As the tax season approaches, many individuals and investors are scrambling to gather their financial documents and prepare their tax returns. One often-overlooked aspect of tax preparation is reporting stock basis, which can be a complex and time-consuming process. However, with the introduction of Form 7203, the Internal Revenue Service (IRS) aims to simplify stock basis reporting for taxpayers. In this article, we will delve into the world of Form 7203, explore its purpose, and discuss how Turbotax can help streamline the process.

The Importance of Accurate Stock Basis Reporting

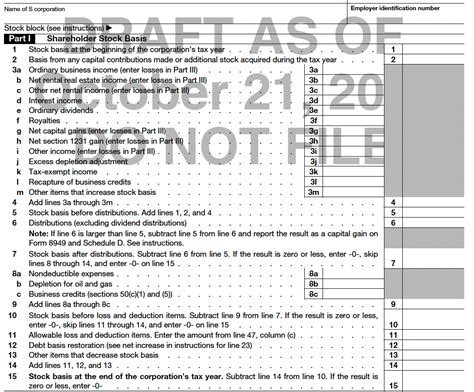

Accurate stock basis reporting is crucial for investors, as it affects the calculation of capital gains and losses. The stock basis represents the original purchase price of a security, including any commissions or fees. When an investor sells a security, the gain or loss is calculated by subtracting the basis from the sale price. Inaccurate or incomplete basis reporting can lead to incorrect tax calculations, resulting in overpaid taxes or even audits.

The Need for Simplification

Prior to the introduction of Form 7203, stock basis reporting was a manual process that involved tracking and documenting every purchase, sale, and dividend reinvestment. This process was often prone to errors, especially for investors with complex portfolios or multiple brokerage accounts. The IRS recognized the need for simplification and introduced Form 7203 to provide a standardized and streamlined approach to stock basis reporting.

What is Form 7203?

Form 7203, also known as the "Statement of Basis of Securities Sold," is a new IRS form designed to simplify stock basis reporting. The form allows taxpayers to report the basis of securities sold during the tax year, making it easier to calculate capital gains and losses. Form 7203 is a companion form to Schedule D (Capital Gains and Losses), which is used to report the sale of securities.

How Turbotax Simplifies Form 7203 Preparation

Turbotax, a leading tax preparation software, has incorporated Form 7203 into its platform to simplify the stock basis reporting process. With Turbotax, users can easily import their investment data from participating brokerage firms, automatically populating the necessary fields on Form 7203. This eliminates the need for manual data entry, reducing errors and saving time.

Turbotax also provides a step-by-step guide to help users complete Form 7203, including:

- Identifying the type of security sold (e.g., stocks, bonds, mutual funds)

- Entering the date of sale and sale price

- Reporting the basis of the security, including any adjustments for dividends or mergers

- Calculating the gain or loss

Benefits of Using Turbotax for Form 7203 Preparation

Using Turbotax to prepare Form 7203 offers several benefits, including:

- Accuracy: Turbotax's automated import feature and step-by-step guidance ensure accurate data entry and minimize errors.

- Convenience: Turbotax streamlines the process, saving users time and effort.

- Audit Protection: Turbotax's expert review and audit protection features provide peace of mind, ensuring users are prepared in case of an audit.

Common Scenarios for Form 7203

Form 7203 is used in various scenarios, including:

- Selling securities: When an investor sells a security, they must report the basis on Form 7203 to calculate the gain or loss.

- Dividend reinvestments: If an investor reinvests dividends, they must adjust the basis of the security on Form 7203.

- Mergers and acquisitions: In the event of a merger or acquisition, investors may need to adjust the basis of their securities on Form 7203.

Tips for Preparing Form 7203 with Turbotax

To get the most out of Turbotax's Form 7203 preparation feature, follow these tips:

- Gather necessary documents: Collect all relevant investment documents, including brokerage statements and confirmation slips.

- Import investment data: Take advantage of Turbotax's automated import feature to populate Form 7203.

- Review and verify: Carefully review and verify the data on Form 7203 to ensure accuracy.

Conclusion

Form 7203 has simplified the stock basis reporting process for taxpayers, and Turbotax has made it even easier to prepare and file this form. By using Turbotax, investors can ensure accurate and efficient reporting of their stock basis, minimizing errors and reducing the risk of audits. Take control of your tax preparation today and let Turbotax guide you through the process.

What is Form 7203 used for?

+Form 7203 is used to report the basis of securities sold during the tax year, making it easier to calculate capital gains and losses.

Can I use Turbotax to prepare Form 7203?

+Yes, Turbotax has incorporated Form 7203 into its platform, allowing users to easily import investment data and complete the form.

What are the benefits of using Turbotax for Form 7203 preparation?

+Using Turbotax for Form 7203 preparation offers accuracy, convenience, and audit protection, ensuring users are prepared for tax season.