Form 5049, also known as the Missouri Sales Tax Resale Certificate, is a crucial document for businesses operating in Missouri. If you're a business owner or planning to start a business in the Show-Me State, understanding the ins and outs of Form 5049 is essential to ensure compliance with state tax laws. Here are 7 things to know about Form 5049 Missouri:

What is Form 5049 Missouri?

Form 5049 is a resale certificate that allows businesses to purchase goods tax-free if they intend to resell them. The form is issued by the Missouri Department of Revenue and is required by law to be accepted by sellers as proof of a buyer's exemption from sales tax.

Who Needs to Obtain Form 5049?

Businesses that engage in the resale of goods, such as retailers, wholesalers, and manufacturers, need to obtain Form 5049. This includes businesses that sell tangible personal property, such as clothing, furniture, and electronics.

How to Obtain Form 5049

To obtain Form 5049, businesses must register with the Missouri Department of Revenue and obtain a sales tax permit. The permit is required for all businesses that engage in the sale of tangible personal property.

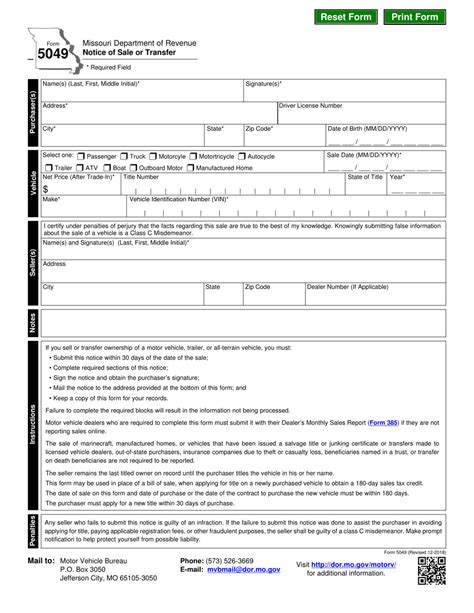

What Information is Required on Form 5049?

Form 5049 requires the following information:

- Business name and address

- Sales tax permit number

- Description of the goods being purchased

- Certification that the goods are being purchased for resale

How to Complete Form 5049

To complete Form 5049, businesses must provide the required information and sign the form. The form must be completed in its entirety, and any missing information may result in the form being rejected.

What are the Benefits of Form 5049?

Form 5049 provides several benefits to businesses, including:

- Exemption from sales tax on goods purchased for resale

- Reduced administrative burden

- Improved compliance with state tax laws

Penalties for Not Obtaining Form 5049

Failure to obtain Form 5049 can result in penalties, including:

- Sales tax liability on goods purchased without the form

- Fines and penalties for non-compliance

- Interest on unpaid sales tax

Conclusion

In conclusion, Form 5049 is a critical document for businesses operating in Missouri. Understanding the requirements and benefits of Form 5049 can help businesses ensure compliance with state tax laws and avoid penalties. By following the guidelines outlined in this article, businesses can obtain and complete Form 5049 with ease.

We encourage you to share your thoughts and experiences with Form 5049 in the comments below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the purpose of Form 5049?

+Form 5049 is a resale certificate that allows businesses to purchase goods tax-free if they intend to resell them.

Who needs to obtain Form 5049?

+Businesses that engage in the resale of goods, such as retailers, wholesalers, and manufacturers, need to obtain Form 5049.

What are the penalties for not obtaining Form 5049?

+Failure to obtain Form 5049 can result in penalties, including sales tax liability on goods purchased without the form, fines and penalties for non-compliance, and interest on unpaid sales tax.