The Form 4852, also known as the Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., is a crucial document for individuals who need to report income that is not reported on a traditional W-2 form. Completing this form can be a daunting task, especially for those who are new to the process. However, with the right guidance, it can be broken down into manageable steps.

In this article, we will walk you through the 5 easy steps to complete Form 4852, making it easier for you to report your income accurately and avoid any potential penalties or delays.

Step 1: Gather Required Information and Documents

Before starting to fill out Form 4852, it's essential to gather all the necessary information and documents. You will need:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your employer's name, address, and Employer Identification Number (EIN)

- The type of income you received (e.g., wages, tips, or retirement income)

- The amount of income you received

- The amount of taxes withheld

- Any other relevant information, such as your occupation or the state where you worked

Make sure to collect all the required documents, including any W-2 forms, 1099 forms, or other statements that show your income and taxes withheld.

Step 2: Determine the Type of Income You Received

Types of Income Reported on Form 4852

Form 4852 is used to report various types of income that are not reported on a traditional W-2 form. Some common types of income reported on this form include:

- Wages, tips, and other compensation

- Retirement income

- Annuity income

- Distributions from pensions, profit-sharing plans, or IRAs

- Insurance contract income

Determine the type of income you received and ensure you have the correct information and documents to support your claim.

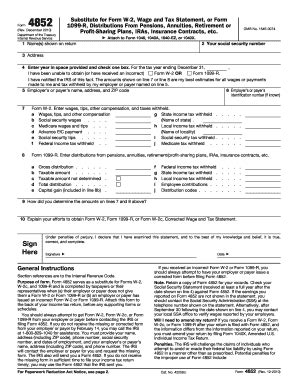

Step 3: Complete the Header Section

Understanding the Header Section

The header section of Form 4852 requires you to provide basic information, such as:

- Your name and Social Security number or ITIN

- Your employer's name, address, and EIN

- The type of income you received

- The tax year for which you are reporting income

Complete this section carefully, ensuring that all the information is accurate and matches the information on your supporting documents.

Step 4: Report Your Income and Taxes Withheld

Reporting Income and Taxes Withheld

In this section, you will report the amount of income you received and the amount of taxes withheld. You will need to complete the following:

- Box 1: Wages, tips, and other compensation

- Box 2: Federal income tax withheld

- Box 4: Social Security tax withheld

- Box 6: Medicare tax withheld

Use the information from your supporting documents to complete this section accurately.

Step 5: Sign and Date the Form

Finalizing Your Form 4852

Once you have completed all the sections, review your form carefully to ensure accuracy. Sign and date the form, and make a copy for your records.

Congratulations! You have successfully completed Form 4852.

What's Next?

After completing Form 4852, you will need to attach it to your tax return (Form 1040) and submit it to the IRS. Make sure to follow the IRS instructions for filing and submitting your tax return.

We hope this article has helped you understand the process of completing Form 4852. If you have any questions or concerns, feel free to ask in the comments below.

What is Form 4852 used for?

+Form 4852 is used to report income that is not reported on a traditional W-2 form, such as wages, tips, and retirement income.

Do I need to complete Form 4852 if I have a W-2 form?

+No, if you have a W-2 form, you do not need to complete Form 4852. However, if you have income that is not reported on a W-2 form, you will need to complete Form 4852.

Where do I submit Form 4852?

+You will need to attach Form 4852 to your tax return (Form 1040) and submit it to the IRS.