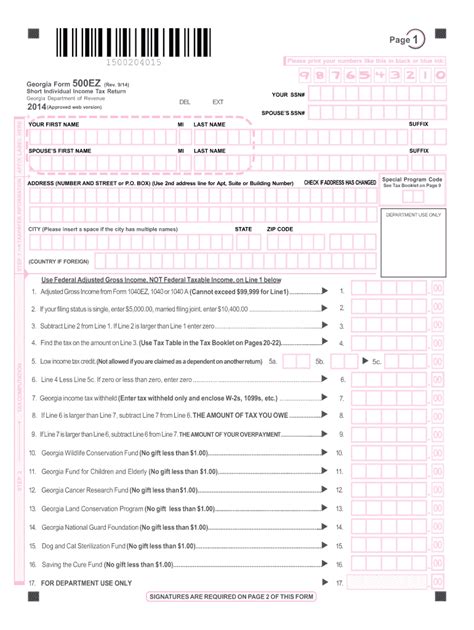

The GA-500 form consists of several sections, each with its own set of instructions and requirements. Here's an overview of the main components:

- Identification Section: This section requires your personal details, including your name, address, Social Security number, and date of birth.

- Income Section: This section requires you to report your income from various sources, including employment, self-employment, investments, and retirement accounts.

- Deductions Section: This section allows you to claim deductions for items such as charitable donations, mortgage interest, and medical expenses.

- Credits Section: This section allows you to claim credits for items such as education expenses, child care, and earned income.

- Tax Liability Section: This section calculates your total tax liability based on your income, deductions, and credits.

Step-by-Step Guide to Filling Out the GA-500 Form

Filling out the GA-500 form requires careful attention to detail and accuracy. Here's a step-by-step guide to help you fill out the form:

Step 1: Gather Required Documents

Before starting to fill out the GA-500 form, make sure you have all the necessary documents, including:

- W-2 forms from your employer(s)

- 1099 forms for self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Step 2: Fill Out the Identification Section

Start by filling out the identification section, which requires your personal details. Make sure to double-check your Social Security number and date of birth.

Step 3: Report Your Income

Report your income from various sources, including employment, self-employment, investments, and retirement accounts. Use the W-2 and 1099 forms to report your income accurately.

Step 4: Claim Deductions

Claim deductions for items such as charitable donations, mortgage interest, and medical expenses. Make sure to keep receipts and documentation for these deductions.

Step 5: Claim Credits

Claim credits for items such as education expenses, child care, and earned income. Use the relevant forms and documentation to support your credits.

Step 6: Calculate Your Tax Liability

Calculate your total tax liability based on your income, deductions, and credits. Use the tax tables or a tax calculator to ensure accuracy.

Common Mistakes to Avoid

When filling out the GA-500 form, it's essential to avoid common mistakes that can lead to processing delays or even an audit. Here are some common mistakes to avoid:

- Math errors: Double-check your calculations to ensure accuracy.

- Inconsistent information: Ensure that your name, address, and Social Security number match the information on file with the Georgia Department of Revenue.

- Missing documentation: Keep receipts and documentation for deductions and credits to support your claims.

Tips for Filing the GA-500 Form

Here are some tips to help you file the GA-500 form accurately and efficiently:

- File electronically: Filing electronically can reduce errors and processing time.

- Use tax software: Tax software can help you navigate the GA-500 form and ensure accuracy.

- Seek professional help: If you're unsure about any aspect of the GA-500 form, consider seeking help from a tax professional.

Conclusion: Take Control of Your Taxes

Filing the GA-500 form requires attention to detail and accuracy. By following the step-by-step guide and avoiding common mistakes, you can ensure that your tax filing is accurate and efficient. Remember to take control of your taxes by seeking help when needed and staying organized throughout the tax filing process.

What is the GA-500 form?

+The GA-500 form is the Individual Income Tax Return form required by the state of Georgia. It's used to report an individual's income, deductions, and credits for the tax year.

What documents do I need to fill out the GA-500 form?

+You'll need to gather documents such as W-2 forms, 1099 forms, interest statements, dividend statements, charitable donation receipts, and medical expense receipts.

Can I file the GA-500 form electronically?

+Yes, you can file the GA-500 form electronically through the Georgia Department of Revenue's website or through tax software.