As a global economy, the United States has a significant presence in international trade and commerce. With this comes the responsibility of ensuring tax compliance for US-based businesses and individuals operating abroad. One crucial aspect of this compliance is the Form 5471, specifically Schedule P, which provides crucial information about controlled foreign corporations (CFCs). In this article, we will delve into the intricacies of Form 5471 Schedule P and provide guidance on mastering its preparation and submission for US tax compliance.

Understanding the Importance of Form 5471

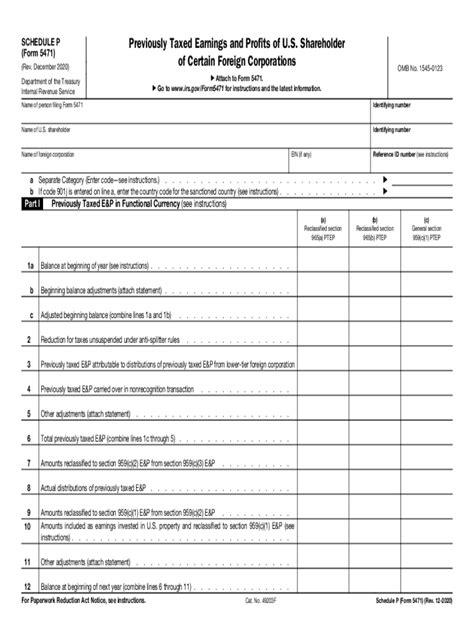

Form 5471 is a critical document required by the Internal Revenue Service (IRS) for US taxpayers with interests in CFCs. This form provides essential information about the financial activities, operations, and ownership structures of these foreign entities. The form is divided into several schedules, including Schedule P, which focuses on the CFC's stock ownership and accounting records.

Who Needs to File Form 5471 Schedule P?

Form 5471 Schedule P is required for US taxpayers who have control over CFCs, either directly or indirectly. This includes:

- US corporations that own at least 10% of the voting stock of a CFC

- US individuals who own at least 10% of the voting stock of a CFC

- US trusts that own at least 10% of the voting stock of a CFC

- Estates of deceased US individuals who owned at least 10% of the voting stock of a CFC

It is essential to note that the 10% ownership threshold applies to both direct and indirect ownership interests.

What Information is Required for Schedule P?

Schedule P requires detailed information about the CFC's stock ownership and accounting records. This includes:

- Stock ownership information, including the name, address, and tax identification number of each shareholder

- A detailed breakdown of the CFC's financial statements, including income statements and balance sheets

- Information about the CFC's tax year and accounting method

- Details about any significant changes in ownership or control

Preparing Schedule P: A Step-by-Step Guide

To ensure accurate and complete preparation of Schedule P, follow these steps:

- Gather Required Documents: Collect all necessary financial statements, ownership records, and tax returns for the CFC.

- Determine the CFC's Tax Year: Identify the CFC's tax year and accounting method to ensure accurate reporting.

- Complete Stock Ownership Information: Provide detailed information about each shareholder, including name, address, and tax identification number.

- Break Down Financial Statements: Provide a detailed breakdown of the CFC's income statements and balance sheets.

- Report Significant Changes: Disclose any significant changes in ownership or control of the CFC.

Common Challenges and Solutions**

Mastering Form 5471 Schedule P requires attention to detail and a thorough understanding of the requirements. Common challenges and solutions include:

- Inaccurate or Incomplete Information: Ensure that all required documents and information are gathered and accurately reported.

- Complexity of Financial Statements: Break down financial statements into clear and concise formats to facilitate accurate reporting.

- Changes in Ownership or Control: Disclose any significant changes in ownership or control to avoid penalties and ensure compliance.

Penalties for Non-Compliance

Failure to file or accurately complete Form 5471 Schedule P can result in significant penalties, including:

- Fines and Penalties: Up to $10,000 per year for failure to file or inaccurate reporting

- Additional Taxes and Interest: Potential assessment of additional taxes and interest on unreported income

Conclusion

Mastering Form 5471 Schedule P is crucial for US taxpayers with interests in CFCs. By understanding the requirements, gathering necessary documents, and accurately reporting information, taxpayers can ensure compliance and avoid penalties. It is essential to seek professional guidance from a qualified tax expert to ensure accurate preparation and submission of Schedule P.

Get Expert Guidance

If you are a US taxpayer with interests in CFCs, it is essential to seek professional guidance from a qualified tax expert. They can help you navigate the complexities of Form 5471 Schedule P and ensure accurate preparation and submission.

Take Action Today!

Don't wait until it's too late! Take action today and seek expert guidance on mastering Form 5471 Schedule P. Comment below with any questions or concerns, and share this article with others who may benefit from this information.

What is the purpose of Form 5471 Schedule P?

+Form 5471 Schedule P is required for US taxpayers with interests in controlled foreign corporations (CFCs) to provide detailed information about the CFC's stock ownership and accounting records.

Who needs to file Form 5471 Schedule P?

+Form 5471 Schedule P is required for US taxpayers who have control over CFCs, either directly or indirectly, including US corporations, individuals, trusts, and estates.

What are the penalties for non-compliance with Form 5471 Schedule P?

+Failure to file or accurately complete Form 5471 Schedule P can result in significant penalties, including fines and penalties of up to $10,000 per year, additional taxes and interest on unreported income.