Filing taxes can be a daunting task, especially for small business owners and individuals who are not familiar with the process. One of the most critical forms for Texas franchise tax is Form 50-129. In this article, we will delve into the world of Form 50-129, exploring its importance, benefits, and key facts that you need to know.

What is Form 50-129?

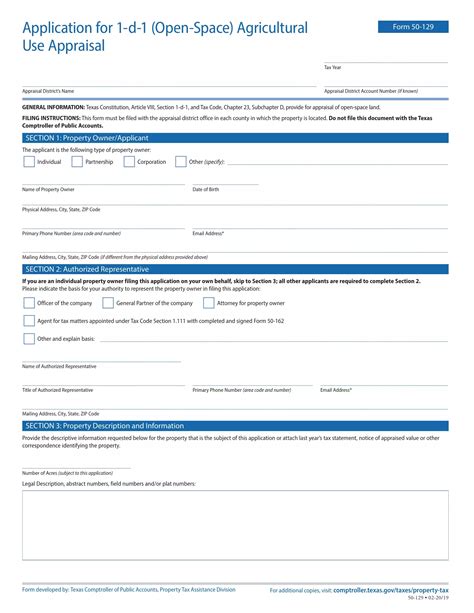

Form 50-129, also known as the Franchise Tax Report for Texas entities, is a crucial document that businesses in Texas must file annually with the Texas Comptroller's office. This form is used to report the entity's franchise tax liability, which is a tax on the privilege of doing business in Texas.

Why is Form 50-129 Important?

Filing Form 50-129 is essential for businesses operating in Texas, as it helps the state to determine the entity's tax liability. Failure to file this form can result in penalties, fines, and even the loss of business privileges. Additionally, Form 50-129 provides valuable information to the state about the entity's financial condition, which helps in evaluating the entity's economic impact on the state.

Benefits of Filing Form 50-129

Filing Form 50-129 has several benefits for businesses in Texas. Some of the key benefits include:

- Avoiding Penalties and Fines: Filing Form 50-129 on time helps businesses avoid penalties and fines that can be costly.

- Maintaining Business Privileges: Filing this form ensures that businesses maintain their privileges to operate in Texas.

- Providing Financial Information: Form 50-129 provides valuable financial information to the state, which helps in evaluating the entity's economic impact.

Key Facts About Form 50-129

Here are some key facts about Form 50-129 that you need to know:

- Filing Deadline: The filing deadline for Form 50-129 is May 15th of each year.

- Filing Requirements: All Texas entities, including corporations, limited liability companies, and partnerships, must file Form 50-129.

- Franchise Tax Rate: The franchise tax rate in Texas is 0.75% of the entity's total revenue.

- No Tax Due Report: If an entity has no tax due, it must still file a No Tax Due Report (Form 05-102) with the Texas Comptroller's office.

Steps to File Form 50-129

Filing Form 50-129 is a straightforward process that can be completed online or by mail. Here are the steps to file Form 50-129:

- Gather Required Information: Gather all required information, including the entity's name, address, and tax ID number.

- Complete Form 50-129: Complete Form 50-129, making sure to provide all required information.

- Submit Form 50-129: Submit Form 50-129 online or by mail to the Texas Comptroller's office.

- Pay Franchise Tax: Pay the franchise tax due, if any.

Common Mistakes to Avoid When Filing Form 50-129

When filing Form 50-129, there are several common mistakes to avoid. Some of the most common mistakes include:

- Late Filing: Filing Form 50-129 late can result in penalties and fines.

- Inaccurate Information: Providing inaccurate information on Form 50-129 can result in delays or even audits.

- Insufficient Payment: Failing to pay the franchise tax due can result in penalties and fines.

Tips for Filing Form 50-129

Here are some tips for filing Form 50-129:

- File Early: File Form 50-129 early to avoid last-minute rush and potential errors.

- Seek Professional Help: Seek professional help if you are unsure about how to file Form 50-129.

- Keep Records: Keep accurate records of your Form 50-129 filing, including the date and time of submission.

Conclusion

In conclusion, Form 50-129 is a critical document that businesses in Texas must file annually. By understanding the importance, benefits, and key facts about Form 50-129, businesses can ensure compliance with Texas franchise tax laws and avoid penalties and fines. Remember to file Form 50-129 on time, provide accurate information, and keep accurate records.

What is the filing deadline for Form 50-129?

+The filing deadline for Form 50-129 is May 15th of each year.

Who is required to file Form 50-129?

+All Texas entities, including corporations, limited liability companies, and partnerships, must file Form 50-129.

What is the franchise tax rate in Texas?

+The franchise tax rate in Texas is 0.75% of the entity's total revenue.