Understanding Form 8862: A Guide to Claiming EIC After Disallowance

The Earned Income Tax Credit (EIC) is a vital tax credit designed to help low-to-moderate-income working individuals and families. However, in some cases, the IRS may disallow the EIC, leading to a significant reduction in the taxpayer's refund. When this happens, taxpayers can use Form 8862 to claim the EIC after disallowance. In this comprehensive guide, we will explore the ins and outs of Form 8862, including its purpose, eligibility criteria, and the step-by-step process of claiming the EIC after disallowance.

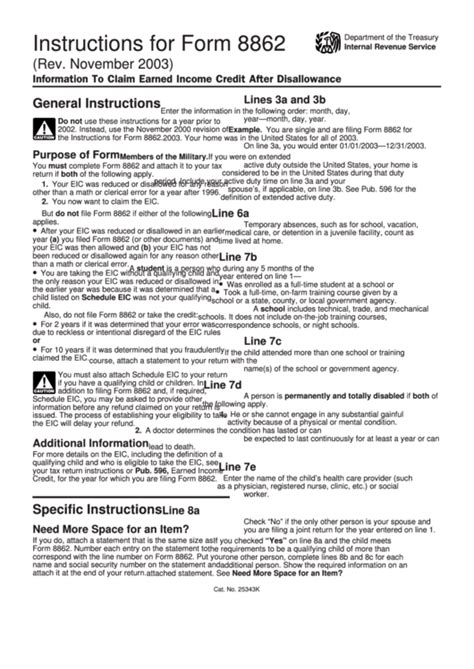

What is Form 8862?

Form 8862, also known as the Information to Claim Earned Income Credit After Disallowance, is a form used by taxpayers to claim the EIC after the IRS has disallowed it. The form requires taxpayers to provide documentation and information to support their EIC claim, which the IRS will review to determine if they are eligible for the credit.

Why is Form 8862 Necessary?

The IRS disallows the EIC for various reasons, including:

- Inaccurate or incomplete information on the tax return

- Failure to meet the EIC eligibility criteria

- Claiming the EIC without meeting the necessary qualifications

When the IRS disallows the EIC, taxpayers may be eligible to claim it again using Form 8862. This form provides an opportunity for taxpayers to provide additional information and documentation to support their EIC claim.

Eligibility Criteria for Form 8862

To be eligible to claim the EIC using Form 8862, taxpayers must meet the following criteria:

- The IRS must have disallowed the EIC for a specific tax year

- Taxpayers must have filed a tax return for the year in question

- Taxpayers must meet the EIC eligibility criteria, including income limits and work requirements

- Taxpayers must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN)

Step-by-Step Process for Claiming EIC After Disallowance

The process for claiming the EIC after disallowance involves the following steps:

- Gather required documentation: Taxpayers must gather all necessary documentation to support their EIC claim, including proof of income, work, and residency.

- Complete Form 8862: Taxpayers must complete Form 8862, providing all required information and documentation.

- Submit Form 8862: Taxpayers must submit Form 8862 to the IRS, along with any required documentation.

- Wait for IRS review: The IRS will review the taxpayer's claim and make a determination regarding their eligibility for the EIC.

- Receive a determination letter: The IRS will send a determination letter to the taxpayer, indicating whether their EIC claim has been approved or denied.

Tips for Completing Form 8862

When completing Form 8862, taxpayers should keep the following tips in mind:

- Use clear and concise language: Taxpayers should ensure that their responses are clear and concise, avoiding any confusion or ambiguity.

- Provide all required documentation: Taxpayers must provide all required documentation to support their EIC claim.

- Double-check for accuracy: Taxpayers should carefully review their form for accuracy and completeness before submitting it to the IRS.

Common Errors to Avoid When Completing Form 8862

When completing Form 8862, taxpayers should avoid the following common errors:

- Inaccurate or incomplete information: Taxpayers must ensure that their responses are accurate and complete, avoiding any mistakes or omissions.

- Failure to provide required documentation: Taxpayers must provide all required documentation to support their EIC claim.

- Missed deadlines: Taxpayers must submit Form 8862 by the specified deadline to avoid any delays or penalties.

Conclusion

Claiming the EIC after disallowance can be a complex and time-consuming process. However, by understanding the purpose and requirements of Form 8862, taxpayers can ensure that their claim is processed efficiently and effectively. Remember to gather all required documentation, complete the form accurately, and submit it by the specified deadline. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the IRS for guidance.

What is the purpose of Form 8862?

+Form 8862 is used by taxpayers to claim the EIC after the IRS has disallowed it. The form requires taxpayers to provide documentation and information to support their EIC claim.

Who is eligible to claim the EIC using Form 8862?

+Taxpayers who have had their EIC claim disallowed by the IRS are eligible to claim the EIC using Form 8862. They must meet the EIC eligibility criteria and provide required documentation to support their claim.

What is the deadline for submitting Form 8862?

+The deadline for submitting Form 8862 varies depending on the specific circumstances of the taxpayer's claim. Taxpayers should check with the IRS or a tax professional to determine the applicable deadline.