Selling an investment property or a business can be a significant financial transaction, and it's essential to report it correctly to the IRS. One way to do this is by using Form 6252, which is specifically designed for reporting installment sales. An installment sale is a type of sale where the buyer pays the seller in installments over a period of time, rather than in a single lump sum. If you're involved in an installment sale, it's crucial to understand how to file Form 6252 correctly to avoid any errors or penalties.

Understanding Form 6252

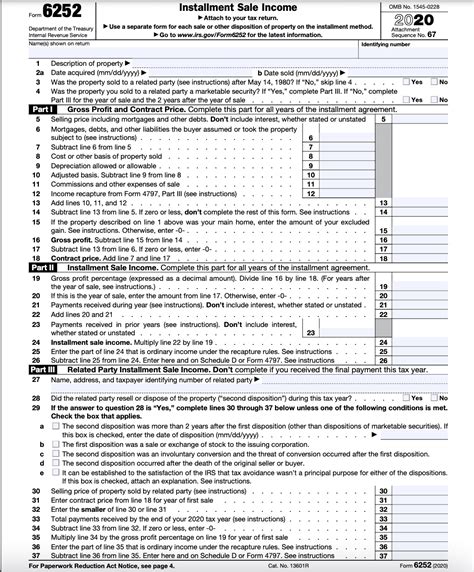

Form 6252 is used to report the sale of property under an installment method. This method allows you to report the gain on the sale over the period of time that the buyer is making payments. The form is used to calculate the gain on the sale and to determine the amount of tax that is due each year.

Tip 1: Determine If You Need to File Form 6252

Not all sales qualify for reporting on Form 6252. To determine if you need to file this form, you need to meet certain criteria. First, the sale must be an installment sale, meaning that the buyer is paying the seller in installments over a period of time. Additionally, the sale must involve the disposition of property, such as real estate, securities, or a business.

Tip 2: Gather All Necessary Information

Before you start filling out Form 6252, make sure you have all the necessary information. This includes:

- The date of the sale

- The sale price of the property

- The amount of the down payment

- The number of installments and the amount of each installment

- The interest rate on the installments

- The total gain on the sale

Having this information will help you fill out the form accurately and ensure that you're reporting the sale correctly.

Tip 3: Calculate the Gain on the Sale

To calculate the gain on the sale, you'll need to determine the gross profit percentage. This is calculated by dividing the total gain by the total sale price. The gross profit percentage is then used to calculate the gain on each installment payment.

Calculating Gross Profit Percentage

The gross profit percentage is calculated as follows:

Gross Profit Percentage = (Total Gain / Total Sale Price) x 100

For example, if the total gain is $50,000 and the total sale price is $200,000, the gross profit percentage would be:

Gross Profit Percentage = ($50,000 / $200,000) x 100 = 25%

Tip 4: Complete Form 6252

Once you have all the necessary information and have calculated the gain on the sale, you can complete Form 6252. The form requires you to report the sale price, the gross profit percentage, and the amount of each installment payment. You'll also need to calculate the gain on each installment payment and report it on the form.

Tip 5: Attach Supporting Schedules

In addition to completing Form 6252, you may need to attach supporting schedules to your tax return. These schedules provide additional information about the sale and the installment payments. The most common supporting schedules are:

- Schedule A: Disposition of Property

- Schedule B: Interest on Installment Sales

These schedules provide more detailed information about the sale and the installment payments, and are used to support the information reported on Form 6252.

Conclusion

Filing Form 6252 can be a complex process, but by following these tips, you can ensure that you're reporting the sale correctly and avoiding any errors or penalties. Remember to determine if you need to file the form, gather all necessary information, calculate the gain on the sale, complete the form, and attach supporting schedules as needed.

By following these tips, you can ensure that you're in compliance with the IRS and avoid any potential issues.

What is an installment sale?

+An installment sale is a type of sale where the buyer pays the seller in installments over a period of time, rather than in a single lump sum.

Do I need to file Form 6252 for every sale?

+No, not all sales qualify for reporting on Form 6252. The sale must be an installment sale and involve the disposition of property, such as real estate, securities, or a business.

How do I calculate the gain on the sale?

+The gain on the sale is calculated by determining the gross profit percentage, which is calculated by dividing the total gain by the total sale price.