In the world of finance, compliance is a critical aspect that every organization must adhere to. One such compliance requirement is the UCCA Form 12, which is a crucial document for companies to submit to the relevant authorities. However, many organizations struggle to understand the intricacies of this form and often find themselves facing penalties and fines for non-compliance. In this article, we will delve into the world of UCCA Form 12 and provide a comprehensive guide for compliance.

The Importance of UCCA Form 12

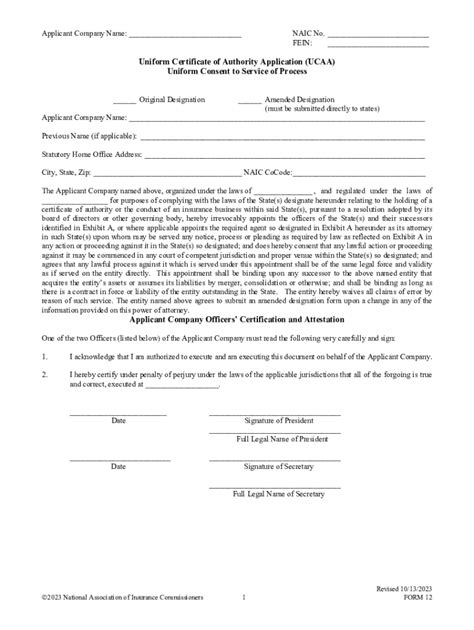

UCCA Form 12 is a Uniform Commercial Code (UCC) financing statement, which is used to record a security interest in personal property. This form is crucial for lenders, as it provides them with a way to perfect their security interest in collateral, thereby reducing the risk of default. However, for many organizations, submitting UCCA Form 12 can be a daunting task, especially if they are not familiar with the requirements.

Benefits of Filing UCCA Form 12

Filing UCCA Form 12 provides several benefits to organizations, including:

- Perfection of Security Interest: By filing UCCA Form 12, lenders can perfect their security interest in collateral, thereby reducing the risk of default.

- Priority Over Other Creditors: A properly filed UCCA Form 12 provides the lender with priority over other creditors in the event of a default.

- Reduced Risk of Loss: By recording a security interest, lenders can reduce the risk of loss in the event of a default.

Understanding UCCA Form 12: A Step-by-Step Guide

To ensure compliance, it is essential to understand the components of UCCA Form 12. Here is a step-by-step guide to help you navigate the form:

Section 1: Filing Information

- Name and Address of Filer: Provide the name and address of the lender or filer.

- File Number: Enter the file number assigned by the filing office.

Section 2: Debtor Information

- Name and Address of Debtor: Provide the name and address of the debtor.

- Type of Debtor: Indicate the type of debtor (e.g., individual, business, etc.).

Section 3: Collateral Information

- Description of Collateral: Provide a detailed description of the collateral.

- Type of Collateral: Indicate the type of collateral (e.g., equipment, inventory, etc.).

Section 4: Security Information

- Security Agreement Date: Enter the date of the security agreement.

- Security Agreement Description: Provide a description of the security agreement.

Common Mistakes to Avoid When Filing UCCA Form 12

When filing UCCA Form 12, it is essential to avoid common mistakes that can lead to rejection or penalties. Here are some common mistakes to avoid:

- Incomplete or Inaccurate Information: Ensure that all information is complete and accurate.

- Failure to Sign: Ensure that the form is signed by the authorized representative.

- Incorrect Filing Fee: Ensure that the correct filing fee is paid.

Penalties for Non-Compliance

Failure to comply with UCCA Form 12 requirements can result in penalties and fines. Here are some potential penalties:

- Fines and Penalties: Failure to file UCCA Form 12 can result in fines and penalties.

- Loss of Priority: Failure to perfect the security interest can result in loss of priority over other creditors.

Best Practices for Filing UCCA Form 12

To ensure compliance, here are some best practices to follow:

- Use the Correct Form: Ensure that the correct form is used.

- Verify Information: Verify all information before submitting the form.

- Submit on Time: Submit the form on time to avoid penalties.

Conclusion

Filing UCCA Form 12 is a critical compliance requirement for organizations. By understanding the components of the form and following best practices, organizations can ensure compliance and avoid penalties. Remember, compliance is key to avoiding fines and penalties.

FAQ Section

What is UCCA Form 12?

+UCCA Form 12 is a Uniform Commercial Code (UCC) financing statement, which is used to record a security interest in personal property.

Why is UCCA Form 12 important?

+Filing UCCA Form 12 provides several benefits, including perfection of security interest, priority over other creditors, and reduced risk of loss.

What are the common mistakes to avoid when filing UCCA Form 12?

+Common mistakes to avoid include incomplete or inaccurate information, failure to sign, and incorrect filing fee.