As a taxpayer, navigating the complexities of tax forms can be daunting. The Form 511 EIC (Earned Income Credit) is a vital document for eligible individuals and families to claim their earned income tax credit. In this article, we will delve into the details of Line 11, Column A, of the Form 511 EIC, providing you with a comprehensive understanding of what it entails and how to accurately complete it.

Understanding the Earned Income Credit (EIC)

The Earned Income Credit (EIC) is a refundable tax credit designed to benefit low-to-moderate-income working individuals and families. The EIC aims to reduce the amount of taxes owed and may even result in a refund. To qualify for the EIC, taxpayers must meet specific eligibility criteria, including income limits, residency requirements, and filing status.

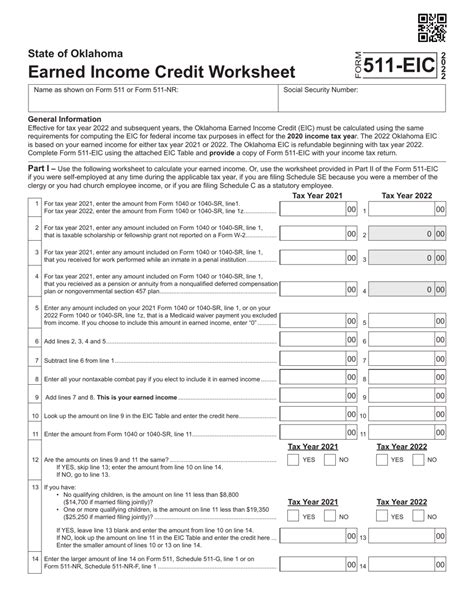

Breaking Down Form 511 EIC

Form 511 EIC is used to calculate the earned income credit. The form consists of several sections, including income, qualifying children, and credit calculations. Line 11, Column A, is part of the income section, which requires taxpayers to report their earned income from various sources.

Line 11, Column A: Earned Income from W-2

Line 11, Column A, specifically asks for the total earned income from W-2 forms. This includes wages, salaries, and tips reported on the taxpayer's W-2 forms. Taxpayers must add up the amounts from all W-2 forms and enter the total on Line 11, Column A.

Here are some essential points to keep in mind when completing Line 11, Column A:

- Only include earned income from W-2 forms, not self-employment income or other types of income.

- Make sure to add up the amounts from all W-2 forms, not just the primary W-2.

- If you have multiple W-2 forms, you may need to attach a separate statement to Form 511 EIC, listing each W-2 form and the corresponding earned income.

Examples and Scenarios

To better understand the concept, let's consider a few examples:

- John has two W-2 forms, one from his primary job and another from a part-time job. His primary job W-2 shows $30,000 in earned income, and his part-time job W-2 shows $10,000 in earned income. John would add these amounts together and enter $40,000 on Line 11, Column A.

- Maria has only one W-2 form, which shows $25,000 in earned income. She would enter $25,000 on Line 11, Column A.

Tips and Reminders

When completing Line 11, Column A, keep the following tips in mind:

- Ensure you have all W-2 forms before starting Form 511 EIC.

- Double-check the earned income amounts on each W-2 form to avoid errors.

- If you're unsure about what constitutes earned income, consult the IRS instructions or seek professional help.

Additional Resources

For more information on the Earned Income Credit and Form 511 EIC, visit the IRS website or consult the following resources:

- IRS Publication 596 (Earned Income Credit)

- IRS Form 511 EIC Instructions

By understanding the intricacies of Line 11, Column A, on Form 511 EIC, you'll be better equipped to accurately complete the form and claim your earned income tax credit. Remember to take your time, and don't hesitate to seek help if you need it.

We hope this article has provided you with a clear understanding of Line 11, Column A, on Form 511 EIC. If you have any further questions or concerns, please don't hesitate to ask. Share this article with others who may benefit from this information, and feel free to comment below with your thoughts or experiences.

What is the Earned Income Credit (EIC)?

+The Earned Income Credit (EIC) is a refundable tax credit designed to benefit low-to-moderate-income working individuals and families.

What is Line 11, Column A, on Form 511 EIC?

+Line 11, Column A, asks for the total earned income from W-2 forms.

What types of income are included on Line 11, Column A?

+Only earned income from W-2 forms is included on Line 11, Column A. Self-employment income and other types of income are not included.