As the largest generation in U.S. history, baby boomers are entering their golden years, and many are seeking ways to reduce their financial burdens. For elderly homeowners in Montana, the Elderly Homeowner Credit Form (also known as the Elderly Homeowner/Renter Credit) offers a valuable tax break. This credit can help alleviate the financial strain of homeownership, allowing seniors to focus on their health, well-being, and quality of life. In this comprehensive guide, we'll delve into the details of the Montana Elderly Homeowner Credit Form, including eligibility requirements, application procedures, and benefits.

What is the Montana Elderly Homeowner Credit Form?

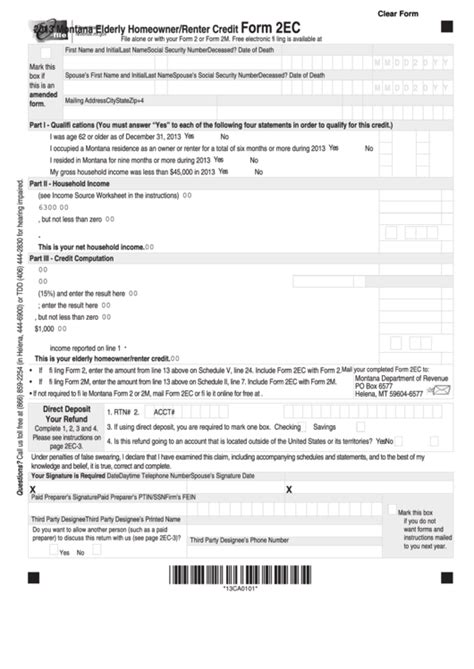

The Montana Elderly Homeowner Credit Form is a tax credit designed to assist low-income elderly homeowners with their property taxes. This credit is administered by the Montana Department of Revenue and is available to eligible individuals who meet specific income and age requirements.

Who is Eligible for the Montana Elderly Homeowner Credit Form?

To qualify for the Montana Elderly Homeowner Credit Form, you must meet the following requirements:

- Be at least 62 years old (or disabled and receiving disability benefits)

- Be a Montana resident

- Own and occupy a home in Montana as your primary residence

- Meet income requirements (adjusted gross income of $45,000 or less for single filers or $56,000 or less for joint filers)

How to Apply for the Montana Elderly Homeowner Credit Form

Applying for the Montana Elderly Homeowner Credit Form is a relatively straightforward process. Here's a step-by-step guide:

- Determine your eligibility: Review the eligibility requirements to ensure you qualify for the credit.

- Gather required documents: Collect your tax returns, proof of income, and proof of residency.

- Complete Form 2: Download and complete the Montana Elderly Homeowner/Renter Credit Form (Form 2) from the Montana Department of Revenue website.

- Submit your application: Mail or fax your completed application to the Montana Department of Revenue.

Benefits of the Montana Elderly Homeowner Credit Form

The Montana Elderly Homeowner Credit Form offers several benefits to eligible homeowners:

- Reduced property taxes: The credit can help reduce your property taxes, alleviating some of the financial burdens of homeownership.

- Increased disposable income: By reducing your property taxes, you'll have more disposable income to allocate towards other living expenses.

- Improved quality of life: The credit can help you maintain your independence and quality of life, allowing you to focus on your health and well-being.

Additional Resources

For more information on the Montana Elderly Homeowner Credit Form, you can:

- Visit the Montana Department of Revenue website

- Contact the Montana Department of Revenue at (406) 444-6900

- Consult with a tax professional or financial advisor

Tips and Reminders

- File your application timely: Submit your application by the deadline to ensure you receive the credit.

- Keep accurate records: Maintain accurate records of your income, residency, and property taxes to support your application.

- Consult with a tax professional: If you're unsure about the application process or have complex tax situations, consider consulting with a tax professional.

Frequently Asked Questions

What is the deadline to apply for the Montana Elderly Homeowner Credit Form?

+The deadline to apply for the Montana Elderly Homeowner Credit Form is typically April 15th of each year.

Can I claim the credit if I'm a renter?

+Yes, renters may be eligible for the credit. However, the credit amount may be lower than for homeowners.

How much is the credit amount?

+The credit amount varies depending on your income and property taxes. You can expect to receive up to $1,000 in credit.

By taking advantage of the Montana Elderly Homeowner Credit Form, eligible homeowners can reduce their financial burdens and enjoy a better quality of life. Don't miss out on this valuable tax break – apply today and start enjoying the benefits of homeownership without the financial strain.