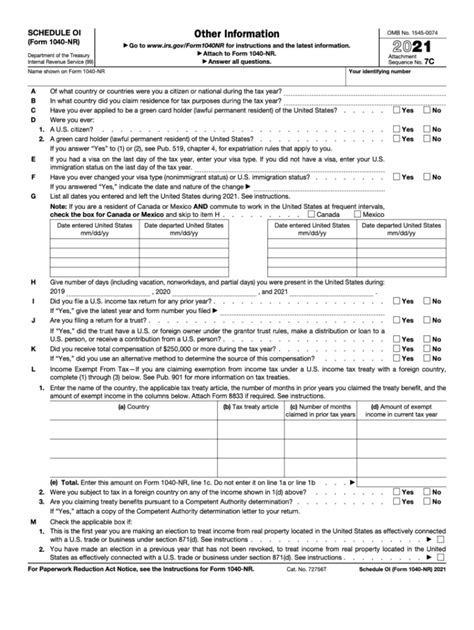

As a non-resident alien, filing taxes in the United States can be a daunting task. One of the most crucial forms you'll need to complete is Form 1040NR, which includes Schedule OI. This schedule is used to report your income from other sources, such as interest, dividends, and capital gains. In this article, we'll provide you with 5 tips to help you accurately fill out Schedule OI on Form 1040NR.

Tip 1: Understand the Purpose of Schedule OI

Before you start filling out Schedule OI, it's essential to understand its purpose. This schedule is used to report your income from sources other than wages, salaries, and tips. This includes income from investments, such as interest, dividends, and capital gains. You'll need to report this income on Schedule OI, and then transfer the total to Form 1040NR.

Types of Income Reported on Schedule OI

Schedule OI is used to report a variety of income types, including:

- Interest income from banks, savings accounts, and bonds

- Dividend income from stocks and mutual funds

- Capital gains from the sale of investments, such as stocks, bonds, and real estate

- Other income, such as royalties, rents, and prizes

Reporting Interest Income

When reporting interest income on Schedule OI, you'll need to include the name and address of the payer, as well as the amount of interest received. You'll also need to report any foreign tax withheld on the interest income.

Tip 2: Gather Required Documents

To accurately fill out Schedule OI, you'll need to gather several documents, including:

- 1099-INT forms for interest income

- 1099-DIV forms for dividend income

- Form 8949 for capital gains and losses

- Schedule K-1 for partnership and S corporation income

Make sure you have all of these documents before you start filling out Schedule OI.

Importance of Accurate Record-Keeping

Accurate record-keeping is crucial when reporting income on Schedule OI. Make sure you keep detailed records of all your income, including interest, dividends, and capital gains. This will help you ensure that you're reporting all of your income accurately.

Tip 3: Report All Income

It's essential to report all of your income on Schedule OI, even if you don't receive a 1099 form. This includes income from foreign sources, such as interest, dividends, and capital gains.

Reporting Foreign Income

When reporting foreign income on Schedule OI, you'll need to convert the income to U.S. dollars using the exchange rate in effect on the date you received the income. You'll also need to report any foreign tax withheld on the income.

Tip 4: Complete Form 8949

If you have capital gains or losses, you'll need to complete Form 8949. This form is used to report the sale of investments, such as stocks, bonds, and real estate.

Completing Form 8949

To complete Form 8949, you'll need to report the following information:

- The date you acquired the investment

- The date you sold the investment

- The proceeds from the sale

- The basis of the investment

- The gain or loss from the sale

Tip 5: Seek Professional Help

Filling out Schedule OI can be complex, especially if you have multiple sources of income. If you're unsure about how to report your income, consider seeking professional help from a tax professional or accountant.

Benefits of Seeking Professional Help

Seeking professional help can provide several benefits, including:

- Accurate reporting of income

- Maximization of deductions and credits

- Avoidance of penalties and interest

By following these 5 tips, you can ensure that you accurately fill out Schedule OI on Form 1040NR. Remember to gather all required documents, report all income, complete Form 8949, and seek professional help if needed.

We hope this article has provided you with valuable insights and tips on how to fill out Schedule OI on Form 1040NR. If you have any questions or need further clarification, please don't hesitate to comment below.

What is Schedule OI used for?

+Schedule OI is used to report income from other sources, such as interest, dividends, and capital gains.

What documents do I need to gather to fill out Schedule OI?

+You'll need to gather 1099-INT forms, 1099-DIV forms, Form 8949, and Schedule K-1.

Do I need to report all income on Schedule OI?

+Yes, you need to report all income on Schedule OI, even if you don't receive a 1099 form.