Filling out tax forms can be a daunting task, but it's essential to get it right to avoid any delays or penalties. In this article, we will guide you through the process of filling out Form 525-TV correctly. Form 525-TV is a crucial document for tax filers, and its accuracy is vital for a smooth tax filing experience.

The importance of accuracy in tax forms cannot be overstated. A single mistake can lead to delays, fines, or even an audit. Moreover, with the ever-changing tax laws and regulations, it's essential to stay up-to-date with the latest requirements. In this article, we will break down the process of filling out Form 525-TV into manageable sections, providing you with a comprehensive guide to ensure accuracy and compliance.

Understanding Form 525-TV

Before we dive into the details, it's essential to understand what Form 525-TV is and its purpose. Form 525-TV is a tax form used to report specific tax-related information to the tax authorities. It's a critical document that requires attention to detail to ensure accuracy.

What You Need to Know Before Filling Out Form 525-TV

Before you start filling out Form 525-TV, there are a few things you need to know:

- Ensure you have the correct form: There are various versions of Form 525-TV, so make sure you have the correct one for your specific tax year.

- Gather all necessary documents: Collect all relevant documents, including receipts, invoices, and bank statements, to ensure you have all the required information.

- Understand the tax laws and regulations: Familiarize yourself with the current tax laws and regulations to ensure you comply with all requirements.

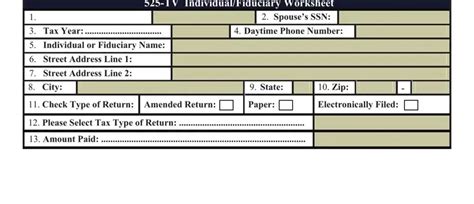

Section 1: Identifying Information

The first section of Form 525-TV requires you to provide identifying information. This includes:

- Your name and address

- Your tax identification number (TIN)

- Your tax year

Make sure to double-check this information to ensure accuracy.

Tips for Filling Out Section 1

- Use your full name as it appears on your tax return.

- Ensure your address is accurate and up-to-date.

- Verify your TIN to avoid any errors.

Section 2: Income Information

The second section of Form 525-TV requires you to report your income information. This includes:

- Your total income

- Your taxable income

- Any deductions or exemptions

Make sure to have all relevant documents, such as your W-2 and 1099 forms, to ensure accuracy.

Tips for Filling Out Section 2

- Report all income, including freelance work and investments.

- Calculate your taxable income carefully to avoid any errors.

- Claim all eligible deductions and exemptions.

Section 3: Tax Credits and Deductions

The third section of Form 525-TV requires you to report any tax credits and deductions. This includes:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Mortgage interest deduction

Make sure to have all relevant documents, such as your mortgage interest statement, to ensure accuracy.

Tips for Filling Out Section 3

- Claim all eligible tax credits and deductions.

- Calculate your EITC carefully to avoid any errors.

- Report all mortgage interest and property taxes.

Section 4: Signature and Verification

The final section of Form 525-TV requires you to sign and verify the information. This includes:

- Your signature

- Date

- Verification statement

Make sure to sign and date the form accurately.

Tips for Filling Out Section 4

- Sign the form in black ink.

- Date the form accurately.

- Verify the information carefully before signing.

By following these steps and tips, you can ensure that you fill out Form 525-TV correctly and avoid any delays or penalties. Remember to stay up-to-date with the latest tax laws and regulations to ensure compliance.

We hope this comprehensive guide has helped you understand the process of filling out Form 525-TV. If you have any questions or concerns, please don't hesitate to ask.

What is Form 525-TV used for?

+Form 525-TV is used to report specific tax-related information to the tax authorities.

What documents do I need to fill out Form 525-TV?

+You will need to gather all relevant documents, including receipts, invoices, and bank statements.

How do I ensure accuracy when filling out Form 525-TV?

+Double-check your information, use the correct form, and follow the tips provided in this guide.

We hope this article has been informative and helpful. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with others who may find it useful, and don't forget to subscribe to our newsletter for more tax-related tips and guides.