As the tax season approaches, many individuals and businesses are preparing to file their tax returns. One important form that some taxpayers may need to complete is Form 2210, also known as the Underpayment of Estimated Tax by Individuals, Estates, and Trusts form. Line 8 on this form can be particularly tricky, and it's essential to understand what it entails to avoid any potential penalties or errors. In this article, we will delve into the world of Form 2210, focusing on Line 8, and provide a comprehensive guide to help taxpayers navigate this complex topic.

What is Form 2210, and Why is it Important?

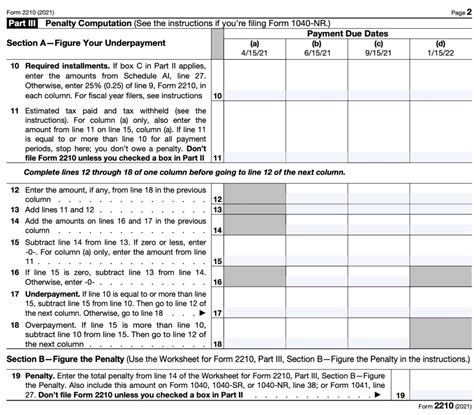

Form 2210 is a tax form used by the Internal Revenue Service (IRS) to calculate the penalty for underpayment of estimated taxes. The IRS requires individuals and businesses to make estimated tax payments throughout the year if they expect to owe more than $1,000 in taxes. This form is used to report these payments and calculate any penalties or interest due.

Breaking Down Line 8 on Form 2210

Line 8 on Form 2210 is where taxpayers report their annualized income. This line is crucial because it determines the amount of estimated tax payments due. The annualized income calculation takes into account the taxpayer's income from various sources, including wages, self-employment income, and investment income.

What is Annualized Income?

Annualized income is the taxpayer's total income for the year, adjusted for the number of periods in which the income was earned. This calculation is necessary because taxpayers may have varying income levels throughout the year, and the IRS wants to ensure that they are making accurate estimated tax payments.

To calculate annualized income, taxpayers need to complete Schedule AI (Annualized Income Installment Method) and attach it to Form 2210. This schedule requires taxpayers to report their income for each period, which is typically quarterly.

How to Complete Line 8 on Form 2210

To complete Line 8 on Form 2210, taxpayers need to follow these steps:

- Calculate their annualized income using Schedule AI.

- Enter the total annualized income on Line 8.

- Multiply the annualized income by the applicable estimated tax rate (usually 90% of the current year's tax liability or 100% of the prior year's tax liability).

It's essential to note that taxpayers can use the annualized income installment method to reduce or eliminate penalties for underpayment of estimated taxes.

Example of Annualized Income Calculation

Let's say John, a self-employed individual, has the following income for the year:

| Period | Income |

|---|---|

| 1st quarter | $20,000 |

| 2nd quarter | $30,000 |

| 3rd quarter | $25,000 |

| 4th quarter | $35,000 |

John's total annual income is $110,000. To calculate his annualized income, he completes Schedule AI and reports the following:

| Period | Income | Annualized Income |

|---|---|---|

| 1st quarter | $20,000 | $80,000 |

| 2nd quarter | $30,000 | $120,000 |

| 3rd quarter | $25,000 | $100,000 |

| 4th quarter | $35,000 | $140,000 |

John's annualized income for each period is calculated by dividing the income for each period by the number of periods remaining in the year.

Common Mistakes to Avoid on Line 8

When completing Line 8 on Form 2210, taxpayers should avoid the following common mistakes:

- Incorrect annualized income calculation: Make sure to use the correct formula and schedule to calculate annualized income.

- Failure to report all income: Include all income sources, including wages, self-employment income, and investment income.

- Inaccurate estimated tax rate: Use the correct estimated tax rate, which is usually 90% of the current year's tax liability or 100% of the prior year's tax liability.

Conclusion

Line 8 on Form 2210 is a critical component of the underpayment of estimated tax calculation. By understanding how to calculate annualized income and complete Line 8 accurately, taxpayers can avoid potential penalties and errors. It's essential to take the time to review the instructions and examples provided by the IRS to ensure accurate completion of this form.

We hope this guide has provided valuable insights into the world of Form 2210 and Line 8. If you have any questions or concerns, please feel free to comment below or share this article with others who may benefit from this information.

Additional Resources

- IRS Form 2210 Instructions

- IRS Schedule AI (Annualized Income Installment Method)

- IRS Estimated Taxes webpage

What is the purpose of Form 2210?

+Form 2210 is used to calculate the penalty for underpayment of estimated taxes.

What is annualized income?

+Annualized income is the taxpayer's total income for the year, adjusted for the number of periods in which the income was earned.

How do I calculate annualized income?

+Use Schedule AI (Annualized Income Installment Method) to calculate annualized income.