Understanding your W-2 form is a crucial step in managing your finances and preparing for tax season. The W-2 form, also known as the Wage and Tax Statement, is a document that your employer is required to provide to you by January 31st of each year. It shows the amount of money you earned from your job, as well as the amount of taxes withheld from your paycheck. In this article, we will break down the components of a W-2 form, explain what each section means, and provide tips on how to use this information to your advantage.

What is a W-2 Form?

A W-2 form is a document that your employer is required to provide to you and the Social Security Administration (SSA) at the end of each year. It reports your income and the amount of taxes withheld from your paycheck. The W-2 form is used to calculate your tax liability and to determine your eligibility for certain tax credits.

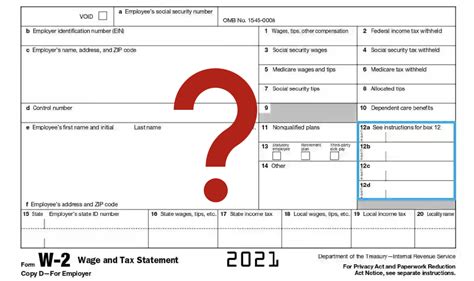

Components of a W-2 Form

A W-2 form is divided into several sections, each with its own specific information. Here are the main components of a W-2 form:

- Employee's Social Security Number: This is your Social Security number, which is used to identify you for tax purposes.

- Employer's Identification Number: This is your employer's identification number, which is used to identify your employer for tax purposes.

- Employer's Name and Address: This is the name and address of your employer.

- Employee's Name and Address: This is your name and address.

- Wages, Tips, and Other Compensation: This section shows the total amount of money you earned from your job, including tips and other forms of compensation.

- Federal Income Tax Withheld: This section shows the amount of federal income tax withheld from your paycheck.

- Social Security Tax Withheld: This section shows the amount of Social Security tax withheld from your paycheck.

- Medicare Tax Withheld: This section shows the amount of Medicare tax withheld from your paycheck.

Decoding the W-2 Form with Everfi

Everfi is a financial education platform that provides interactive lessons and tools to help you understand personal finance and career development. In this section, we will use Everfi's W-2 decoder tool to break down the components of a W-2 form and explain what each section means.

W-2 Decoder Tool

The W-2 decoder tool is an interactive tool provided by Everfi that helps you understand the components of a W-2 form. Here's how to use the tool:

- Enter your W-2 form information into the tool.

- The tool will break down the components of your W-2 form and explain what each section means.

- Use the tool to identify any errors or discrepancies on your W-2 form.

Benefits of Using the W-2 Decoder Tool

Using the W-2 decoder tool can help you:

- Understand the components of your W-2 form

- Identify any errors or discrepancies on your W-2 form

- Use the information on your W-2 form to prepare for tax season

- Make informed decisions about your finances and career development

Tips for Using Your W-2 Form

Here are some tips for using your W-2 form:

- Review your W-2 form carefully to ensure that the information is accurate.

- Use the information on your W-2 form to prepare for tax season.

- Keep a copy of your W-2 form for your records.

- Use the W-2 decoder tool to understand the components of your W-2 form.

Common Errors on W-2 Forms

Here are some common errors that can occur on W-2 forms:

- Incorrect Social Security Number: Make sure that your Social Security number is correct on your W-2 form.

- Incorrect Employer Information: Make sure that your employer's information is correct on your W-2 form.

- Incorrect Wage Information: Make sure that your wage information is correct on your W-2 form.

What to Do if You Find an Error on Your W-2 Form

If you find an error on your W-2 form, here's what to do:

- Contact your employer to report the error.

- Provide documentation to support your claim.

- Work with your employer to correct the error.

Conclusion

Understanding your W-2 form is a crucial step in managing your finances and preparing for tax season. By using the W-2 decoder tool and following the tips outlined in this article, you can ensure that you are making the most of your W-2 form. Remember to review your W-2 form carefully, use the information to prepare for tax season, and keep a copy of your W-2 form for your records.

We hope this article has been helpful in decoding your W-2 form with Everfi. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them understand their W-2 forms.

What is a W-2 form?

+A W-2 form is a document that your employer is required to provide to you and the Social Security Administration (SSA) at the end of each year. It reports your income and the amount of taxes withheld from your paycheck.

How do I use the W-2 decoder tool?

+To use the W-2 decoder tool, enter your W-2 form information into the tool. The tool will break down the components of your W-2 form and explain what each section means.

What should I do if I find an error on my W-2 form?

+If you find an error on your W-2 form, contact your employer to report the error. Provide documentation to support your claim and work with your employer to correct the error.