As a homeowner or potential buyer, navigating the complexities of mortgage insurance can be overwhelming. One crucial aspect of mortgage insurance is the HUD-92051, also known as the HUD Mortgage Insurance Endorsement. In this article, we will delve into the world of HUD-92051, explaining its significance, benefits, and how it works.

What is HUD-92051?

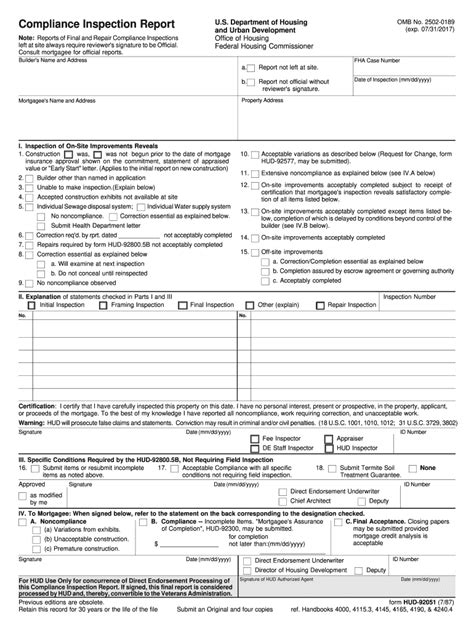

The HUD-92051 is an endorsement issued by the U.S. Department of Housing and Urban Development (HUD) for mortgage insurance policies. This endorsement is a critical component of the mortgage insurance process, as it provides assurance to lenders that the mortgage is insured against default.

Why is HUD-92051 Important?

The HUD-92051 endorsement is essential for several reasons:

- Risk Management: By endorsing the mortgage insurance policy, HUD assumes a portion of the risk associated with lending. This encourages lenders to offer more competitive interest rates and terms.

- Increased Accessibility: The HUD-92051 endorsement helps make mortgage financing more accessible to a broader range of borrowers, including those with lower credit scores or smaller down payments.

- Compliance: Lenders must obtain the HUD-92051 endorsement to comply with HUD regulations and guidelines.

How Does HUD-92051 Work?

The HUD-92051 endorsement process involves several steps:

- Mortgage Application: The borrower submits a mortgage application to a lender.

- Mortgage Insurance: The lender requires mortgage insurance to mitigate risk. The borrower purchases a mortgage insurance policy from a private mortgage insurance (PMI) company.

- HUD Endorsement: The lender submits the mortgage insurance policy to HUD for endorsement.

- Endorsement: HUD reviews and endorses the mortgage insurance policy, issuing a HUD-92051 endorsement.

Benefits of HUD-92051

The HUD-92051 endorsement offers several benefits to borrowers and lenders:

- Competitive Interest Rates: With the HUD-92051 endorsement, lenders can offer more competitive interest rates, making mortgage financing more affordable.

- Increased Loan-to-Value Ratio: Borrowers may qualify for higher loan-to-value ratios, allowing them to purchase a home with a smaller down payment.

- Reduced Risk: The HUD-92051 endorsement reduces the risk associated with lending, making mortgage financing more accessible to a broader range of borrowers.

HUD-92051 vs. Other Endorsements

The HUD-92051 endorsement is distinct from other endorsements, such as the VA Loan Guaranty and the FHA Mortgage Insurance. While these endorsements also provide assurance to lenders, they have different requirements and benefits.

- VA Loan Guaranty: The VA Loan Guaranty is an endorsement issued by the U.S. Department of Veterans Affairs for mortgages guaranteed by the VA.

- FHA Mortgage Insurance: The FHA Mortgage Insurance is an endorsement issued by HUD for mortgages insured by the Federal Housing Administration (FHA).

Key Differences

The key differences between the HUD-92051 endorsement and other endorsements are:

- Eligibility: The HUD-92051 endorsement is available to a broader range of borrowers, including those with lower credit scores or smaller down payments.

- Insurance Premiums: The insurance premiums for the HUD-92051 endorsement are typically lower than those for other endorsements.

FAQs

What is the purpose of the HUD-92051 endorsement?

+The HUD-92051 endorsement provides assurance to lenders that the mortgage is insured against default, encouraging lenders to offer more competitive interest rates and terms.

How does the HUD-92051 endorsement benefit borrowers?

+The HUD-92051 endorsement benefits borrowers by providing access to more competitive interest rates, higher loan-to-value ratios, and reduced risk.

What is the difference between the HUD-92051 endorsement and other endorsements?

+The HUD-92051 endorsement is distinct from other endorsements, such as the VA Loan Guaranty and the FHA Mortgage Insurance, in terms of eligibility, insurance premiums, and benefits.

We hope this comprehensive guide to the HUD-92051 endorsement has provided you with a deeper understanding of this critical aspect of mortgage insurance. If you have any further questions or concerns, please don't hesitate to reach out.