Employers in Georgia are required to provide workers' compensation insurance to their employees, with a few exceptions. If you're an employer in Georgia, you might be wondering about the process of exempting certain employees or yourself from workers' compensation insurance. In this article, we'll delve into the details of the Georgia workers comp exemption form, who is eligible, and how to apply.

What is the Georgia Workers Comp Exemption Form?

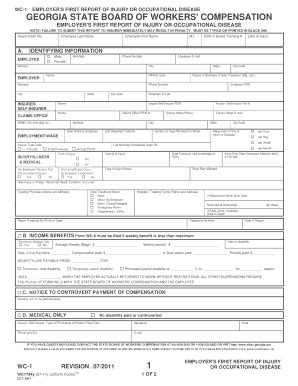

The Georgia workers comp exemption form, officially known as the "Request for Workers' Compensation Exemption" form, is a document that allows certain employers or employees to opt-out of the workers' compensation insurance requirement. This form is used to notify the State Board of Workers' Compensation of an employer's intention to exempt themselves or specific employees from coverage.

Who is Eligible for Exemption?

In Georgia, the following individuals may be eligible for exemption from workers' compensation insurance:

- Sole proprietors and single-member limited liability companies (LLCs) who do not have any employees

- Partners in a partnership who do not have any employees

- Corporate officers who own at least 25% of the corporation and do not receive a salary or wages

- Certain employees of railroads and their subcontractors

- Domestic servants

Exemption Requirements

To be eligible for exemption, employers or employees must meet specific requirements. These requirements include:

- Filing the exemption form with the State Board of Workers' Compensation

- Paying a filing fee (currently $100)

- Providing proof of exemption eligibility

How to Apply for Exemption

To apply for exemption, follow these steps:

- Determine eligibility: Review the exemption requirements to ensure you or your employees meet the eligibility criteria.

- Obtain the exemption form: Download the Request for Workers' Compensation Exemption form from the State Board of Workers' Compensation website or contact their office to request a copy.

- Complete the form: Fill out the form accurately and thoroughly, providing all required information and supporting documentation.

- Submit the form: Mail or fax the completed form to the State Board of Workers' Compensation, along with the required filing fee.

- Wait for approval: The State Board will review your application and notify you of their decision.

Consequences of Not Complying with Workers' Compensation Requirements

Failure to comply with workers' compensation requirements can result in severe consequences, including:

- Fines and penalties

- Stop-work orders

- Criminal charges

Conclusion and Next Steps

In conclusion, the Georgia workers comp exemption form is a critical document for employers and employees seeking to opt-out of workers' compensation insurance. Understanding the exemption requirements, eligibility, and application process is vital to ensuring compliance with state regulations. If you're unsure about the exemption process or have questions, consider consulting with a qualified attorney or contacting the State Board of Workers' Compensation.

We invite you to share your thoughts, experiences, or questions about the Georgia workers comp exemption form in the comments section below. Your feedback will help us improve our content and provide valuable insights to our readers.