In today's fast-paced business world, navigating complex tax regulations and forms can be overwhelming, especially when it comes to employee benefit plans. One of the most critical forms for businesses with employee benefit plans is the Form 5500. Filing this form accurately and on time is crucial to avoid penalties and maintain compliance with the Employee Retirement Income Security Act of 1974 (ERISA). In this article, we will provide simple instructions on how to easily file your Form 5500, ensuring that you stay on top of your employee benefit plan obligations.

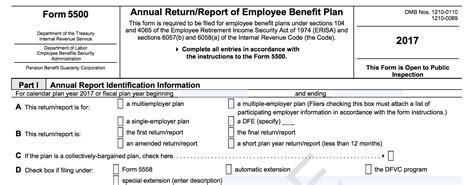

The Form 5500 is an annual report that must be filed by businesses that sponsor employee benefit plans, such as 401(k), pension, or health insurance plans. The form is used to report information about the plan's financial condition, investments, and operations. Filing the Form 5500 is a critical requirement for maintaining tax-qualified status and ensuring that the plan remains compliant with ERISA regulations.

To help you navigate the process, we have broken down the steps to file your Form 5500 into simple, easy-to-follow instructions.

Understanding the Form 5500 Requirements

Before you begin the filing process, it's essential to understand the requirements for Form 5500. The form must be filed annually, and the deadline is typically July 31st of each year. The form requires information about the plan's financial condition, investments, and operations, including:

- Plan name and number

- Employer identification number (EIN)

- Plan administrator's name and address

- Financial statements, including balance sheets and income statements

- Investment information, including assets and liabilities

- Information about plan amendments and changes

Who Needs to File Form 5500?

Not all businesses with employee benefit plans need to file Form 5500. The form is required for businesses that sponsor:

- Defined benefit plans

- Defined contribution plans

- Welfare benefit plans, including health insurance plans

- Pension plans

However, there are some exceptions to this rule. For example, businesses with fewer than 100 participants in their benefit plan may be exempt from filing Form 5500.

Step-by-Step Instructions for Filing Form 5500

Filing Form 5500 can seem like a daunting task, but by following these simple instructions, you can ensure that your form is accurate and complete.

- Gather required information: Before you begin the filing process, gather all the required information, including plan documents, financial statements, and investment information.

- Choose the correct form: There are two versions of Form 5500: the standard form and the EZ form. The EZ form is for businesses with fewer than 100 participants in their benefit plan.

- Complete the form: Complete the form accurately and thoroughly, using the instructions provided by the IRS.

- Attach required schedules: Attach required schedules, including Schedule A (Insurance Information), Schedule C (Service Provider Information), and Schedule D (DFE/PE Information).

- File the form: File the form electronically through the ERISA Filing Acceptance System (EFAST2) or by mail to the IRS.

Common Mistakes to Avoid

When filing Form 5500, there are several common mistakes to avoid, including:

- Incomplete or inaccurate information: Make sure that all required information is complete and accurate.

- Missing schedules: Ensure that all required schedules are attached to the form.

- Incorrect filing deadline: File the form by the July 31st deadline to avoid penalties.

Benefits of Filing Form 5500 Electronically

Filing Form 5500 electronically through EFAST2 offers several benefits, including:

- Increased accuracy: Electronic filing reduces the risk of errors and ensures that the form is complete and accurate.

- Faster processing: Electronic filing allows for faster processing and review of the form.

- Reduced paperwork: Electronic filing eliminates the need for paper forms and schedules.

How to File Form 5500 Electronically

To file Form 5500 electronically, follow these steps:

- Create an account: Create an account on the EFAST2 website.

- Prepare the form: Prepare the form electronically using the EFAST2 software.

- Submit the form: Submit the form electronically through the EFAST2 system.

Conclusion

Filing Form 5500 is a critical requirement for businesses with employee benefit plans. By following these simple instructions and avoiding common mistakes, you can ensure that your form is accurate and complete. Filing electronically through EFAST2 offers several benefits, including increased accuracy, faster processing, and reduced paperwork. Take the first step today and file your Form 5500 with confidence.

Next Steps

If you have any questions or concerns about filing Form 5500, we encourage you to seek professional advice from a qualified tax professional or benefits administrator. Additionally, you can visit the IRS website for more information on Form 5500 and other employee benefit plan requirements.

Final Thoughts

Filing Form 5500 is a critical requirement for businesses with employee benefit plans. By following these simple instructions and avoiding common mistakes, you can ensure that your form is accurate and complete. Remember to file electronically through EFAST2 for increased accuracy, faster processing, and reduced paperwork. Take the first step today and file your Form 5500 with confidence.

We hope this article has provided you with valuable insights and guidance on how to easily file your Form 5500. If you have any further questions or concerns, please don't hesitate to reach out to us.

What is Form 5500?

+Form 5500 is an annual report that must be filed by businesses that sponsor employee benefit plans, such as 401(k), pension, or health insurance plans.

Who needs to file Form 5500?

+Businesses that sponsor defined benefit plans, defined contribution plans, welfare benefit plans, including health insurance plans, and pension plans need to file Form 5500.

What is the deadline for filing Form 5500?

+The deadline for filing Form 5500 is typically July 31st of each year.