California is known for its beautiful coastline, scenic mountains, and bustling cities, but it's also famous for its complex tax laws. As a business owner in California, it's essential to stay on top of your tax obligations to avoid any penalties or fines. One crucial form for S corporations in California is the S Corp Extension Form 100.

Understanding the Importance of California S Corp Extension Form 100

As an S corporation in California, you're required to file an annual tax return with the Franchise Tax Board (FTB) by the original due date, which is typically March 15th for calendar-year corporations. However, if you need more time to prepare your tax return, you can file for an extension using Form 100.

What is California S Corp Extension Form 100?

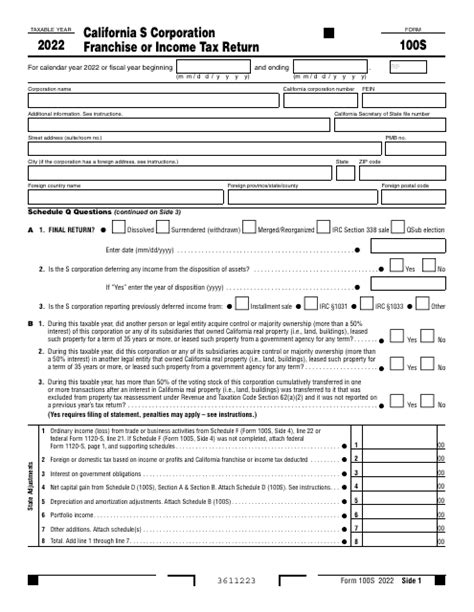

Form 100, also known as the Application for Automatic Extension of Time, is a form used by S corporations in California to request an automatic six-month extension of time to file their annual tax return. This form is used to extend the deadline for filing the California S corporation tax return, which is typically due on March 15th for calendar-year corporations.

Why Do You Need to File California S Corp Extension Form 100?

There are several reasons why you might need to file Form 100:

- You need more time to gather financial statements or other necessary documents.

- You're waiting for additional information from a partner, shareholder, or other entity.

- You're experiencing unexpected delays in preparing your tax return.

- You're seeking more time to resolve any issues or discrepancies in your tax return.

Benefits of Filing California S Corp Extension Form 100

Filing Form 100 can provide several benefits, including:

- Avoiding penalties and fines for late filing.

- Gaining more time to prepare an accurate and complete tax return.

- Reducing stress and pressure associated with meeting the original deadline.

- Allowing you to focus on other important business tasks and responsibilities.

How to File California S Corp Extension Form 100

To file Form 100, follow these steps:

- Complete the form: You can download Form 100 from the FTB website or obtain it from your tax professional. Fill out the form accurately and completely, making sure to include your corporation's name, address, and tax ID number.

- Sign and date the form: Sign and date the form, ensuring that you're authorized to sign on behalf of the corporation.

- File the form: Submit the form to the FTB by the original due date, which is typically March 15th for calendar-year corporations. You can file the form electronically or by mail.

Important Deadlines for California S Corp Extension Form 100

Keep in mind the following deadlines when filing Form 100:

- Original due date: March 15th for calendar-year corporations.

- Extended due date: September 15th for calendar-year corporations, or six months from the original due date.

Common Mistakes to Avoid When Filing California S Corp Extension Form 100

When filing Form 100, avoid the following common mistakes:

- Failing to sign and date the form.

- Not including the corporation's tax ID number.

- Filing the form late or after the extended due date.

- Not keeping accurate records of the form and supporting documentation.

Conclusion

Filing California S Corp Extension Form 100 is a straightforward process that can provide you with more time to prepare your tax return and avoid any penalties or fines. By understanding the importance of this form and following the steps outlined above, you can ensure that your S corporation remains compliant with California tax laws.

If you have any questions or concerns about filing Form 100, consult with a tax professional or contact the FTB directly. Remember to keep accurate records of the form and supporting documentation, and avoid common mistakes to ensure a smooth and successful filing process.

What is the deadline for filing California S Corp Extension Form 100?

+The original due date for filing Form 100 is March 15th for calendar-year corporations. The extended due date is September 15th for calendar-year corporations, or six months from the original due date.

Can I file California S Corp Extension Form 100 electronically?

+Yes, you can file Form 100 electronically through the FTB's website or through a tax professional.

What happens if I miss the extended due date for filing California S Corp Extension Form 100?

+If you miss the extended due date, you may be subject to penalties and fines. It's essential to file Form 100 by the extended due date to avoid any additional fees or penalties.