The CoreLogic freeze form - a document that can bring relief to many consumers who have been victims of identity theft or want to protect their credit reports. Filling out this form can be a daunting task, but with the right guidance, you can do it with ease. In this article, we will guide you through the process of filling out the CoreLogic freeze form in 5 simple steps.

What is CoreLogic and Why Do I Need to Freeze My Report?

CoreLogic is a leading provider of consumer, financial, and property information. The company maintains a vast database of consumer information, including credit reports. If you're a victim of identity theft or want to protect your credit reports from unauthorized access, you can request a freeze on your report. This will prevent anyone from accessing your credit report without your permission.

Why Freeze Your Credit Report?

Freezing your credit report can provide an additional layer of protection against identity theft. When your report is frozen, lenders and creditors cannot access your report, making it difficult for thieves to open new accounts in your name. Additionally, freezing your report can help prevent credit inquiries and new account openings, which can negatively affect your credit score.

Step 1: Gather Required Information

Before filling out the CoreLogic freeze form, you'll need to gather some required information. This includes:

- Your full name and address

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Date of birth

- A copy of your government-issued ID (driver's license, state ID, or passport)

- A copy of your utility bill or bank statement

Make sure you have all the necessary documents and information before proceeding to the next step.

What If I Don't Have All the Required Information?

If you don't have all the required information, you can still fill out the form, but you may need to provide additional documentation to verify your identity. In some cases, CoreLogic may request additional information or documentation to process your request.

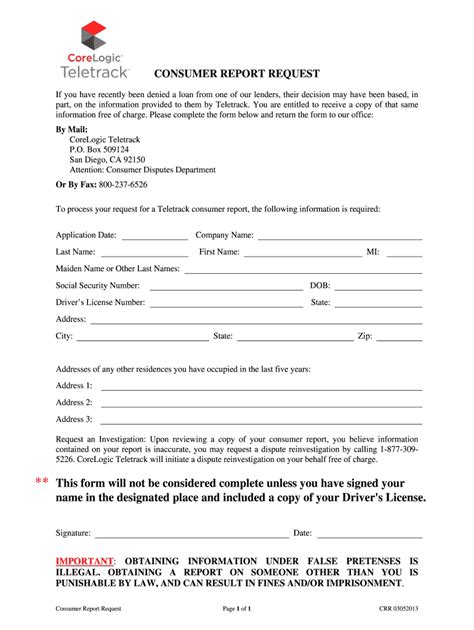

Step 2: Fill Out the Freeze Form

Once you have gathered all the required information, you can start filling out the CoreLogic freeze form. The form is typically divided into sections, each requiring specific information. Make sure to fill out each section carefully and accurately.

- Section 1: Request for Security Freeze

- Check the box to request a security freeze

- Provide your name, address, and date of birth

- Section 2: Verification of Identity

- Provide your Social Security number or ITIN

- Attach a copy of your government-issued ID

- Section 3: Additional Information

- Provide a copy of your utility bill or bank statement

- Check the box to confirm that you have read and understood the terms of the security freeze

What If I Make a Mistake on the Form?

If you make a mistake on the form, you can correct it by filling out a new form or by contacting CoreLogic directly. Make sure to keep a copy of the corrected form for your records.

Step 3: Submit the Freeze Form

Once you have completed the freeze form, you can submit it to CoreLogic. You can submit the form online, by mail, or by fax.

- Online: Visit the CoreLogic website and follow the instructions to submit your form electronically.

- Mail: Send the completed form to the address listed on the form.

- Fax: Fax the completed form to the number listed on the form.

How Long Does It Take to Process the Freeze Request?

CoreLogic typically processes freeze requests within 3-5 business days. You will receive a confirmation letter once your request has been processed.

Step 4: Receive Confirmation

Once your freeze request has been processed, you will receive a confirmation letter from CoreLogic. This letter will include:

- A confirmation of your security freeze

- A unique PIN or password to lift or remove the freeze

- Instructions on how to lift or remove the freeze

Make sure to keep this letter safe, as you will need the PIN or password to lift or remove the freeze in the future.

What If I Don't Receive a Confirmation Letter?

If you don't receive a confirmation letter within 3-5 business days, you can contact CoreLogic to verify the status of your freeze request.

Step 5: Lift or Remove the Freeze

If you need to lift or remove the freeze, you can do so by contacting CoreLogic. You will need to provide your PIN or password to verify your identity.

- Lift: Temporarily lift the freeze for a specific period or for a specific lender.

- Remove: Permanently remove the freeze from your report.

Make sure to follow the instructions carefully to avoid any delays or issues.

What If I Need to Lift the Freeze for a Specific Lender?

If you need to lift the freeze for a specific lender, you can do so by contacting CoreLogic and providing the lender's name and information. CoreLogic will lift the freeze for the specified lender, and you can then apply for credit or loans with that lender.

What is the difference between a security freeze and a credit lock?

+A security freeze is a more permanent solution that restricts access to your credit report, while a credit lock is a temporary solution that can be lifted or removed at any time.

Can I still apply for credit or loans with a security freeze in place?

+No, you cannot apply for credit or loans with a security freeze in place. You will need to lift or remove the freeze before applying for credit or loans.

How long does it take to process a security freeze request?

+CoreLogic typically processes security freeze requests within 3-5 business days.

By following these 5 steps, you can easily fill out the CoreLogic freeze form and protect your credit reports from unauthorized access. Remember to keep your PIN or password safe, as you will need it to lift or remove the freeze in the future. If you have any questions or concerns, don't hesitate to contact CoreLogic or a financial advisor for guidance.