As a parent or guardian, managing the tax obligations of a minor can be a daunting task. The IRS requires that minors who earn income report it on their tax return, just like adults. However, the tax laws and forms can be complex, making it challenging to navigate the process. That's where IRS Form 8615 comes in – a vital tool designed to simplify tax returns for minors.

In this article, we will delve into the world of IRS Form 8615, exploring its purpose, benefits, and how to use it effectively. We'll also provide examples, statistics, and practical tips to help you understand the process better.

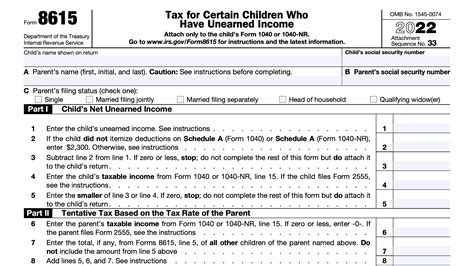

What is IRS Form 8615?

IRS Form 8615, also known as the "Dependent Income" form, is used to report the income of a minor on their parent's tax return. This form is designed for minors who are under the age of 18 (or under 24 if a full-time student) and have unearned income, such as interest, dividends, or capital gains. By using Form 8615, parents can report their child's income and claim any applicable tax credits or deductions.

Benefits of Using IRS Form 8615

Using Form 8615 offers several benefits, including:

- Simplified tax reporting: By reporting a minor's income on their parent's tax return, you can avoid having to file a separate tax return for the child.

- Reduced tax liability: Form 8615 allows you to claim the child's income on your tax return, which may reduce your overall tax liability.

- Increased accuracy: By reporting the child's income on your tax return, you can ensure accuracy and avoid potential errors or penalties.

Who Needs to File IRS Form 8615?

To determine if you need to file Form 8615, you'll need to consider the following factors:

- The minor's age: If the child is under 18 (or under 24 if a full-time student), you may need to file Form 8615.

- The type of income: If the child has unearned income, such as interest, dividends, or capital gains, you'll need to report it on Form 8615.

- The amount of income: If the child's unearned income exceeds $1,100, you'll need to file Form 8615.

How to Complete IRS Form 8615

Completing Form 8615 is relatively straightforward. Here's a step-by-step guide to help you get started:

- Gather the necessary information: You'll need the child's name, Social Security number, and the amount of unearned income.

- Complete Part I: Report the child's unearned income, including interest, dividends, and capital gains.

- Complete Part II: Calculate the child's tax liability using the tax tables or tax rate schedules.

- Complete Part III: Claim any applicable tax credits or deductions, such as the child tax credit.

Common Mistakes to Avoid

When completing Form 8615, it's essential to avoid common mistakes that can lead to errors or penalties. Here are some common mistakes to watch out for:

- Failing to report all unearned income

- Incorrectly calculating the child's tax liability

- Failing to claim applicable tax credits or deductions

Practical Tips and Examples

Here are some practical tips and examples to help you understand the process better:

- Example: John, a 12-year-old, earns $1,500 in interest from a savings account. His parents will need to report this income on Form 8615 and claim any applicable tax credits or deductions.

- Tip: Keep accurate records of the child's unearned income, including interest statements and dividend reports.

Statistical Data and Trends

According to the IRS, over 1.4 million taxpayers filed Form 8615 in 2020, reporting a total of $13.4 billion in unearned income. The most common types of unearned income reported on Form 8615 include:

- Interest income (74%)

- Dividend income (21%)

- Capital gains income (5%)

Conclusion

IRS Form 8615 is a vital tool designed to simplify tax returns for minors. By understanding the purpose, benefits, and how to use the form effectively, you can ensure accuracy and reduce your overall tax liability. Remember to avoid common mistakes, keep accurate records, and claim applicable tax credits or deductions.

If you have any questions or concerns about IRS Form 8615, feel free to comment below. Share this article with others who may benefit from this information.

What is the purpose of IRS Form 8615?

+IRS Form 8615 is used to report the income of a minor on their parent's tax return.

Who needs to file IRS Form 8615?

+Parents or guardians of minors who have unearned income, such as interest, dividends, or capital gains, need to file Form 8615.

What are the benefits of using IRS Form 8615?

+The benefits of using Form 8615 include simplified tax reporting, reduced tax liability, and increased accuracy.